Good morning.

At 5 p.m. ET today, Facebook will deliver its Q3 results, kicking off a huge week of Big Tech earnings calls. Last week, tech investors got a bit of a scare when Snap Inc. warned that advertisers were pulling back on their spend in the wake of the supply-chain woes. That pronouncement hit the Nasdaq hard.

With that in mind, investors will be anxious to hear what Facebook has to say about the outlook for digital ads. Ahead of that, global stocks and U.S. futures are barely moving.

In crypto, Bitcoin has recovered some of its weekend losses, when it fell below $60,000. But it trades below its Friday price level.

Let’s see what else is moving the markets.

Markets update

Asia

- We begin the week with mixed markets in Asia. The Nikkei, the worst of the bunch, is off 0.7% in afternoon trading.

- China is locking down roughly one-third of the country to combat the Delta variant. COVID jitters, plus the energy crunch and a Beijing’s regulatory crackdown are forcing economists to revise lower their growth estimates for 2021.

- Saudi Aramco, the world’s largest oil producer, announced this weekend it will aim to achieve its net-zero goal throughout its operations by 2050. Investors are unimpressed. Shares were down 0.1% on Monday.

Europe

- The European bourses were trading sideways with the Stoxx Europe 600 unchanged two hours into the trading session. Energy, banks and autos were leading the way higher at the start.

- Shares in HSBC were up 0.5% in London at the open after Europe’s largest bank reported a big earnings beat and $2 billion worth of share-buybacks.

- Italy is emerging as a surprise front-runner for one of Intel’s new multi-billion euro chip-manufacturing plants, Reuters reports in a weekend scoop.

U.S.

- U.S. futures are off their lows. That’s after all three major averages pulled off a third-straight week of gains.

- It’s a big week for tech earnings. We have Facebook (today), Microsoft and Google‘s Alphabet tomorrow. Apple and Amazon go on Thursday.

- As of Friday’s close, 117 S&P firms had reported earnings, and roughly 85% had posted a bottom-line beat, Deutsche Bank reports. That’s solidly above the five-year average.

Elsewhere

- Gold is flat, trading around $1,800/ounce.

- The dollar is up a whisker.

- Crude is flat. Brent trades around $85/barrel.

- Bitcoin is steady after Friday’s tumble. It trades around $62,000, flat over the past seven days.

***

Help wanted

Last week, the S&P 500 hit a new all-time high, boosted by a seven-session winning streak. It closed in the red (just barely) on Friday, but still managed to climb 1.6% on the week, led by real estate, bank and health care stocks. The benchmark has now come all the way back, recouping all the losses incurred during that September swoon.

So far in October, strong earnings are giving stocks a lift. That’s notable because the outlooks haven’t been all that great.

This emerging paradox hasn’t gone unnoticed. In conversations with investors, “inflation and input costs have been a major focus,” mirroring what CEOs are saying, says Goldman Sachs’ U.S. equities chief David Kostin.

Are these headwinds transitory?, as Treasury Secretary Janet Yellen says. So far, companies are passing along the price-rises—we’ve seen that from Unilever and Procter & Gamble, to name just two—and consumers are absorbing the hit.

How long can that last?

Economists figure that one key component of inflation—the supply chain bottlenecks—will begin to ease next year. (The shipping giants concur.) They’re less optimistic about the other big factor: the tight labor market. Berenberg chief economist Holger Schmieding told Bloomberg TV this morning that labor shortages will likely keep inflation at an elevated level long after the supply-chain issues are sorted.

Goldman agrees.

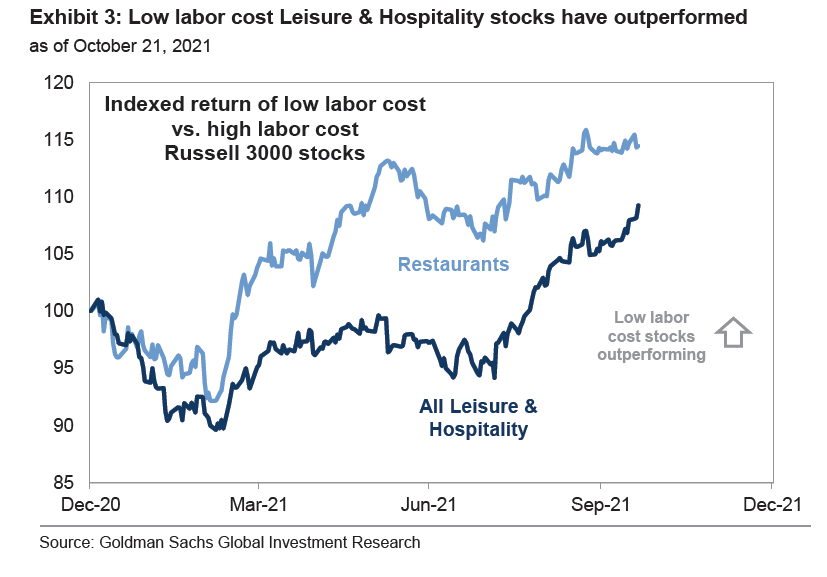

“Labor market tightness is one theme that has recently driven equity market performance and will likely remain a challenge for many companies for years,” Kostin writes. On the flip side are sectors defined by low-labor costs, namely, the leisure and hospitality sectors. They’re outperforming the markets lately.

Goldman gives a kind of rule-of-thumb advisory on how to adjust your portfolio for a world of rising wages and a skills shortage.

“Stocks with the highest sales/assets and sales/employee ratios have outperformed during the past decade and in recent weeks,” Kostin writes. These stocks, he adds, “look well-positioned to outperform going forward.”

How do you find these companies? Look for “sales per employee” data of listed companies. Here’s the Top 5 for the S&P 500, according to Goldman: Moderna, Valero Energy, AmerisourceBergen Corp., Phillips 66, and Cardinal Health. Netflix and Apple make the top-10.

Anything above $400,000 in sales per employee (that’s the S&P 500 median) should have some upside, Goldman figures.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

The latest meme stock in the Trump SPAC wave: Phunware—Fortune

Retailers are paying big money to find staff for the holiday season—Fortune

The U.S. Is Turning Green. What Will This Climate Plan Cost and Who Will Pay?—Wall Street Journal

Carbon Offsets Are Used by Companies Seeking ‘Net Zero,’ but Concerns Persist—Wall Street Journal

Market candy

+825%

Coal stocks are having a very good year. Look no further than Peabody Energy Corp (ticker: BTU). The coal-mining stock is up more than nine-fold—+825% as of Friday's close—in the past 12 months. New York Times markets columnist Jeff Somer writes that the sector is booming ahead of the big COP26 climate talks, and that run is likely to continue into 2022.

This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.