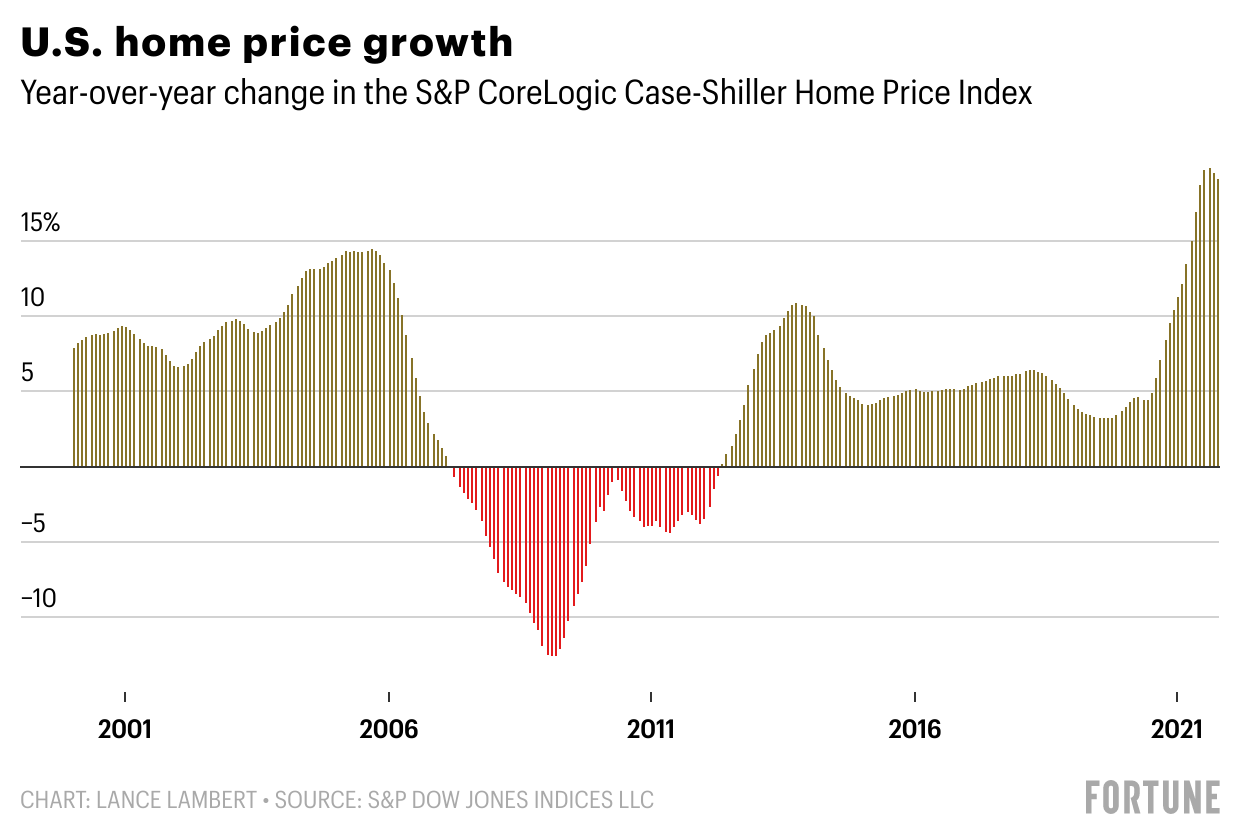

The bad news for homebuyers: Over the past year, the U.S. has seen the fastest period for home price growth in recorded history—even greater than any of the years leading up to the bursting 2008 housing bubble. The silver lining: Home values just posted their second consecutive month of decelerating price growth.

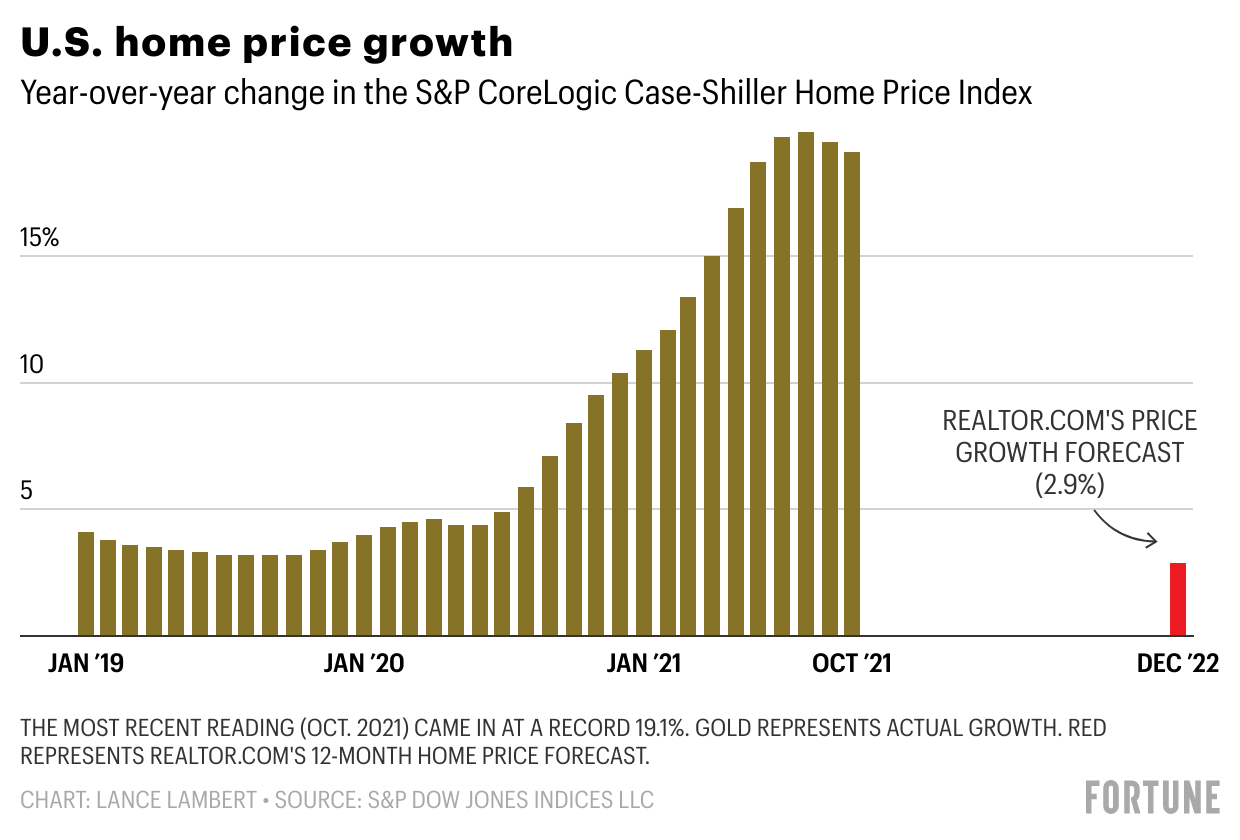

Year over year, U.S. home prices rose 19.1% between October 2020 and October 2021, according to the S&P CoreLogic Case-Shiller Index, the leading measure of residential real estate price. That’s down from the all-time high of a 19.8% home price increase between August 2020 and August 2021, meaning that home price growth started to cool in the autumn. But that slowdown is bigger than it might first appear. See, that year-over-year period still includes the frenzied 2021 spring housing market, during which bidding wars hit an all-time high. When you look at the last two months for which data is available, September and October, home prices rose 0.8% month over month, which is significantly slower than the 2.3% spike between March and April.

However, home shoppers should not mistake this latest slowdown as price relief. After all, the 19.1% uptick in home prices is far above the average 3.2% pay raise workers can expect this year. That said, there’s a growing consensus among industry insiders that the deceleration in home price growth is just getting started. And that price growth slowdown has the potential to be even more substantial if an inflation-concerned Federal Reserve pushes interest rates up by more than expected. If the interest rate of the average 30-year fixed mortgage (currently at 3.1%) were to rise even half a percent, it would have the potential to lock out some buyers from the market altogether, lower demand, and lower levels of home price growth.

“Mortgage rates will rise to 3.6% [this year], bringing price growth down to earth…This low price growth will likely discourage speculators from entering the market and allow more first-time buyers to have a chance at winning a home,” writes Daryl Fairweather, chief economist at Redfin. In the same report, Redfin predicts that annual home price growth in 2022 will plunge to 3%. If that happens, it would be the slowest year-over-year change in home prices since 2012.

That assessment of continued price growth deceleration in 2022 was shared by every forecast model reviewed by Fortune. Among the eight industry models we looked at, the most bullish are clearly by Zillow (predicting 11% home price growth in 2022) and Goldman Sachs (predicting an annualized rate of 12.6%). While those forecasts would mark a serious numerical dip from the 19.1% we’ve seen over the past 12 months, they still predict a market in which home prices are growing at more than double the average annual rate (4.6%) they’ve grown since 1980. Home price growth forecasts by Freddie Mac (7%) and Fannie Mae (7.9%) would also mark an above-average year.

Meanwhile, joining Redfin on the more bearish side are Realtor.com (forecasting 2.9% home price growth in 2022) and CoreLogic (1.9%). While the Mortgage Bankers Association, which is predicting the median price of existing homes will drop 2.5% by the end of 2022, has the lone model predicting a price drop.

Why is home price growth likely to continue decelerating in 2022? Some of it is simply a housing market returning to normal after a pandemic-spurred boom sent home price growth to unsustainable levels. Record-low mortgage rates are expected to rise, while looming return-to-office plans have cut down on some second-home purchases. Seasonality—the cooling period in the summer and fall during which home sales usually fall—has also returned to the market after it was absent last year, as more Americans return to vacationing and pre-pandemic life.

But price growth deceleration doesn’t mean the housing market is weakening. In fact, even at a much lower rate of home price growth, it could still be a buyer’s nightmare. The mismatch between supply, with inventory still floating around a 40-year low, and demand, driven by the influx of first-time millennial homebuyers, is poised to keep this a seller’s market through 2022.

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.