If the heavyweights of Wall Street are to be believed, 2022 will be a rate-hike-palooza.

In recent days, investment bank after investment bank has published revised forecasts, and they all predict the same thing: that the Federal Reserve will raise interest rates at a quicker pace this year than anybody would have anticipated just a week ago.

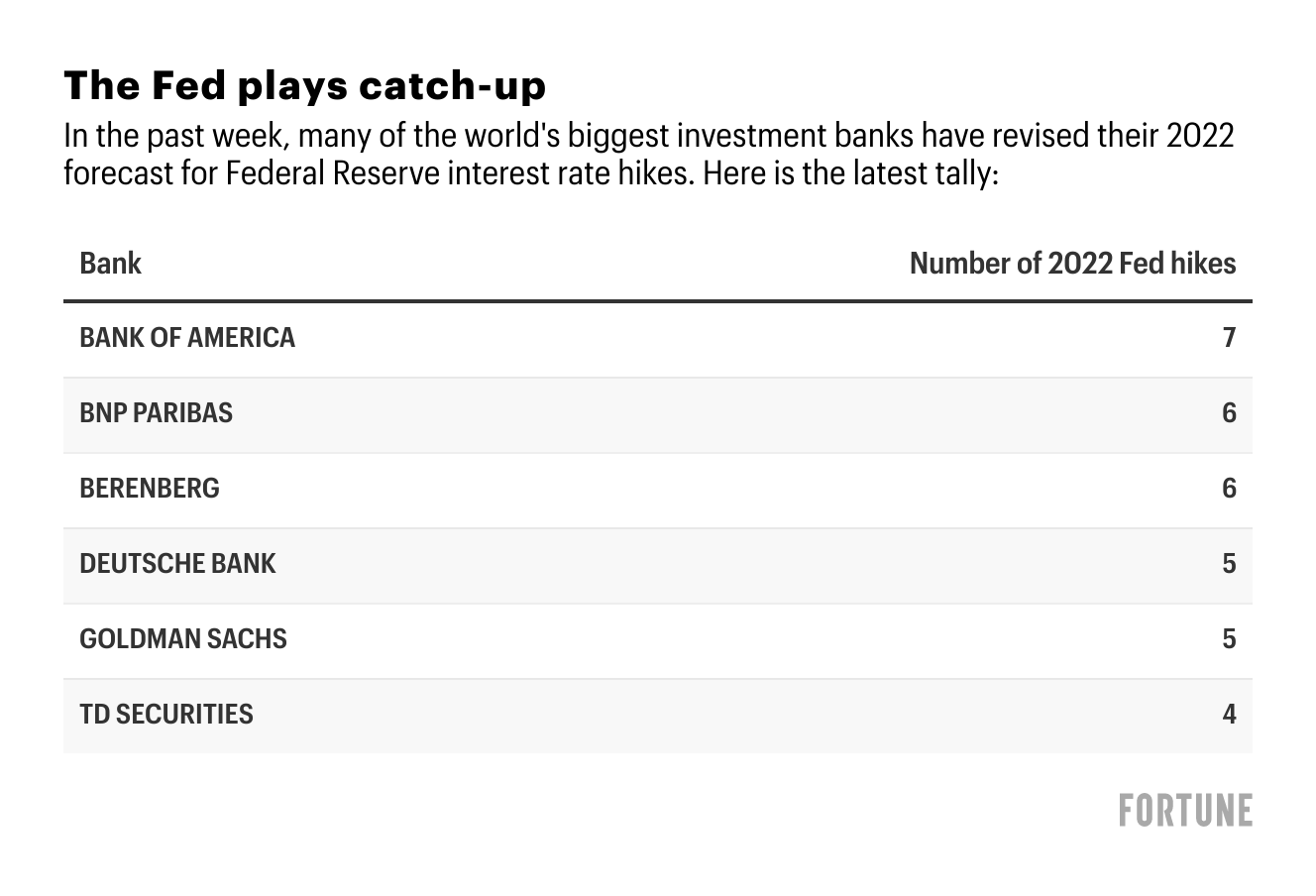

The latest is from Goldman Sachs, which now sees five rate hikes this year (up from four), joining Deutsche Bank at that number. Bank of America thinks the central bank will be even more aggressive. It predicts seven 25-basis-point hikes this year, one for each of the remaining Federal Open Market Committee (FOMC) meetings. That would bring the Federal funds rate to 1.75% to 2% by year-end, essentially hiking up borrowing costs for Americans after years of rock-bottom lending rates.

At last week’s FOMC meeting, Fed chairman Jerome Powell gave a clear signal that the central bank will wind up its bond purchases in Q1, and will move to raise interest rates as often as needed to tame runaway inflation. Stocks whipsawed throughout the week as it became clearer to investors that the central bank is solidly behind the curve in tightening monetary policy.

“The striking thing about chair Powell’s press conference this week was that he in effect made a compelling case that the Fed should have already hiked rates in the second half of last year,” said Ethan Harris, global economist at Bank of America, in noting telltale signs of a slowing economy, a turbulent labor market, and rising prices. “The only thing missing from the narrative was, ‘And so, we are behind the curve and are hiking today.’”

Harris’s team believes the first rate hike will come in March to fit in seven hikes this year. Next year? An additional four hikes, bringing the two-year tally to eleven.

‘The market will stay volatile’

The markets have been pricing in rate cuts for some time, and yet risk assets just finished a tumultuous week, with huge intraday swings on Monday, Wednesday, and Friday. When the dust settled though, the S&P 500 closed higher by nearly 0.8% for the week, its first positive week of 2022. The Nasdaq finished essentially flat on the week.

Deutsche Bank research strategist Jim Reid predicts today could be another wild one. “Until the market and the Fed stop leapfrogging each other in terms of interest rate expectations, the market will stay volatile. With such an extreme month, today’s month-end might see some position squaring, so maybe there’ll be another late swing/surge/slump in the last 90 minutes,” he wrote to clients this morning.

On cue, U.S. futures have been in and out of the red all morning, premarket. European stocks were broadly higher on Monday, but that, too, could be a sign of investors catching up to the Friday late-afternoon rally in the U.S.

Longer term, Wall Street is warning investors that a Fed playing catch-up could send further ructions through the markets. As Harris says, “Clearly, risk assets are vulnerable.”

He continues, “One way to view the recent stock market correction is that with the Fed no longer in deep denial, markets have caught on to the idea that inflation is a problem and the Fed is going to do something about it. As the Fed pivot continues—and the bond market prices in more hikes—we could see more volatility. However, the stock market is not the economy. The fundamental backdrop for growth remains solid regardless of whether stocks are flat or down 20%. Even the hikes we are forecasting only bring the real funds rate slightly above zero at the end of next year.”

In other words, even with the Fed tightening, rock-bottom lending rates will still be with us. House-hunters no doubt will find little consolation in that argument. The same could be said for investors who are long on growth stocks.

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.