Good morning,

“Whether it’s a washing machine that you have in your house, an airplane you’re flying in, or a space shuttle going to space, we’re really in the middle of all of those design, and engineering decisions,” Nicole Anasenes, SVP and CFO at Ansys, an engineering simulation company, told me.

Before becoming CFO in March, Anasenes, who has worked in several financial leadership roles at tech companies, including IBM, gave up her seat on Ansys’ board of directors she had since 2018. “When there was an opportunity to join the management team, it wasn’t a really hard decision to make because I had worked alongside them for so long and came to admire them quite a bit,” she says.

Ansys trades on Nasdaq under the ticker ANSS and is led by CEO Ajei Gopal. Founded in 1970, the Canonsburg, Pennsylvania-based company develops software to simulate computer models of machine components and electronics. An example? An engineer at an automotive company can use computer-based modeling to help design and virtually test the behavior of “digital sensors, to be able to stop in front of a pedestrian you don’t see,” Anasenes says.

Ansys reported 2020 annual revenue of $1.681 billion. In its 2021 second-quarter earnings, announced on August 4, “we grew annual contract value 25%; and we grew revenue 16%,” Anasenes says. Although “you have to look at growth in long-term patterns because quarters can be volatile,” the company is on course for its financial target of double-digit growth, she says.

So, what’s spurring the growth? “There are secular trends that are even more important in a world where you can’t physically be together [and] where simulation is essential to continue the rate and pace of innovation,” Anasenes says. Innovation includes “a focus on climate change and reducing the use of fossil fuels and electrification being a mechanism for power,” the proliferation of 5G applications, and safety components around autonomous vehicles, she explains. Employees are also at the heart of the company’s momentum, Anasenes says. Team members sat with clients and asked them questions such as, “how do you change the way you work to leverage the power of simulation?” she says.

A former CFO and COO at Squarespace and CFO at Infor, Anasenes also spent more than a decade at IBM in leadership positions in corporate finance, M&A, and market development. Using her vast experience in the tech sector, she leads the internal digital transformation team at Ansys, which consists of members of the finance and IT teams.

“Finance is always a big portion of this because it’s an investment in the business,” Anasenes says. “But also, all of these business transformations affect financial processes at some point in time.” Since beginning her role, transformations in the finance team’s workflow include the use of “robotic process automation to eliminate manual journal entries,” she says.

“My view is, yes, transformation can lead to cost savings,” Anasenes explains. “But more importantly, it leads to human beings doing the work that they aspire to do. They spend their time solving interesting, challenging, and intellectually stimulating problems. My personal goal for the organization is that we can continue to be on this path.”

Employee engagement and providing opportunities for individuals to contribute and add value to their work experience is “something that I think is a win,” she says.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

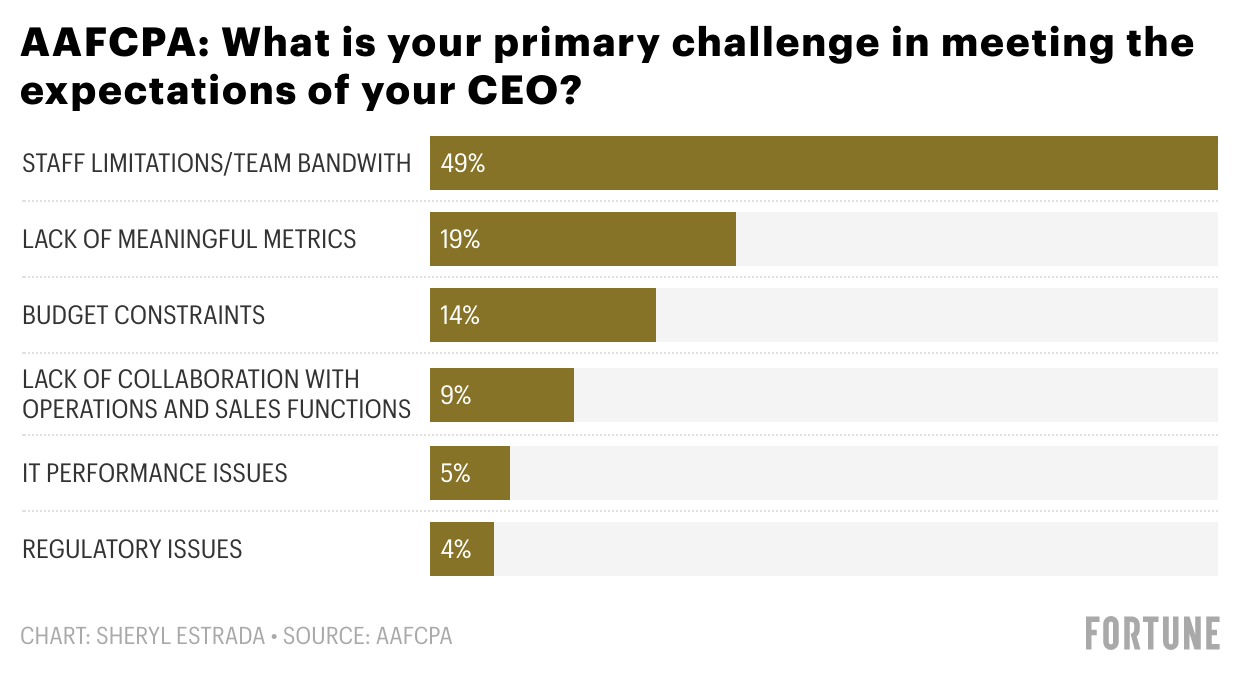

AAFCPA, a CPA and consulting firm based in New England, recently released its 2021 CFO Survey. Data analytics and management challenges faced by finance chiefs are highlighted in the report. But limitations in staffing and systems topped the list of challenges. About 49% of respondents said that staff limitations/team bandwidth is the primary obstacle to meeting CEO expectations, up from 33% in 2017. The data is based on a survey of more than 200 senior financial executives.

Going deeper

In the public-cloud-services market, there are four trends in cloud computing expected to increase capabilities and offerings, according to a recent Gartner report. The trends are cloud ubiquity, sustainability and carbon-intelligent cloud, regional cloud ecosystems, and an expanded cloud infrastructure and platform service (CIPS) providing automation. For example, “hyperscale” CIPS providers will manage the broad adoption of artificial intelligence/machine-learning enabled cloud services. This year, global end-user spending on public cloud services will reach $396 billion, Gartner forecasts. And spending will grow 21.7% to reach $482 billion in 2022.

Leaderboard

J.B. Lockhart was named the first CFO at A24, a film and TV studio, The New York Times reported. Lockhart has served as the National Basketball Association’s CFO since 2017.

Ryan Kee was promoted to CFO at Grown Rogue International Inc., a multi-state cannabis company. Kee replaces Michael Johnston who resigned. Kee was also elected as a director during Grown Rogue's latest annual general meeting. He was previously the chief accounting officer at the company, since September 1, 2020.

Overheard

“Day traders may reap short-term profits, but serious long-term investors have concluded that the old energy of the past—oil and gas extraction, is just that—old, with a sell-by date that is moving closer by the day.”

—Kathy Hipple, finance professor at Bard College, as told to CNBC.