Good morning,

Finance chiefs remain optimistic about workplace flexibility and revenue growth—even as job-hopping becomes the norm. “CFOs are bullish about the future,” Kathryn Kaminsky, vice chair and U.S. trust solutions co-leader at PwC, said on a call with journalists.

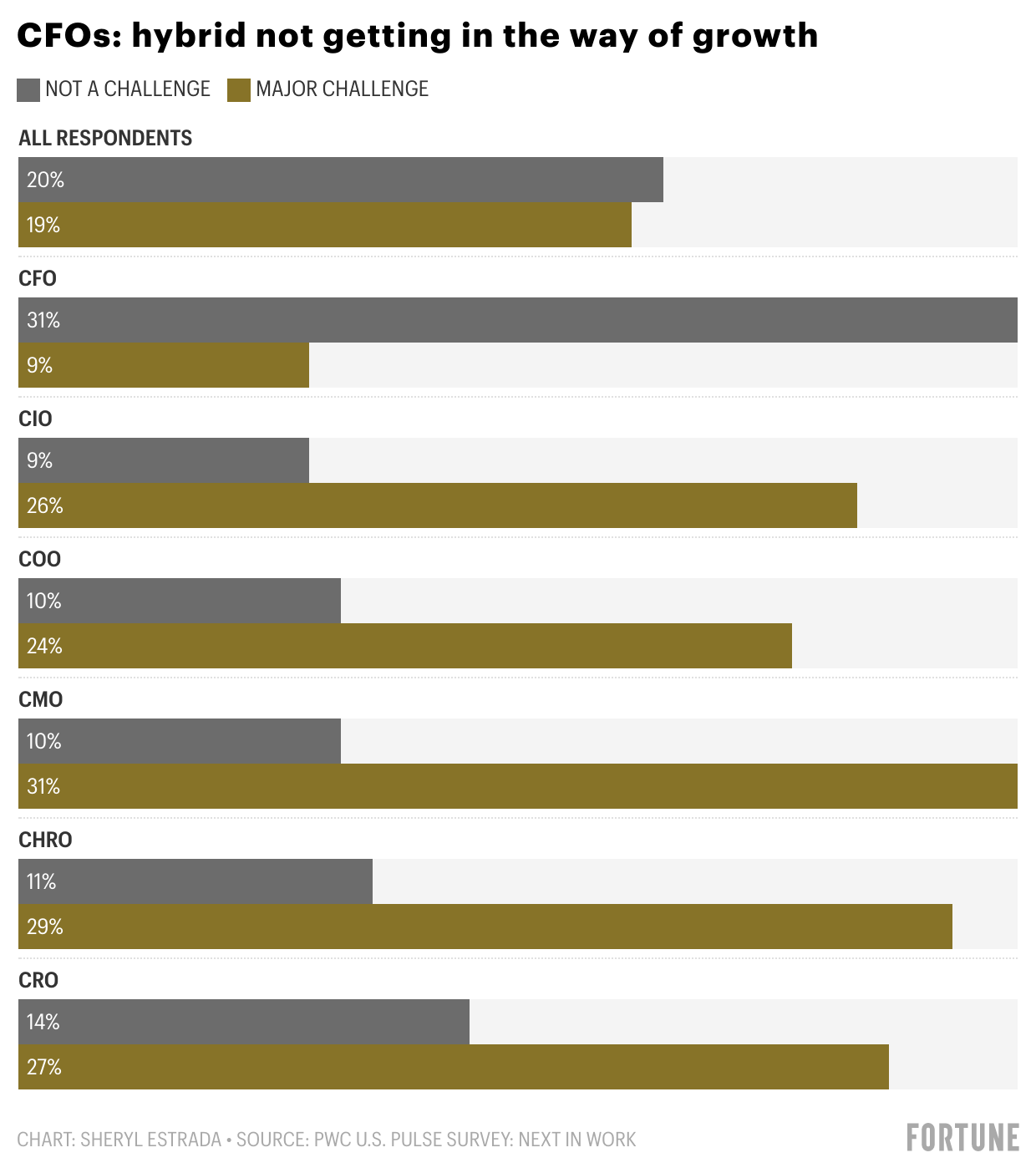

About 31% of CFOs said hybrid work is not a challenge to revenue growth compared to 20% of all executives surveyed, according to a PwC report released on August 19. The survey, administered August 2-6, is based on the insight of 752 predominantly Fortune 1000 U.S. executives from across the C-suite, including board members and 1,007 employees, the firm noted.

About a third (33%) of executives will have a mixed model, with some employees hybrid, some in-person, full-time, and some fully remote. CFOs understand that when it comes to retaining employees, flexibility and options are key, especially since employee turnover is on the rise, the report found. The majority (88%) of executives surveyed said their company is experiencing higher turnover than normal. And, approximately 65% of employees surveyed said they were seeking a new job in August, up from 36% in May, according to PwC.

But 45% of CFOs said they’re only somewhat concerned about turnover indefinitely remaining and impacting revenue growth, according to the report. And 36% said they’re very concerned about turnover. CFOs have been in financial modeling mode for the past 18 months and believe “we’ll get a flattening of this turnover,” said Neil Dhar, PwC’s chief clients officer. “They’ve just become used to modeling in relation to how different scenarios may play themselves out,” Dhar explained. Many consider “the Delta variant as another speed bump in this long journey that we’ve had,” he said. Their financial modeling will reflect that it may take a few more months to “return to normality,” Dhar said.

Although the Great Resignation may eventually level off, CFOs are still concerned a labor shortage may limit growth. And 48% of finance chiefs said an area where hybrid growth can be complicated is the loss of in-person corporate culture. So, CFOs are focusing on employees and purpose.

“Far and away the most of all respondent groups, CFOs say their company is going to emphasize leadership and culture (63%) and company purpose and values (61%) to differentiate from competitors,” according to the report. In addition, to attract talent, 51% said they’re rethinking their company’s purpose statement. And 60% plan to advance diversity and inclusion efforts internally, including leadership and mentoring programs.

However, CFOs are also acknowledging more than other executives that “compensation structure changes is the main reason why people are leaving,” Dhar said. Over the past few months, amid a war for talent, many U.S. companies have increased wages for employees in certain roles.

“I would encourage CFOs to look at the whole picture because if you’re competitive on the starting wage, you’ll get people in,” Chipotle Mexican Grill Inc. CFO Jack Hartung told me in May. “If you’re not competitive on the opportunities going forward, you won’t keep them.”

To support workplace flexibility and culture, technology is a priority as 68% of CFOs are investing in digital transformation over the next year. In PwC’s US Cloud Business survey, 55% of finance chiefs said they’re currently using or developing new cloud-based business models. “What we’ve seen clearly for the last 18 months is companies that are on the forefront have really embraced digital transformation,” Dhar said.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

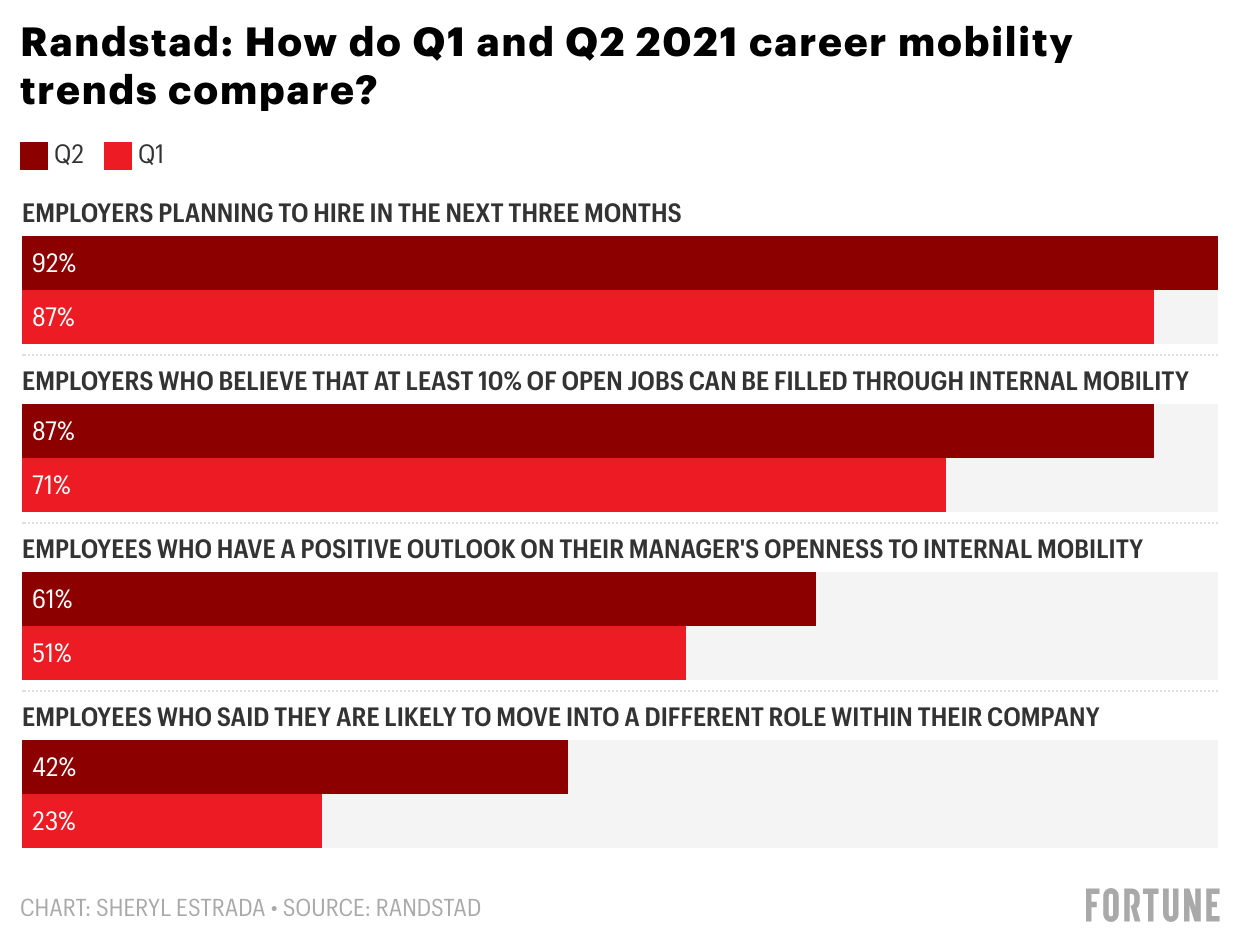

Randstad RiseSmart's Q2 2021 Career Mobility Outlook report released August 19 found more U.S. employers are hiring. Key trends also include an uptick from Q1 in the adoption of internal mobility opportunities and employees willing to switch roles.

Going deeper

The global crypto asset management market is expected to accumulate $9.36 billion by 2030, according an August 18 report released by Allied Market Research. It's expected to demonstrate a compound annual growth rate of 30.2% from 2021 to 2030. The growth is fueled by a surge in crypto investments, simplified processes for purchasing crypto, and increased digitalization in financial organizations, the report found. Emerging economies present new opportunities. But Allied Market Research cautions the market may be restrained by the lack of skilled security professionals and high implementation costs.

Leaderboard

Navdeep Gupta was named EVP and CFO at DICK'S Sporting Goods, effective October 1, 2021. Gupta joined DICK'S in November 2017 as SVP, finance and chief accounting officer. He succeeds Lee Belitsky, who will remain with the company as an EVP overseeing areas including supply chain, real estate, and construction.

Peter Hunter was named CFO at Field Effect, a global cyber security company. Prior to joining Field Effect, Hunter was CFO at Fullscript. He also served as chief operating officer and CFO at Privacy Analytics.

Overheard

"Although we see a gradual return to a more normal environment in markets across Europe, other markets, particularly in Asia, remain subject to severe restrictions due to new waves of the infection."

—Cees ’t Hart, CEO at Carlsberg Group, the latest big brewer to report a recovery in its business, as told to Fortune.