Good morning,

Are we in a stock market bubble?

Not necessarily, according to Adena Friedman, president and CEO at Nasdaq. Innovation in technology is a major factor in the rapid growth of earnings, Friedman said during Fortune’s Most Powerful Women Summit in Washington, D.C. on Tuesday. “I think we need to look at all of the ingredients that are contributing to the market valuations,” she said. “First is a true digital transformation of the corporate community and everyone’s lives.”

The tech that is enabling the transformation represents a “long-term growth opportunity that is massive,” Friedman said. “Investors are looking for growth and they’re rewarding companies that can do that,” she explained. This in turn drives asset values up because of the opportunities that are in front of those companies, Friedman said. And startups are contributing to this tech trend.

“The companies that are going public today are amazing … they are driving a technological transformation of the economy,” Friedman said. “That is a 20-year trend.” Investors understand want the trends are and how to lean in on them, she said.

The IPO market in 2021 has been “record-breaking, on fire, historic, extremely active, very busy,” Matthew Kennedy, senior market strategist at Renaissance Capital, told Fortune in July. Driven by factors including low interest rates and abundant liquidity, in the first quarter of 2021, there were 365 IPOs about 677% higher than the same time the prior year. Friedman also noted that the accommodating monetary policy is driving a lot more corporate and M&A activity.

Friedman said the rise in growth investing and trends are real, but there’s no way to fully predict the future. “No one has a crystal ball as to what’s going to happen in the markets,” she said.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

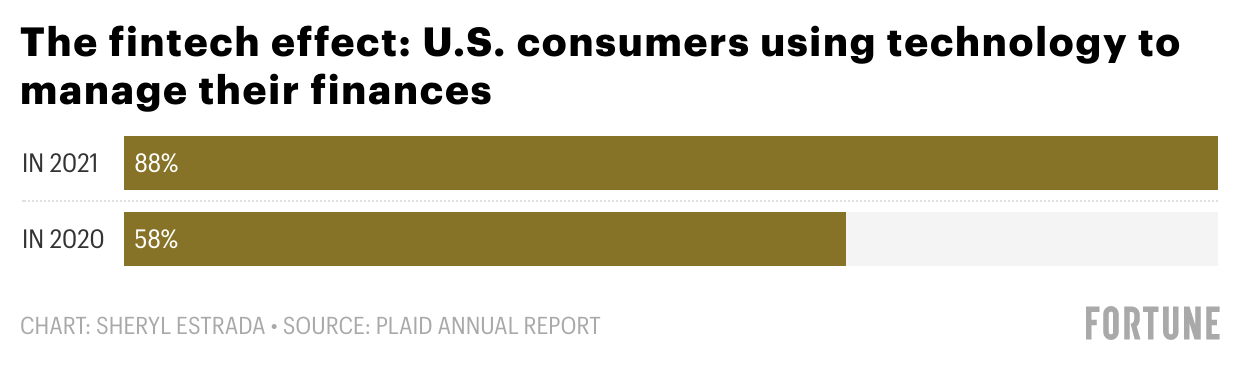

Plaid, a fintech startup, released its annual report on October 12 based on how consumers use financial technology. In 2021, 88% of U.S. consumers reported using fintech, compared to 58% in the 2020. The year-on-year increase in consumer use “means that fintech is now one of the most adopted technologies," John Pitts, Plaid’s global head of policy, told Fortune. Bill payments and digital banking were most prevalent in overall uses of fintech.

Going deeper

The tech and telecom M&A market saw about $1 trillion worth of deals so far this year, according to a recent report by S&P Global Market Intelligence's 451 Research. This growth is on pace to double the previous annual spending record of $626 billion, set in 2020, the report found. There were 3,120 deals in the sector as of September 29, according to 451 Research. Among the largest technology transactions included Square Inc.'s $29 billion acquisition of Afterpay Ltd., a buy-now-pay-later processor.

Leaderboard

Abhi Maheshwari was named CFO at Aisera, an AI service management platform. Maheshwari joins Aisera from CrowdStrike, a global enterprise cloud company. As CAO for CrowdStrike, he led accounting operations, reporting, treasury and tax functions. Prior to joining CrowdStrike, Maheshwari was head of worldwide finance at Logitech.

Harry Thomasian Jr. was named CFO at Precigen, Inc., a biopharmaceutical company, effective October 18. Thomasian will report to Precigen's president and CEO Helen Sabzev. Prior to Precigen, Thomasian worked at EY. He most recently served as senior client services partner and the Baltimore office growth markets leader for the life sciences industry and senior partner in EY's Capital Markets Center in Tokyo as well as other various global, area and local leadership positions.

Overheard

“It's called the she-cession for a reason.”

—Mellody Hobson, co-CEO and president of Ariel Investments and co-chair of Fortune’s Most Powerful Women Summit, on the pandemic driving millions of women out of the workforce and the resulting effects, as reported by Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.