The Federal Reserve has flipped into inflation fighting mode. The Russian invasion of Ukraine has the global supply chain under increased duress. The pandemic still isn’t over. Meanwhile, recession fears are widespread.

How are chief executive officers handling it all?

To find out, Fortune ran a new CEO survey, conducted in collaboration with Deloitte. We invited the top executives at Fortune 500 companies, Fortune Global 500 companies, and some members of our global Fortune community to participate. In total, 116 CEOs across the globe responded to the June 2022 survey.

Here are some numbers to know.

The numbers to know

9%

- … of CEOs said they expect their firm’s growth to be “weak” (7%) or “very weak” (2%) over the coming year. (In June 2021, 0% of CEOs forecasted “weak” or “very weak” growth).

49%

- … of CEOs said they expect their firm’s growth to be “strong” (43%) or “very strong” (6%) over the coming year. Another 42% said “modest.”

49%

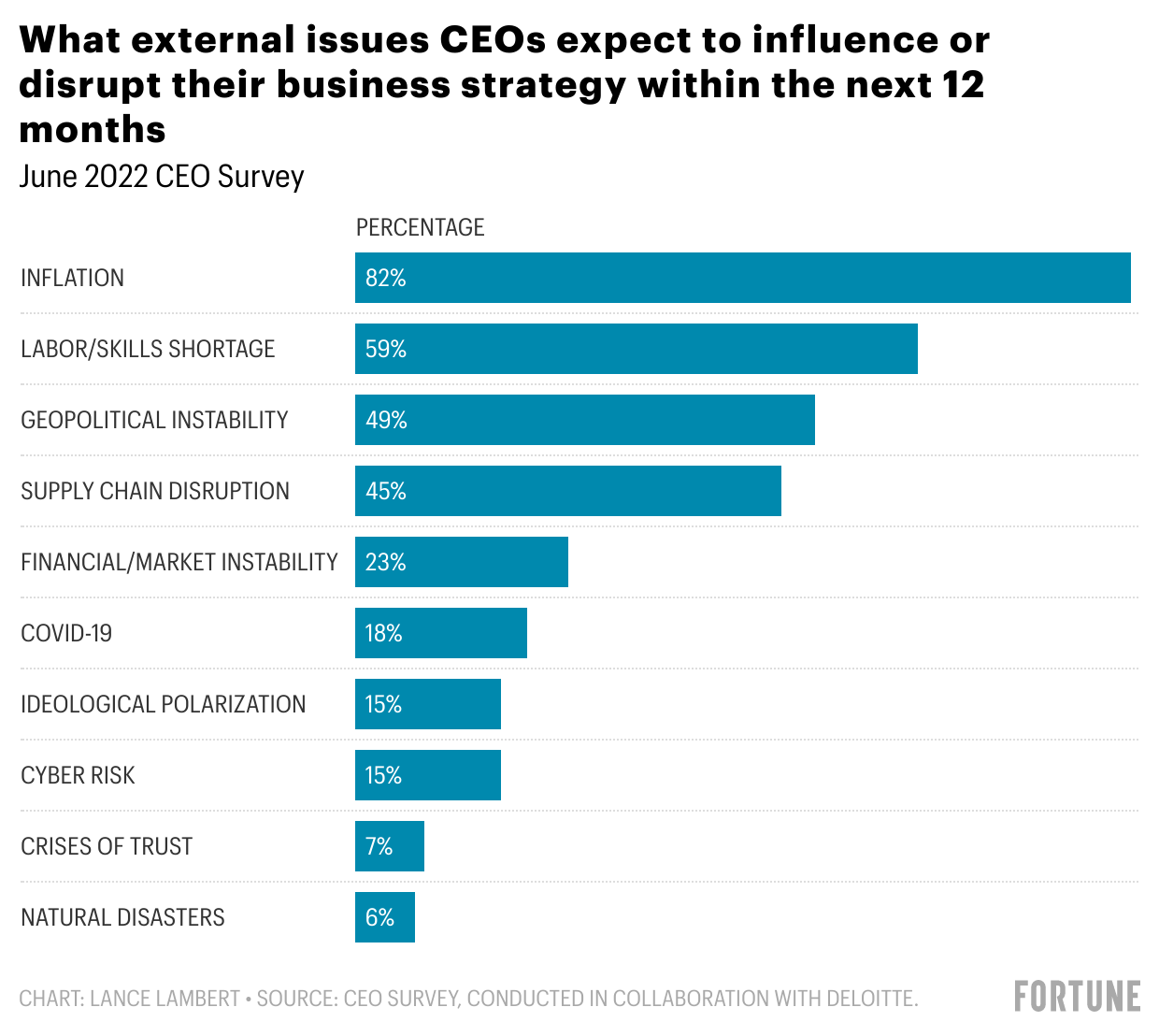

- … of CEOs expect geopolitical instability to disrupt their business over the coming 12 months.

67%

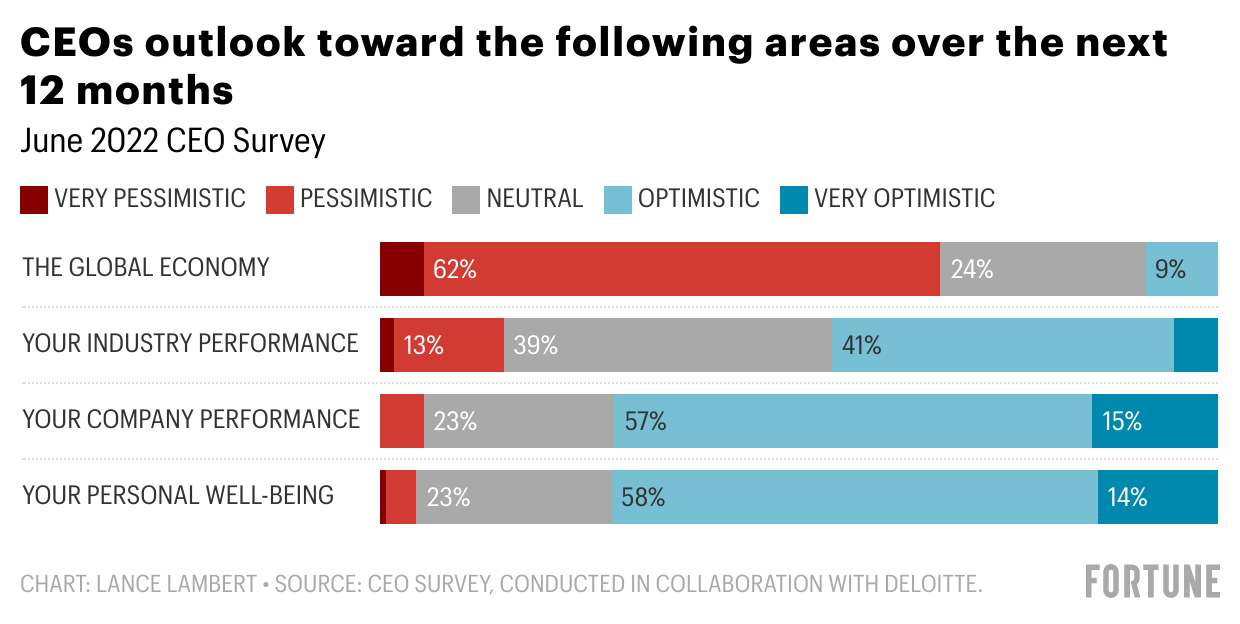

- … of CEOs are feeling “pessimistic” (62%) or “very pessimistic” (5%) about the global economy over the next 12 months.

5%

- … of CEOs are feeling “pessimistic” (5%) or “very pessimistic” (0%) about their company performance over the next 12 months.

72%

- … of CEOs say they’ve disclosed DEI metrics to their employees. While 46% say they’ve also disclosed DEI metrics to the public.

Big picture

While CEOs are clearly expecting economic headwinds, they’re hardly bearish. At least not when it comes to their own business prospects.Only 1 in 10 CEOs expect to have weak growth over the coming year. However, the sluggish stock market tells us Wall Street doesn’t agree.

A few deeper takeaways

1. The “sugar high” is coming to an end.

The recovery from the COVID-19 recession will go down as one of the fastest economic recoveries ever recorded. It only took two years to go from a 14.9% jobless rate (in April 2020) to 3.6% (May 2022).

Amid that speedy recovery, business was great. Maybe even a little too good—you might even call it a “sugar high” of sorts. But now, CEOs clearly believe that “sugar high” will soon dissipate. Look no further than the fact that 67% of CEOs have a “very pessimistic” or “pessimistic” view of the global economy heading forward.

That said, only a tiny percentage of CEOs are pessimistic about their own company or industry. Is that overconfidence on their part? Or does it mean CEOs’ bearish economic views are narrative based and not reflective of slowing business? (If you have thoughts on the disconnect, feel free to email me at lance.lambert@fortune.com).

2. Inflation. Inflation. Inflation.

During the early phase of inflationary periods, things aren’t too bad for business. Those with market power can simply flex their “pricing power” and up prices. In theory, that gets harder as inflation lingers on. Indeed, price-to-earnings ratios, historically speaking, begin to slump as inflationary periods progress. For some companies, we’re already in that phase.

While the Fed has moved into full-blown inflation fighting mode, CEOs aren’t convinced inflation will go away anytime soon. Among the CEOs we surveyed, 82% expect it to continue disrupting business strategy over the coming year.

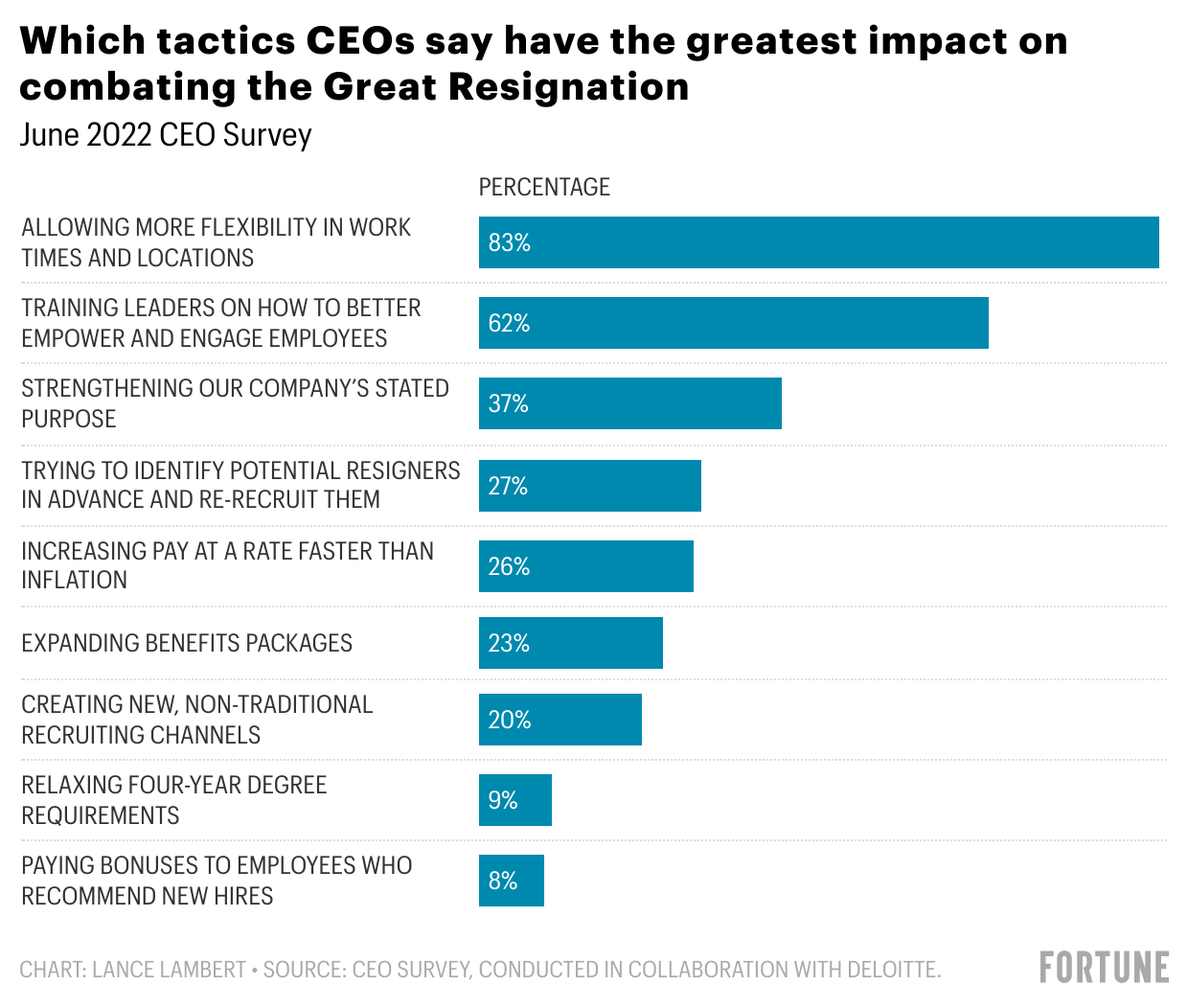

3. The office was a good bargaining chip.

There’s no doubt about it: Every single CEO in America has been forced to face the realities of the tight labor market. To ease turnover rates, CEOs simply allowed many staffers to keep their WFH freedoms. Among the CEOs we surveyed, 83% said allowing more flexibility in work time and locations helped them combat the Great Resignation.

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.