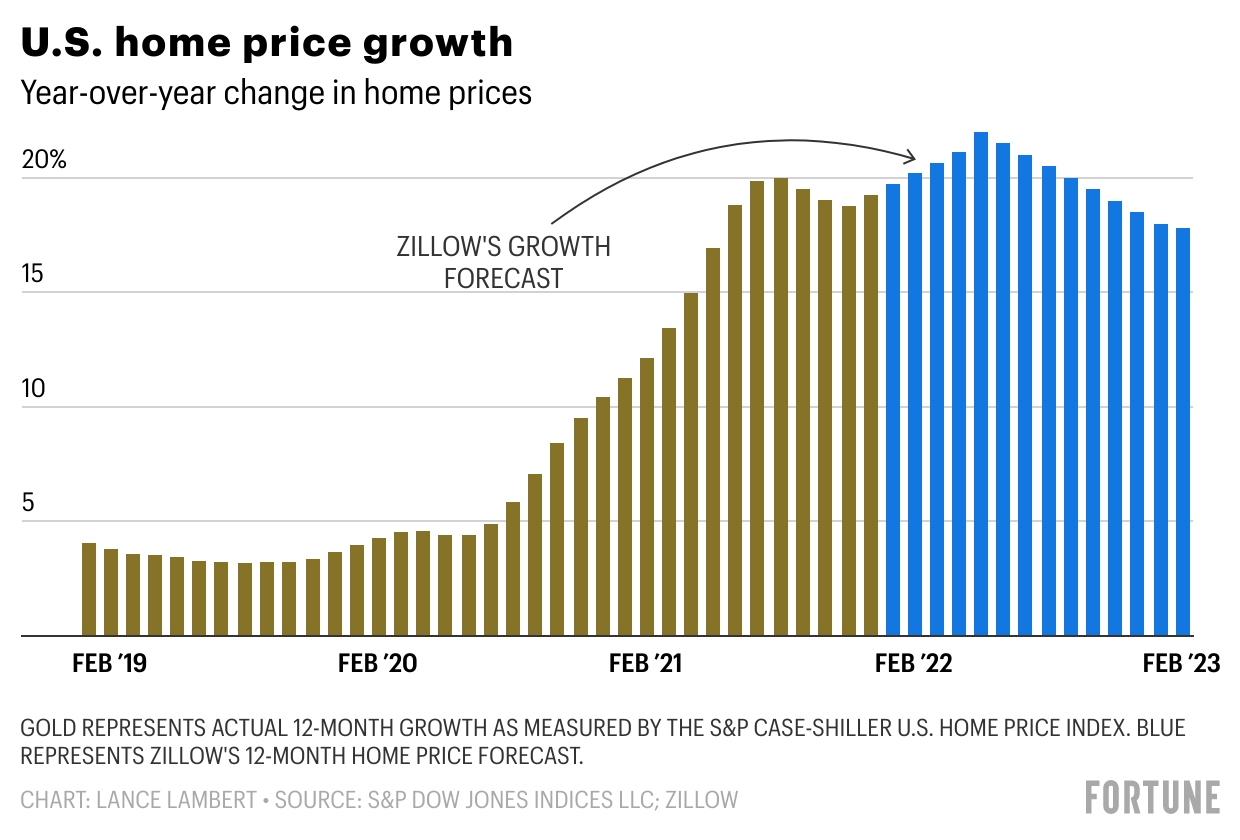

Depleted, stretched, and disheartened. That’s how a lot of home shoppers, who’ve lost home bid after bid over the past year, are feeling these days. When it comes to timing, they’ve certainly gotten the short end of the stick. Over the past 12 months, U.S. home prices are up 18.8%—an uptick larger than any 12-month period leading up to the 2008 housing crash.

But the next crop of homebuyers might even have it worse. On Wednesday, Zillow released its latest forecast. The home listing site now predicts that the year-over-year rate of home price growth will hit 22% in May. That would, of course, represent an acceleration in home price growth.

Beyond May, Zillow foresees only a subtle slowdown in the rate of growth. By February 2023, that year-over-year home price growth will be at 17.8%, according to Zillow’s forecast model. However, that’s hardly any relief for buyers. In fact, it would still be nearly four times greater than the average annual rate of home price growth (4.6%) posted since 1986.

“Annual home value growth is likely to continue accelerating through the spring,” wrote the Zillow researchers. “The robust long-term outlook is driven by our expectations for tight market conditions to persist, with demand for housing exceeding the supply of available homes.”

The cost pain for homebuyers isn’t limited to prices: Mortgages rates are also soaring.

The Federal Reserve is getting serious about reining in runaway inflation. As a result, financial markets are pushing up mortgage rates. Back in January 2021, the average 30-year fixed mortgage rate was at an all-time low of 2.65%. That steadily climbed to 3.11% by December 2021. But over the past three months, the rate has skyrocketed. As of Friday, the average 30-year fixed mortgage rate stands at 4.16%. That’s a bigger deal than it might appear. A homebuyer who took out a $400,000 mortgage at a 2.65% rate would’ve gotten a $1,612 monthly payment. At a 4.16% rate, that payment soars to $1,947 per month. Over the course of 30 years, that’s an additional $120,559.

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.