What in the world—the business world, that is—went wrong last New Year’s Eve?

Apparently some cranky cosmic bureaucrat in charge of business conditions woke up the next morning with a truly epic hangover. On the first day back to work, Jan. 3, the S&P 500 closed at an all-time high—and has traveled along a jagged downward path since. Four days later, interest rates jumped to their highest level since before the pandemic. Three days after that, the Bureau of Labor Statistics reported that inflation had cracked 7% for the first time since 1982. By mid-month, COVID’s Omicron variant had pushed average daily U.S. cases to a towering all-time high over 800,000.

That was just January. Since then, Russia has invaded Ukraine; supply chains, which expert consensus agreed would be fixed by now, still aren’t fixed; the unprecedented U.S. labor shortage continues to plague employers; and recession expectations are rising by the day.

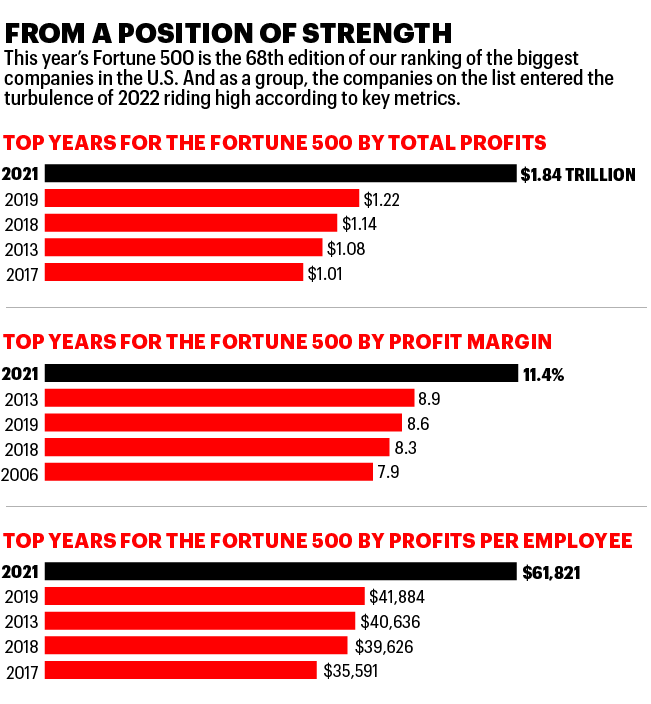

So we’re happy to share some good news. This issue marks the 68th edition of the Fortune 500, our ranking of America’s largest companies by revenue. And we can report that collectively, those 500 big companies entered this miserable spell in a condition that’s near the strongest we have observed in almost seven decades of compiling our list. Critically important measures—profit margin, return on equity, revenue per employee, profit per employee, total assets, and more—were above, sometimes way above, any previous level.

That standout performance doesn’t just reflect a bounce-back from 2020, which was, of course, rocked by the pandemic. By strictly financial standards, 2020 wasn’t all that bad; profits plunged far more deeply in 2002, 2003, and 2009, for example, and the following-year rebounds, in percentage terms, were far larger—yet the performance measures overall weren’t as good as they were in 2021. In addition, a key measure of financial strength, equity capital, is the highest it has ever been. Another measure of strength, liabilities as a percentage of total assets (better known as leverage), is comfortably low—well below the average over the 28 years we’ve been using the current methodology of assembling the 500.

Overall, this group of companies is financially fit and in fighting form, ready to take on tough business challenges that seem poised to get worse. It’s encouraging news amid the economic wreckage—but wait, there’s more.

An often overlooked upside of tumult is that it offers significant opportunities, and not just in the clichéd sense that every problem is an opportunity. Turbulent times are when the competitive order within industries shifts the most. It makes sense. When times are good and nearly everyone is doing well, it’s hard for laggards to get ahead of leaders and hard for leaders to widen their leads significantly. But nasty conditions bring out performance differences that weren’t apparent when the sun was shining. This isn’t just theory. McKinsey research has shown that tough times are when industry leaders and laggards are most likely to change places.

Today’s mix of economic factors is ideal for producing big winners and big losers because it’s so contradictory and puzzling. The conundrums partly reflect sudden dissonance between the recent past and the starkly different present. Consider that Coinbase bounded into the 500 for the first time this year based on its knockout 2021 performance, as crypto trading boomed. (For more, see the story.) But its stock has recently plunged even more dramatically than Bitcoin; as of late May, Coinbase had lost 73% of its value in 2022. During the first-quarter earnings season, 77% of reporting S&P 500 companies announced better-than-expected profits, yet the S&P 500 index fell steadily.

More disconcerting are contradictions in the here and now. For example, the economy shrank in the first quarter, yet the unemployment rate is near its ultralow pre-pandemic level of 3.5%. That’s not supposed to happen. Companies that previously ran scenario exercises for “stagflation” don’t know what to do. Stagflation is a combination of slow growth, high inflation, and unemployment that’s persistently high, not persistently low. So now what? Another example: When stocks go down, bonds and gold usually go up—but not this time. Everything is going down. How do you hedge against that? Consumer sentiment has fallen to an 11-year low, says the University of Michigan, yet retail spending rose in April. Or was that increase just inflation? With managers baffled by conflicting signals, we could be entering a shakeout for the ages.

The economy shrank in the first quarter, yet unemployment is near its pre-pandemic low of 3.5%. that’s not supposed to happen.

In this unique environment, winning companies will likely distinguish themselves in three ways:

They will invest in their core, cutting costs elsewhere. Companies that simply cut costs fastest and deepest are least likely to come out of slowdowns ahead of their peers, says research by the Harvard Business School’s Nitin Nohria and Ranjay Gulati. The winners, by contrast, cut costs in operations but invest more than their competitors in research, marketing, and strategic acquisitions, in line with what’s central to their business.

They will manage cash and prices more skillfully than their rivals do. In high inflation, pricing becomes extremely difficult and supremely important. Today “your business needs a full-time task force on pricing” charged with continually monitoring competitors’ prices, input prices, and consumer psychology, says consultant and bestselling author Ram Charan. Disciplined cash management can mean life or death when all companies are trying to pay slow and collect fast. None of this is glamorous or much fun, but it’s crucial.

Leaders will define reality and give hope. In unsettled times, workers are desperate for information about their company’s outlook. The best leaders give it to them straight. They then put that reality into a larger context, explaining that unprecedented challenges are normal, they’re interesting, and the organization can learn from them, so brighter days lie ahead. Research from the U.S. military shows that people who receive that message perform far better than those who don’t.

It would be foolish to predict whether 2022 will be as rewarding to the Fortune 500 as 2021 was, but it will likely be more instructive. Odds are strong we’ll see new dominant players and spectacular flameouts. Most important, we’ll learn by identifying who was good, who was lucky, who just hunkered down, and who was brave enough to seize opportunities that others missed.

This article appears in the June/July 2022 issue of Fortune with the headline, “Welcome to the contradiction economy.”

See the full 2022 Fortune 500 list.