This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters.

There’s a distinct risk-off cloud hanging over the global markets as investors count down the hours to the annual Jackson Hole confab of central bankers. Asia and Europe are awash in red, though off their lows. U.S. futures are flat.

Crypto looks worse. For a third straight day, Bitcoin is in decline. It’s now fallen nearly 7% since breaking through the $50,000 mark over the weekend.

Let’s see what else is moving markets. We begin in Asia.

Markets update

Asia

- Asia is mostly lower, with the Hang Seng down 1.5% in afternoon trading.

- For the second straight day, Chinese tech stocks were the big drag, with Alibaba, Meituan and Apple supply partner AAC Tech lower in afternoon trading.

Europe

- The European bourses are under pressure with the Stoxx Europe 600 down nearly 0.7% at the start.

- And you think the supply chain woes in your part of the world are bad… There’s an island in the North Atlantic that’s fast running out of McDonald’s milkshakes, chicken dinners and petrol, and now economists are worried these shortages could derail the recovery. Where, pray tell, is this down-on-its-luck place? Psst, you can find it here, above France and east of Ireland.

- Shares in Gazprom fell nearly 1% yesterday in Moscow after the Russian oil and gas giant ran into fresh legal troubles in Germany that could impact the future of its highly controversial Nord Stream 2 pipeline.

U.S.

- U.S. futures are lower this morning, putting the S&P 500’s five-day winning streak in jeopardy. Yesterday, the S&P and Nasdaq hit new all-time highs with financials and energy leading the way.

- Investors await Fed chief Jerome Powell’s big Jackson Hole speech tomorrow for signs when (and if) the central bank will begin tapering. Spoiler: fireworks are unlikely.

- Shares of Salesforce are up 1.9% in pre-market trading after the software giant reported a big bottom-line beat and raised its full-year outlook, boosted by one of its newest acquisitions, Slack.

Elsewhere

- Gold is down, trading below $1,790.

- The dollar is gaining with stocks wobbly this morning.

- Crude is lower, with Brent hovering below $71/barrel.

- Bitcoin continues its slide, sinking below $47,000, erasing all of the last week’s gains.

***

By the numbers

51

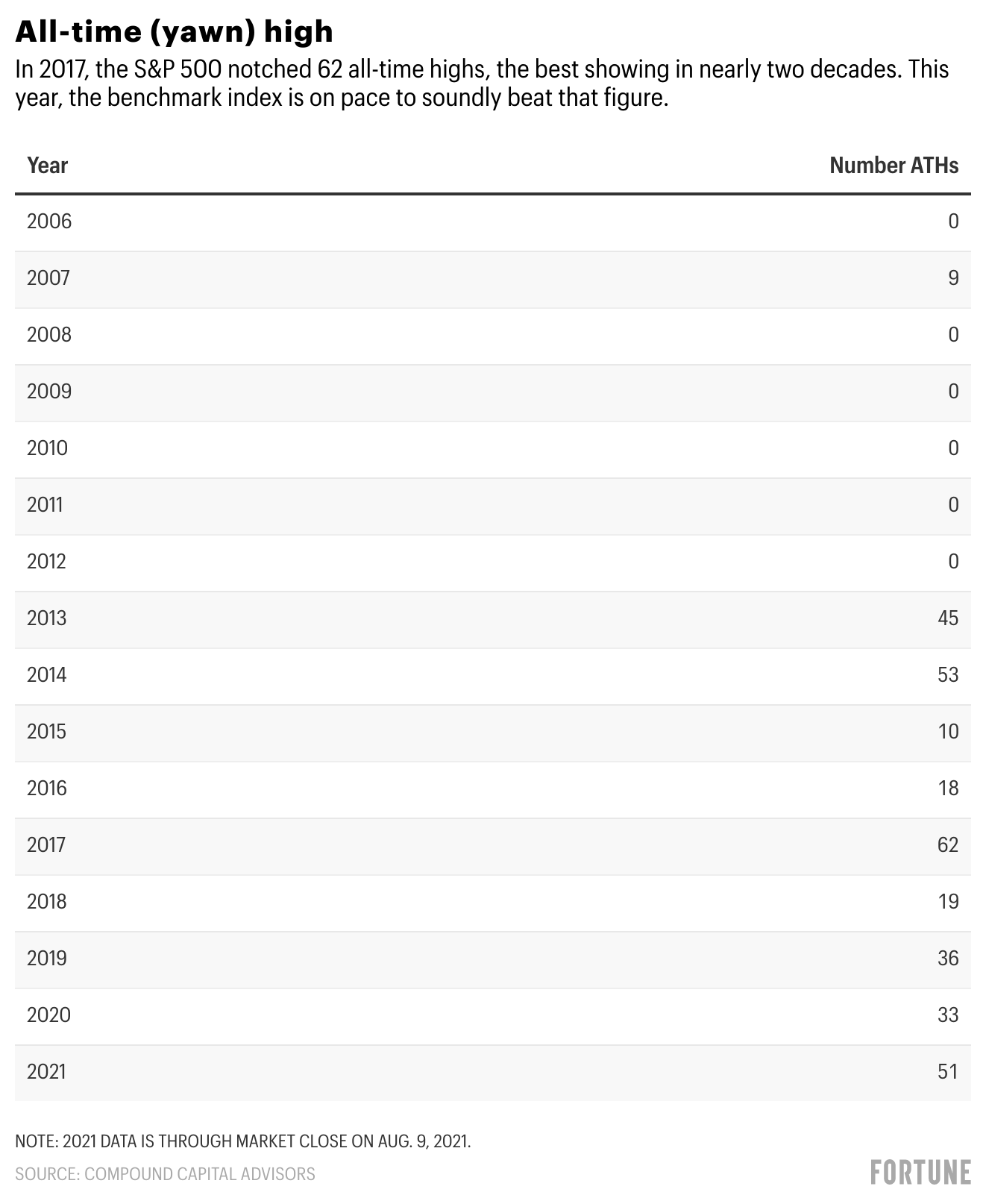

The S&P 500 is on a five-day winning streak, a rally that’s put it into all-time-high territory again and again again. The benchmark has now closed at a new ATH a staggering 51 times so far in 2021. When I first mentioned this streak a weeks ago, I thought the S&P had a decent shot of surpassing the 2017 level (62), but figured the 1995 record was a real long shot (77). At the rate we’re going, I would not be se surprised if we saw that record fall by Thanksgiving. And, following the recent run, the S&P is now more than double its pandemic-crash low of 2,237.40 reached on March 23, 2020.

Eight straight

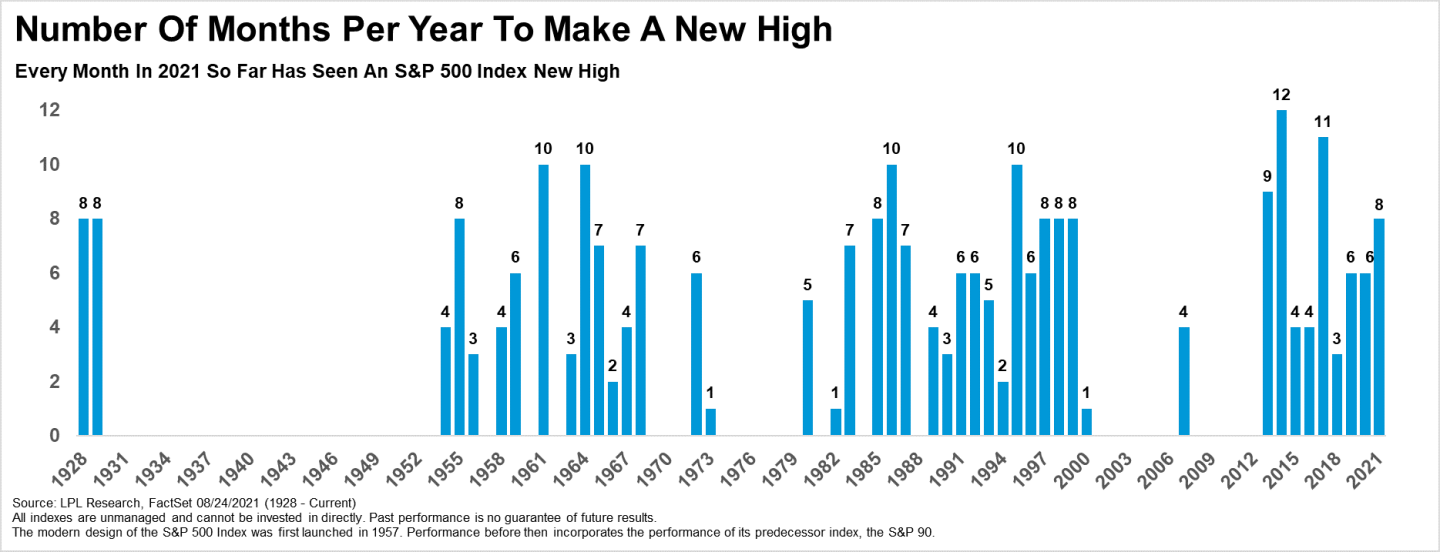

Another impressive characteristic of the S&P: it’s been remarkably consistent. It’s hit a new all-time highs each month this year. “Every month so far in 2021 has seen a new high, 8 for 8,” writes LPL Financial chief market strategist Ryan Detrick. “Only once have all 12 months made a new all-time high, and that was in 2014. This is somewhat surprising, given the S&P 500 gained only 11.4% in 2014, but it was a very slow and persistent move. Most investors (including this author) would guess it was 1995, but that spectacular year saw new highs in ‘only’ 10 months.”

1.9%

In the past month, the benchmark S&P is up 1.9%. (Given all these record closes, you might be disappointed by that performance.) The big winner so far is financials, up 6.6% in the past month as investors bet tapering is in the cards, and, further out, interest rates will climb. Add a $1.2 trillion infrastructure deal, and you can see why investors are bullish on banks.

***

Have a nice day, everyone. There’s more news below.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

The jobless turn to crypto video game for financial relief—Fortune

The father-son beef that is rattling the world’s largest pork processor—Fortune

Apparel sales soar as shoppers opt for cozy, stretchy ‘workleisure’—Fortune

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

The CEO/movie star pay gap

These aren't the best of times for the stars of the big screen. The COVID pandemic has essentially shut cinemas around the world, depriving actors and actresses of a vital income stream. "For high-earning CEOs, the trend is exactly the opposite," writes Fortune's Geoff Colvin.