Good morning,

CFOs are increasingly becoming less optimistic about the U.S. economy due to persistent inflation. It was actually a top subject of Q4’21 earnings calls for both central banks and companies, S&P Global Market Intelligence’s Panjiva found. Mentions of inflation-related words appeared in 71% of calls, which is an increase from 39.2% in the same period a year ago. And the latest news is—inflation is higher than analysts expected.

The consumer price index released on Thursday showed an increase of 0.6% in January and an annual inflation rate of 7.5%. It’s the biggest gain since February 1982, Fortune reported. So, what does sky-high inflation mean for planning, assumptions, earnings, and everything else CFOs are concerned about?

I asked Larry Harris, Ph.D., professor and finance chair at the USC Marshall School of Business, and a former chief economist at the U.S. Securities and Exchange Commission, for his assessment. Higher expected rates on variable instruments (tradable or negotiable assets) will be expensive, Harris says. “Borrowing at fixed rates now is wise,” he says. “Wages and prices will be rising, which will affect budgeting.”

Amid these times of uncertainty, Harris offered some suggestions on how CFOs can prepare their companies:

–Start incorporating inflation into planning models and do a ‘What-if’ analysis to ensure you’ll be able to handle all reasonable scenarios.

-Avoid entering long-term fixed-rate sales contracts, but try to secure long-term fixed-rate supply contracts.

-Get up to speed on financial hedging strategies and ensure you’re authorized and able to engage in them and that you can properly control them against unauthorized speculation. Also, retire variable rate long-term debt and replace it with fixed-rate debt.

-Redouble efforts to collect accounts receivable but try to stretch out accounts payable. Ensure lines of credit are strong in case higher interest rates produces a downturn in economic activity.

-Study the history of your industry’s performance in the late 1970s and early 1980s to see what problems were most important during the last major inflationary period.

Wall Street predicted the Federal Reserve would institute as many as seven interest rate hikes this year to tamp down inflation. “As inflation continues, inflationary expectations are building, which will create more inflation,” Harris explains. “Stopping it will become increasingly difficult the longer the inflation lasts. Rates will have to rise substantially, and the Fed will have to stop buying so many bonds.”

The Fed’s “policy response to the pandemic was heroic, and its ongoing accommodation has been instrumental in enabling the real economy to withstand waves of new COVID variants,” BlackRock’s Chief Investment Officer of Global Fixed Income Rick Rieder said in an emailed statement. “But monetary policy needs to migrate back toward a neutral stance in fairly short order over the coming few months.”

I’d love to hear your thoughts on where you think inflation is heading—and how your company is coping in the meantime. Drop me a line at the email address below.

Thanks for reading. Have a good weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

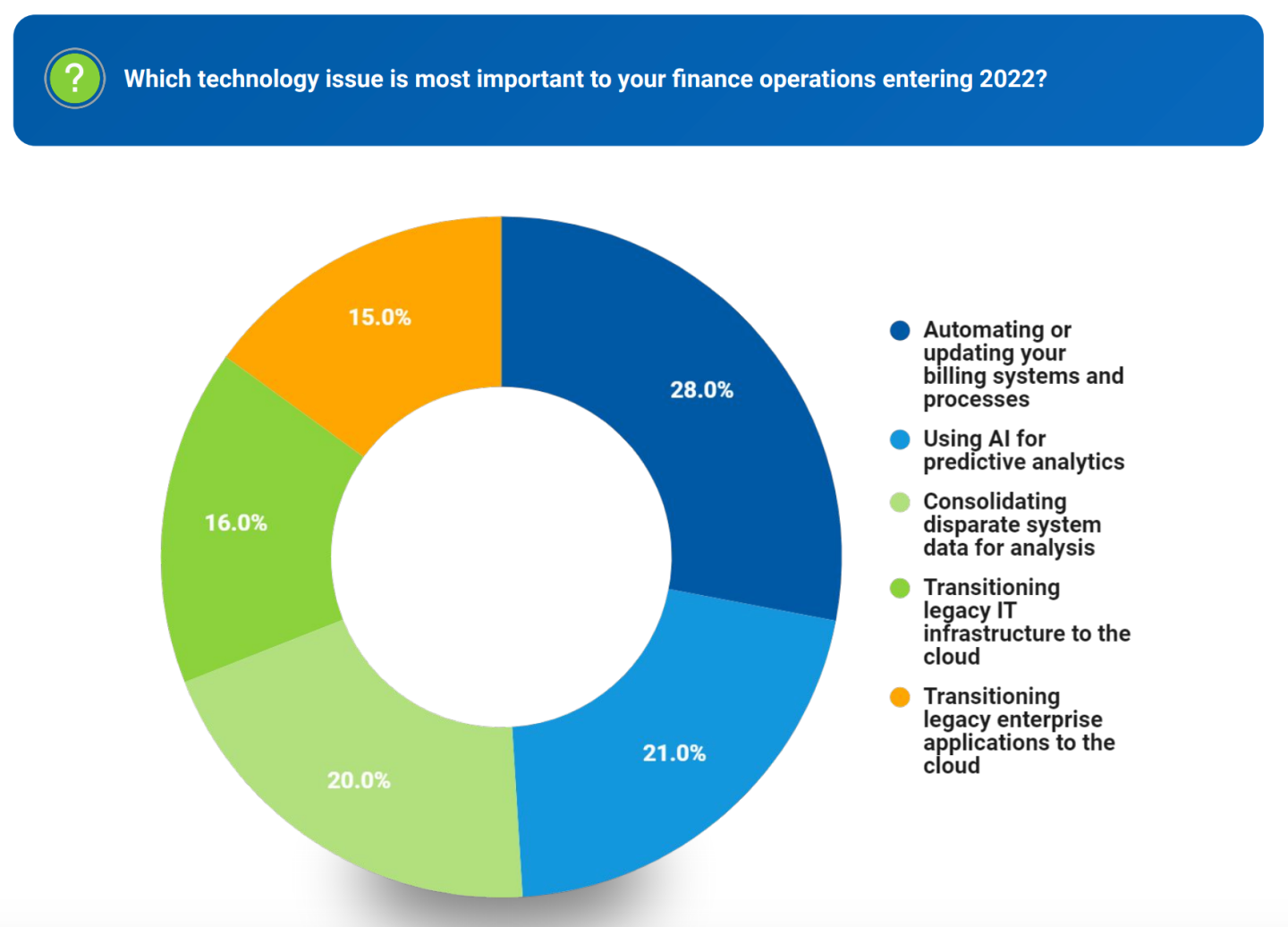

2022 Trends in Finance Survey, released on Feb. 10 by BillingPlatform, a revenue management platform, takes a look at how CFOs are adapting to macroeconomic trends. Digital transformation across the entire lead-to-revenue process is a major goal for the finance leaders surveyed. Top tech issues include automating or updating billing systems and processes (28%), using A.I. for predictive analytics (21%), and consolidating disparate system data for analysis (20%). The findings are based on a survey of more than 300 CFOs and senior finance executives in the U.S. across various industries, with most companies generating $100 million or more in revenue per year, according to the report.

Going deeper

In case you missed it, here’s what was featured in CFO Daily this week:

Hiring is surging—and so are staffing costs

Tyson Foods CEO is betting on A.I. and automation to reduce labor costs

From CFO to CEO: Peloton’s Barry McCarthy’s path to the top job is an increasingly common one

Activision Blizzard focused on the bottom line—and women paid the price

Leaderboard

Here are notable moves:

Dawn Allen was named CFO at Tate & Lyle PLC, effective May 16. Allen joins the company from Mars Incorporated, where she has been global CFO and VP of global transformation since 2020. Prior to that, during a 25-year career at Mars, she has held a number of senior financial roles in Europe and the U.S. including global divisional CFO, food, drinks and multi-sales and regional CFO, Wrigley Americas.

Andrew Bates was named CFO at NAVEX, which offers integrated risk and compliance management software. Bates brings more than two decades of experience in senior finance roles, including CFO at Viewpoint Software. This announcement marks Bates’ return to NAVEX, where prior to Viewpoint, he served as VP of finance. He also served as the corporate controller at Pixelworks.

Zac Coughlin was named EVP and CFO at PVH Corp. (NYSE:PVH), effective April 4. Coughlin joins PVH from DFS Group Limited, where he served as Group CFO and COO. Prior to joining DFS, Coughlin was CFO at Converse, Inc., a division of Nike, Inc., He started his career with Ford Motor Company where he held multiple global financial leadership roles.

Mark Guinan, EVP and CFO Quest Diagnostics (NYSE: DGX), a provider of diagnostic information services, has announced his intention to retire in 2022. Guinan served eight and a half years in the role. A process to identify Quest’s new CFO has begun, according to the company. Guinan will participate in the selection process and will remain in his role through the transition.

Dean Freeman was named CFO at Benson Hill, Inc. (NYSE: BHIL), a food technology company. DeAnn Brunts has elected to return to retirement from her full-time executive role. Freeman officially joined Benson Hill as EVP of finance on Feb. 2, 2022. Most recently, he served as the president and CEO of First Source Capital, a commercial finance company he founded in 2019. Prior to that, he held roles as CFO at GCP Applied Technologies and interim CEO at Watts Water Technologies.

Mark Gallenberger CFO at Cerence Inc. (Nasdaq: CRNC), will retire effective March 11. Gallenberger will remain with Cerence in an advisory role through mid-November to assist with the transition. Mitch Cohen has joined Cerence and will serve in an interim role to provide oversight of the finance organization. Prior to joining Cerence, Cohen was a consulting CFO for various companies through his entity, MMC Ventures LLC. Before that, Cohen served as CFO of Athenian Venture. The company in conducting a search for a new CFO.

René Just CFO at Centogene N.V. (Nasdaq: CNTG), has resigned, effective March 31, after the expected filing date of Centogene’s Annual Report on Form 20-F, according to the company. Miguel Coego Rios was appointed EVP of finance and legal and Interim CFO, effective Feb. 08. Most recently, Rios was VP and general manager South Europe at Orphazyme A/S. Before that he was VP and CFO at Mundipharma.

Rachel Pisciotta was named CFO at MCNC, a technology organization. She succeeded Pat Moody who announced her retirement last year after 22 years. Prior to joining MCNC, Pisciotta was the director of finance and business development at Business Protection Specialists, Inc. She also previously served as director of finance at Duke University Health System and was VP and CFO at Strong Home Care Group at the University of Rochester.

Overheard

"We were really hindered by our balance sheet, and now we have this agility and flexibility to invest in capturing more than our fair share of the growth of luxury."

—Neiman Marcus Group CEO Geoffroy van Raemdonck on the company reinventing itself amid a high-end spending boom, as told to Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.