Valuations may be starting to trend down, but there’s no need for founders to get too worried yet. After all, valuations aren’t everything.

Over the last two years, private companies have soared in value, but that didn’t necessarily mean founders were taking home more money. In fact, sometimes they’ve been making less.

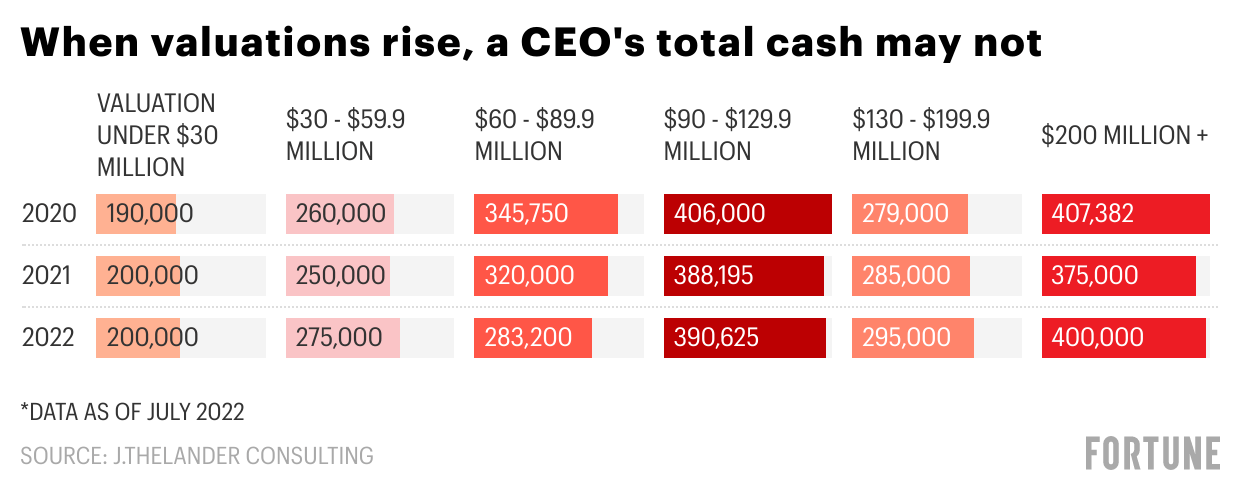

Data from J.Thelander Consulting, collected from more than 2,000 private companies, shows that, over the last three years, the median total cash CEOs took home actually dropped when a company’s valuation bumped up to $130 million from $90 million (Total cash is the combination of base salary and bonuses). Meanwhile, those CEOs also gave up a greater stake in the company in 2021 and 2022 as their company’s valuation went up.

Here’s a look:

It’s not a perfect rule: Total cash largely picked back up when valuations climbed above $200 million. But the data serves as an important reminder, particularly now—when valuations are in the early innings of a drop—that valuations don’t necessarily translate into financial success.

“As the market shows, valuations are subjective and are not a reliable barometer for determining compensation,” Jody Thelander, CEO and founder of J.Thelander Consulting, tells me in an email.

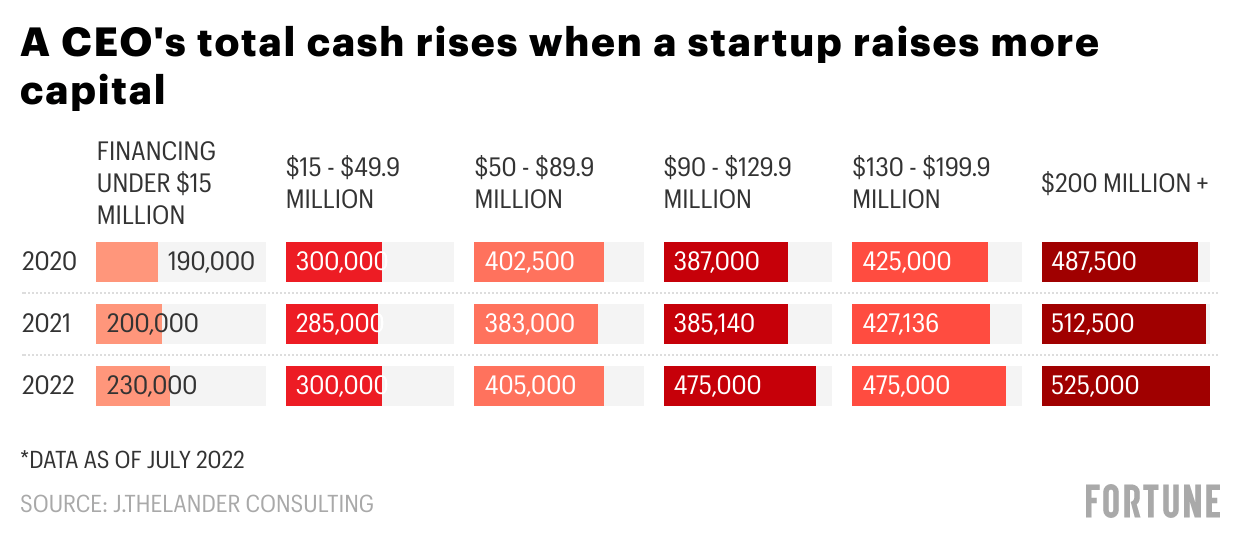

That being said, funding rounds do tend to be an important indicator for a pay raise—and the checks VCs have been writing have gotten smaller.

CEOs and top executives always get a financial boost after companies score more funding from venture capitalists. “In all cases, founder and non-founder total cash rises as financing goes up,” Thelander says.

A plunge in valuations may not have a drastic impact on CEO compensation. A significant drop in funding very well could.

In general, compensation has been climbing for CEOs and top employees since 2020, as companies have struggled to retain their talent and have utilized everything from base pay, equity, and bonuses to keep them put, according to Thelander.

Will that continue? It’s hard to say when companies are laying off workers en masse. At the same time, the unemployed don’t appear to be having much trouble finding a new gig.

A programming note… In observance of Labor Day, you will not be getting Term Sheet in your inbox Monday. Enjoy the long weekend, and see you in a few days.

Until then,

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

Submit a deal for the Term Sheet newsletter here.

Jackson Fordyce curated the deals section of today’s newsletter.

VENTURE DEALS

- Alloy, a New York-based identity decisioning platform for banks and fintechs, raised an additional $52 million in funding. Lightspeed Venture Partners and Avenir Growth led the round and were joined by investors including Canapi Ventures, Bessemer Venture Partners, Avid Ventures, and Felicis Ventures.

- OneSignal, a San Mateo, Calif.-based customer engagement platform, raised $50 million in Series C funding. BAM Elevate led the round and was joined by investors including Nimble Partners, SignalFire, and Zach Coelius.

- PROOF, a Los Angeles-based NFT-focused podcast and events platform, raised $50 million in Series A funding. A16z crypto led the round and was joined by investors including Seven Seven Six, True Ventures, Collab+Currency, Flamingo DAO, SV Angel, and VaynerFund.

- Fairmarkit, a Boston-based automated sourcing platform, raised $35.6 million in Series C funding. OMERS Growth Equity led the round and was joined by investors including GGV Capital, Insight Partners, HighlandX, and ServiceNow.

- Landa, a New York-based real estate investing company, raised $25 million in Series A funding. NFX, 83North, and Viola Ventures invested in the round.

- Learnsoft, a San Diego-based learning and talent platform, raised $16.7 million in Series A funding led by Elsewhere Partners.

- FX HedgePool, a London and New York-based peer-to-peer matching platform for foreign exchange transactions, raised $8 million in Series A funding. Information Venture Partners led the round and was joined by investors including Fidelity International Strategic Ventures and NAventures.

- adwoa beauty, a Dallas-based beauty brand, raised $4 million from Pendulum.

- Haru Invest, a Singapore-based digital asset management platform, raised $4 million in funding led by Cocone Corporation executive chairman Chun Yang-Hyun.

- PsycApps, a London-based mental health video game developer, raised £1.5 ($1.73 million) in seed funding from Morningside Ventures.

PRIVATE EQUITY

- CIVC Partners acquired a majority stake in OTR Transportation, a Chicago-based freight broker. Financial terms were not disclosed.

- Fortis Solutions Group, a portfolio company of funds managed by Harvest Partners, acquired Digital Dogma Corp, a Santa Fe Springs, Calif.-based labels, shrink sleeves, and packaging digital manufacturer. Financial terms were not disclosed.

- An affiliate of H.I.G. Capital acquired CPS Building Services, a Cambridgeshire, U.K.-based mechanical and electrical services provider. Financial terms were not disclosed.

- PayrHealth, backed by Osceola Capital, acquired Supero Healthcare Solutions, an Austin-based provider enrollment and credentialing company. Financial terms were not disclosed.

- Funds advised by SK Capital Partners and Edgewater Capital Partners agreed to acquire the scintillation and photonic crystals business of Saint-Gobain, a Hiram, Ohio-based crystals provider for radiation detection applications. Financial terms were not disclosed.

- Technical Safety Services, a portfolio company of LLCP, acquired CEPA Operations, an Ontario, Calif.-based regulatory certification services provider for controlled environment equipment for pharmaceutical and healthcare settings. Financial terms were not disclosed.

EXITS

- Gridiron acquired a majority stake in Magneto & Diesel Holdings, a distributor and remanufacturer of aftermarket parts and components for diesel-powered engines based in Humble, Texas, from Warren Equity Partners. Financial terms were not disclosed.

OTHER

- Novo Nordisk agreed to acquire Forma Therapeutics, a Watertown, Mass.-based rare blood disorders and sickle cell disease treatment company, for about $1.1 billion.

- Carta acquired Capdesk, a London-based equity management platform. Financial terms were not disclosed.

- HTEC acquired Mistral Technologies, a Sarajevo, Bosnia-based product development software company. Financial terms were not disclosed.

- Instacart acquired Eversight, a Palo Alto-based pricing and promotions platform for CPG brands and retailers. Financial terms were not disclosed.

- Measurabl acquired WegoWise, a Santa Barbara, Calif.-based software platform for utility data automation and residential real estate. Financial terms were not disclosed.

- Smartsheet acquired Outfit, a Brisbane-based brand management, templating, and creative automation platform. Financial terms were not disclosed.

FUNDS + FUNDS OF FUNDS

- Cantos Venture, a San Francisco-based venture capital fund, raised $50 million for a third fund focused on pre-seed and seed-stage investments in climate, TechBio, aerospace, and computing startups.

PEOPLE

- AE Industrial Partners, a Boca Raton, Fla.-based private equity firm, promoted Tyler Rowe to principal and Austen Dixon, Graham Kantor, and Eugene Kim to vice president.

- CenterOak Partners, a Dallas-based private equity firm, hired Mark Langer as a managing director. Formerly, he was with Heartwood Partners.

- Founders Fund, a San Francisco-based venture capital firm, hired Sam Blond as a partner. Formerly, he was with Brex.

- ICG, a London-based alternative asset manager, hired Andrea Serra as head of europe for ICG strategic equity. Formerly, he was with Blackstone.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers. Sign up to get it delivered free to your inbox.