Good morning,

On Laurie Krebs’ last official day as CFO of Red Hat, an IBM subsidiary software company, she posted a note expressing her thoughts about retiring. It resulted in an outpouring of support from colleagues who said she paved the way for women and was a mentor and supportive leader.

“A bittersweet but exciting new day for me as I ‘officially’ retire my position as CFO of Red Hat and pass the title and responsibility to the amazing Carolyn Nash who will continue to lead, build and empower an incredible organization,” Krebs wrote in a LinkedIn post on April 1. She thanked her team: “We have been able to prove that caring about associates AND being a successful company are complementary concepts,” she wrote.

Red Hat, which provides open-source software capabilities for businesses, was acquired by IBM in July 2019 for $34 billion. Krebs joined Red Hat in 2016 as VP of global tax. She brought 30 years of experience in executive roles in the tax function at companies like KPMG, Nortel, and Cree. Krebs began her tenure as CFO at Red Hat in October 2019. In Q4 2021, Red Hat revenue was up 19%. IBM’s software revenue for the quarter was $7.3 billion, up 8.2%. “Software revenue growth reflects strength in Red Hat and our automation offerings,” IBM CEO Arvind Krishna said on the recent earnings call.

I reached out to Krebs on her last day as CFO. I asked her if she had any advice for the next generation of financial leaders. Krebs shared what’s she’s learned:

–In managing through tough economic times, always lead with company associates, your team, and your customers in mind.

–Be transparent and authentic. Help your team and your customers through the thought processes you used to form decisions. You will never make everyone happy, but if you lead with honesty and transparency, you will earn the trust.

–Treat customers as an extension of your associates.

–Strive to be a business partner with your stakeholders versus simply a finance reporting machine. Initiate cross-functional conversations to learn what the other stakeholders are facing so that you can be part of an enterprise-wide solution.

Krebs, who spearheaded the Women in Finance group, also wrote, “the road to Red Hat and the CFO position I held there were never on my career roadmap, but I’m so thankful I found my way there.” She has advice for personal development.

“Not all CFO positions are the same,” Krebs says. “Just like not all companies are the same. So don’t assume you need to fit into the stereotypical CFO mold of singularly being a financial leader. Use the role to influence all decisions, as a leader for the company, to drive the enterprise forward and to be an advocate for associates through the process.”

Almost exactly one year ago, I sat down with Krebs for our first interview. It was the first week of my new job at Fortune to launch the CFO Daily. After our interview finished, Krebs took some time to get to know me. She asked how my new job was going. When the article published, Krebs reached out to me on LinkedIn. “You are very talented,” she told me. “I look forward to our continued connection, and wish you the best in your career. I know it will continue to be bright!” Since I was just starting out in a new position, her encouragement meant the world to me. We still keep in touch.

Red Hat will have Krebs’ influence a little while longer before she fully begins the next chapter of her life.

“I will continue to help in a finance consulting capacity at Red Hat through June after which I have my sights set on enjoying time with my family, spending time at the beach and whatever else I find as I quietly and excitedly exit the workforce knowing I gave it my all,” she wrote.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

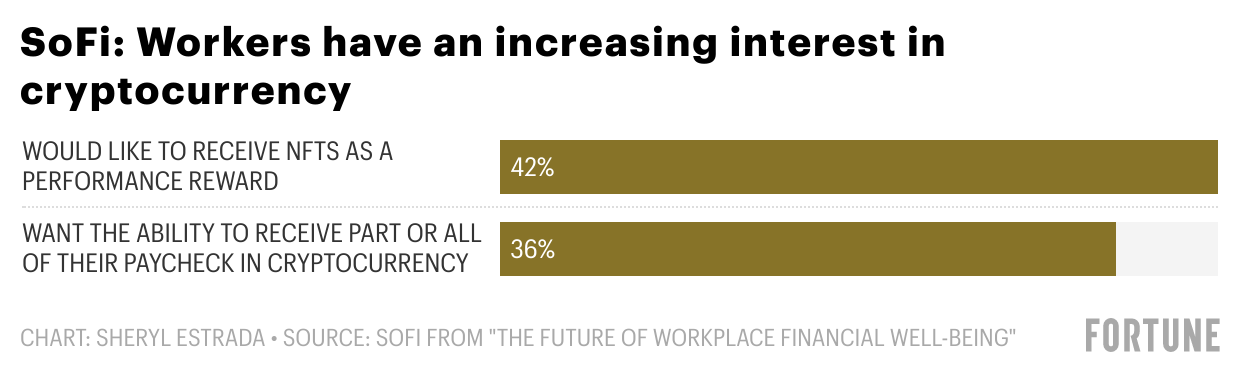

The new report, “The Future of Workplace Financial Well-Being,” released by SoFi (Nasdaq: SOFI) a digital personal finance company and Workplace Intelligence, found 75% of employees surveyed are facing at least one source of major financial stress. Financial planning tools and benefits such as retirement matching remain important to employees. But the report also found a trend in digital currency. About 36% of workers want the ability to receive part or all of their paycheck in cryptocurrency, and 42% would like to receive NFTs as a performance reward. The findings are based on a survey of 800 HR business leaders and 800 full-time employed workers from across industries and locations.

Going deeper

Goldman Sachs’s grim message for investors: Your portfolio will flatline this year—and that’s if you’re lucky, a Fortune report by Bernhard Warner, delves into Goldman's best-case and worst-case scenario for stocks. The worst? "The investment bank reckons equities could tumble a further 21% to finish 2022 at 3,600. That would be Goldman's 'recession scenario,'" Warner writes.

Leaderboard

Flavia H. Pease was named CFO at Charles River Laboratories International, Inc. (NYSE: CRL). Pease succeeds David R. Smith, who is retiring. Pease will join Charles River as corporate executive VP on April 25, and is expected to assume the role of CFO in early May 2022. She will join the company after more than 20 years in financial leadership roles at Johnson & Johnson, most recently serving as VP and Group CFO of Johnson & Johnson’s global Medical Devices business.

Stephanie Pope was promoted from VP and CFO of Boeing Commercial Airplanes to president and CEO of Boeing Global Services. Pope succeeds Ted Colbert, who will become president and CEO of the company’s defense, space, and security business. Pope was also previously VP and CFO of Boeing Global Services, overseeing all financial activities for the business unit since its founding in 2017. In more than two decades of service at Boeing, Pope has held a number of leadership positions of increasing responsibility.

Overheard

"The market still feels hot, but a slowdown in online searches, home tours, and mortgage applications suggests more buyers are getting priced out."

—Real estate brokerage Redfin finds that the red-hot housing market is showing its first signs of cooling, as reported by Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.