Activist investors smell money. Can retail investors profit by following them?

It’s tempting to try now that activist hedge funds are baying at target companies more ferociously than they’ve done since 2019. Salesforce, for example, has attracted five prominent activists (Paul Singer’s Elliott Management, Jeffrey Ubben’s Inclusive Capital, Mason Morfit’s ValueAct Capital, Dan Loeb’s Third Point, and Jeffrey Smith’s Starboard Value). Other mega-firms like Google parent company Alphabet, Bayer, Best Buy, Meta Platforms, Shell, and Unilever are also recent targets.

Brace for more. A new report from the Conference Board predicts “increased Big ‘A’ activism, which aims to change corporate strategy.”

Hedge fund hyperactivity seems an obvious opportunity for individual investors. An activist fund typically invests in a company, then urges the company to take action that it believes will juice stock performance. Much academic research finds that, on average, it works. So all you have to do is buy shares in target companies, sit back, and watch your money grow, right?

The answer is “Yes, but.” Yes, but it isn’t that easy. Plus, your profits might be meager or nonexistent.

First, timing matters. Investors looking to exploit the activist effect must find out if an activist fund has bought into a target company. If a fund buys over 5% of a company’s stock, federal regulations require it to file a publicly available form (called a 13D) no more than 10 days after crossing the 5% threshold. If the activist owns less than 5%, it can announce its position at any time but isn’t required to.

Many studies have explored what happens around that crucial date when an activist fund discloses its investment. The results have been remarkably similar. During a given window—a well-known study used a 40-day window from 20 days before the disclosure to 20 days after—the target company’s stock price, on average, delivers an “abnormal return” of around 5% to 6%. Some research has found higher or lower returns for longer or shorter windows, but the results are generally in the same neighborhood.

This sounds like the slam-dunk trade of all time—make 5% to 6% in 40 days. You can retire next year.

But look closer.

The most glaring problem is that those research windows start well before the activist discloses its investment in Company X, and about half of the 5% to 6% return occurs in the 20 days before the disclosure. Maybe that’s because the activist firm is loading up on shares, pushing up the price. Perhaps it has told other funds it’s building a stake, and they’re buying too. In any case, the average investor will be none the wiser until half the return is gone.

But at least the other half is still available, right? Yes, but again, it isn’t that easy. The target company’s stock price, already trending up, tends to jump further within moments of disclosure. “Trying to get this remaining ‘tail’ of the bump in stock price would require getting quickly into the stock right upon the filing of the 13D by the activist,” says Harvard Law School’s Lucian Bebchuk, who has studied investor activism for years. “This requires monitoring and a quick reaction that would be difficult for an individual investor.”

Another caveat: Maybe you noticed that the 5% to 6% return observed by academics is an “abnormal return.” That isn’t a return as most individual investors understand the term. It’s the difference between a stock’s actual return and the return the market was expecting. For instance, if the market expected a –10% return for the stock, an abnormal return of 5% to 6% translates to an actual return of –5% to –4%. In a case like that, you’re beating expectations but losing money.

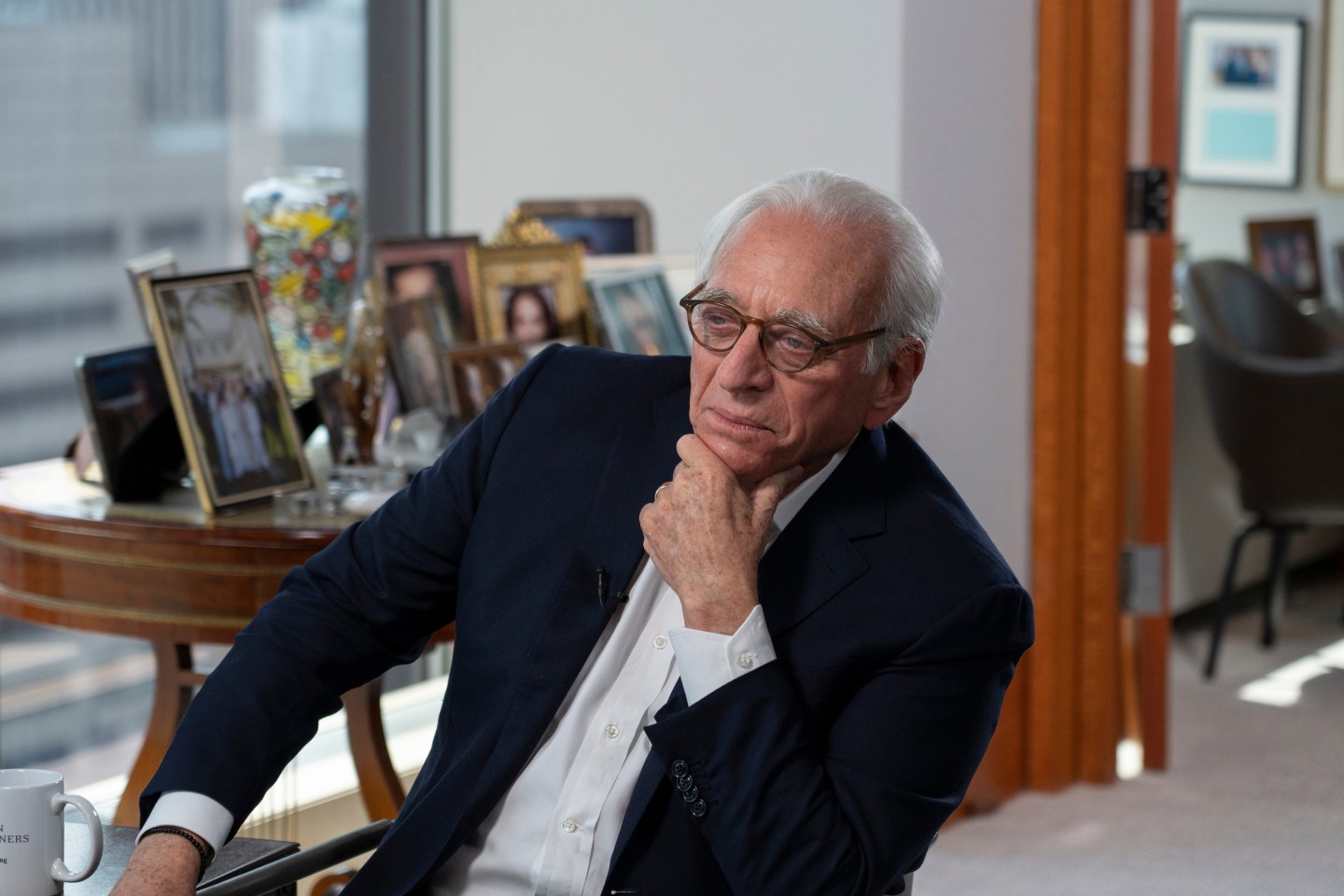

Consider also that a few activist funds are targeting companies at which they’re unlikely to succeed, notably Alphabet and Meta. An activist’s ultimate weapon is the threat of waging a proxy fight to replace some or all of a company’s directors. In January, for example, Nelson Peltz’s Trian Partners launched a proxy fight at Walt Disney, then called it off three weeks later. Peltz explained, “Now Disney plans to do everything we wanted it to do.” But at Alphabet and Meta, the founders hold special shares granting them voting majorities, so they’re guaranteed to win any proxy fight. The activists in those cases “are trying to put public pressure on the board to make reforms,” says Charles Elson, former director of the John L. Weinberg Center for Corporate Governance at the University of Delaware. But they can’t wield the sledgehammer approach that’s so effective elsewhere.

Bottom line, you might make modest gains by investing in every activist hedge fund’s target company immediately after disclosure. But that strategy is not, alas, a guaranteed route to riches. If anyone ever finds one, we’ll let you know.

Learn how to navigate and strengthen trust in your business with The Trust Factor, a weekly newsletter examining what leaders need to succeed. Sign up here.