U.S. companies posted record profits in 2021, even as Americans struggled with rising consumer prices amid the COVID-19 pandemic.

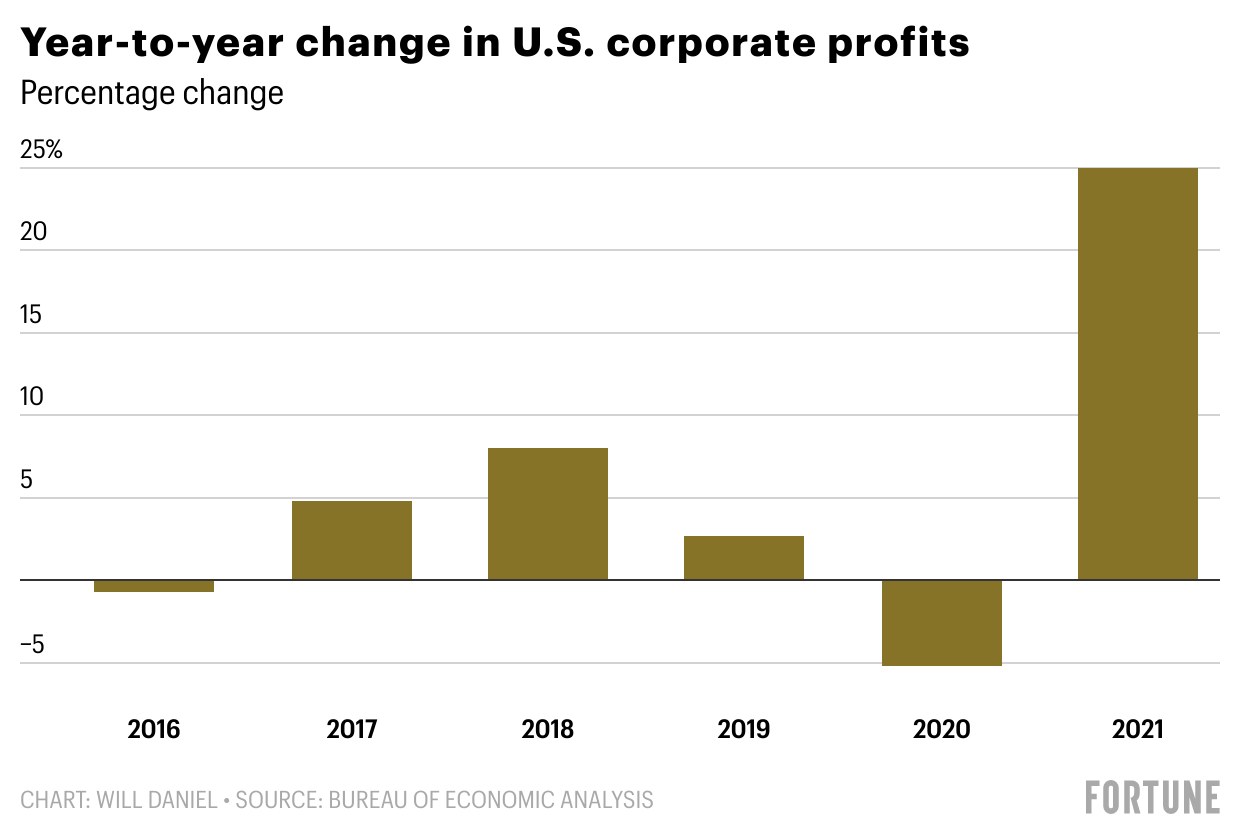

Corporate pretax profits surged 25% year over year to $2.81 trillion, the Bureau of Economic Analysis said on Wednesday. That’s the largest annual increase since 1976, according to the Federal Reserve.

When taxes are factored in, last year’s corporate profit increases were even more of an outlier. They soared 37% year over year, more than any other time since the Fed began tracking profits in 1948.

The considerable jump in corporate profits highlights how businesses have passed off rising production and supply costs to consumers and lends weight to criticism by top Democrats that outsize price hikes are at least partially responsible for rising inflation.

“Corporate greed is motivating large companies to use the pandemic and supply-chain issues as an excuse to raise prices simply because they can,” House Energy and Commerce Committee Chairman Rep. Frank Pallone (D-N.J.) said during a February inflation hearing.

Democrats will likely keep the topic of rising corporate profits front and center ahead of a Senate Budget Committee hearing next week titled: “Corporate Profits Are Soaring as Prices Rise: Are Corporate Greed and Profiteering Fueling Inflation?”

The progressive group Groundwork Collaborative, which focuses on economic issues and has repeatedly criticized corporate America for its price hikes during the pandemic, was also quick to come out with a statement after the corporate profit data was released.

“CEOs can’t stop bragging on corporate earnings calls about jacking up prices on consumers to keep their profits soaring—and today’s annual profit data shows just how well their inflation strategy is working,” Groundwork’s executive director Lindsay Owens said. “These megacorporations are cashing in and getting richer, and consumers are paying the price.”

Consumer prices jumped 6.7% in 2021 as snarled supply chains caused by the COVID-19 pandemic sent commodity prices and other products that businesses rely on soaring. And that trend has continued into this year, with recent inflation data showing consumer prices up 7.9% year over year in February, the biggest gain since 1982.

The average American’s wages have increased 11% to offset some of those price increases, but real wage growth—a measure of wages adjusted for price increases—has been under pressure recently.

In February, real wage growth decreased 2.6% from a year ago, according to the Bureau of Labor Statistics. While it has been difficult for wages to keep pace with inflation, Morgan Stanley economists expect consumer earnings will continue to rise, causing corporate profit margins to take a hit in 2022.

“Wage gains are not just due to the rapid recovery from the COVID-19 shock that may ease as the economy loses some steam,” Morgan Stanley economists Julian Richers and Ellen Zentner told Bloomberg. “Instead, higher wage growth in excess of productivity is likely to be the norm, not the exception, for some time as the labor share of corporate income normalizes.”

In the fourth quarter of 2021, corporate profit growth did slow sharply, rising just 0.7% from the previous quarter. Still, in every quarter of 2021, U.S. corporations’ overall profit margin remained above 13%, a level reached during only one previous quarter in the past 70 years.

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.