COVID-19 and the rising movement for social change are moving corporate America into realms it never could have imagined. Whether it’s remote work, social impact, or diversity and inclusion, meeting the labor market’s new expectations requires new leadership competencies.

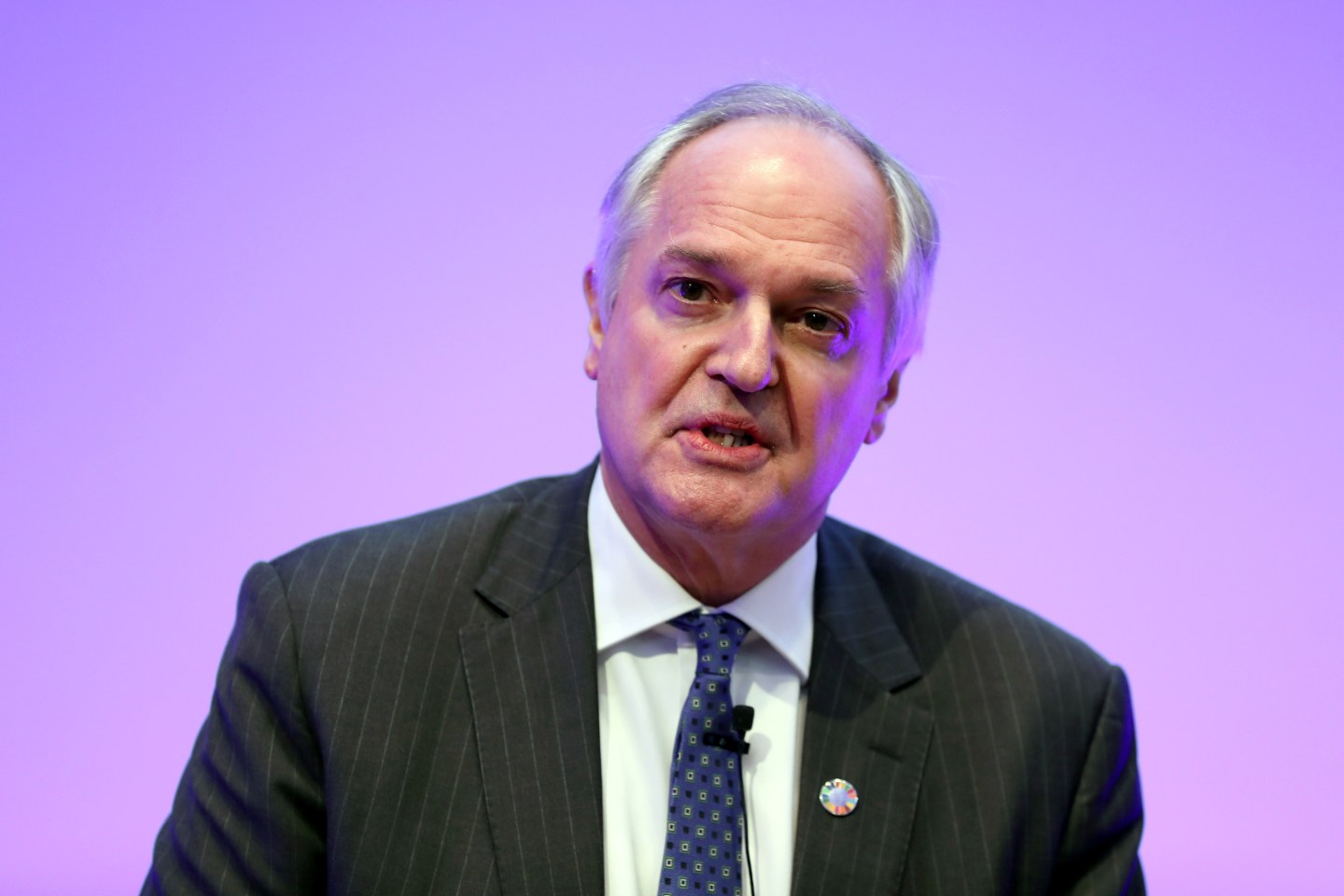

These new expectations are evolving by the month or even week, according to Paul Polman, former Unilever CEO and board member.

“It has changed in the last three months. I would even say it has changed even more so in the last two weeks,” Polman said at Fortune‘s The Modern Board virtual panel on ESG measures. “It’s not surprising when you have this enormous scale of change, bigger than the Industrial Revolution, and a speed of change more than the technological revolution.”

Given the magnitude and rate of change, Polman suggests most boards in their current construction are not capable of leading through these times.

“The reason boards struggle with that is they’re just not equipped to deal with today’s challenges,” he explained. “It might sound harsh, but that is the reality. They don’t reflect the real world anymore. They grew up at a different time period, did an outstanding job then, but the world has moved on.”

He added that today’s boards may be “a bottleneck” that inhibit progress against climate change and inequality. But it’s not just the board’s problem, “We also need to replace a lot of CEOs,” Polman added.

During his tenure as Unilever’s CEO, the company’s stock more than doubled, from around $23 to $56. This was despite investments Polman made in the interest of employee engagement, culture, and responsible business practices relating to climate, and a shareholder attempt to wrest power away from him because of that.

“I think what we have proven is that this longer-term multi-stakeholder model with purpose at the core ultimately is also the best model for the shareholders,” Polman said.

Gabrielle Sulzberger, board member at Mastercard, Eli Lilly, and others, agreed about the pace of change, mentioning that this acceleration is occurring for all three aspects of ESG (environmental, social, governance) strategy.

“We have found that boards increasingly needed to make decisions and, whether you’re a disrupter or the disrupted, the pace in which we had to make decisions was evolving,” she said. “The query as to who and what the board should look like and board composition was all the more elevated…if the context of this conversation is ESG, it really speaks to [governance] and this issue of refreshment.”

Amy Chang, board member at Disney, Procter & Gamble, and others, including some startups, underlined the urgency for evolved leadership and fresh perspectives given the emergence of younger generations in the workforce and consumer market that are increasingly looking for and responding to ESG efforts.

“If we look at it in the U.S., we’re already at 25% of the population is Gen Z,” she explained. “They have $150 billion of purchasing power. So you can’t really afford to ignore that if you’re any type of consumer focused company. And…these folks are about to be their employee base as well.”

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.