This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Buongiorno, Bull Sheeters.

The buyers are back. U.S. futures are rebounding, following European stocks higher.

Asia though continues to be volatile. Today’s big headline: a mouthpiece for China demonized video games as a form of “spiritual opium,” and that sent tech shares crashing.

Crypto too is having a rough morning. But its recent rally has been a significant one. In today’s essay, I dig into the big winners and losers from the past month. And, yes, crypto leads the way as an out-performer.

But first, let’s see what’s moving the markets.

Markets update

Asia

- The major Asia indexes are mostly lower in afternoon trading with the Hang Seng down nearly 0.4%.

- Breaking: kids really like video games. Jumpy investors sent shares in Tencent Holdings down as much as 11% on Tuesday after some curmudgeonly comments from Chinese state media decried video games as “spiritual opium” and “electronic drugs.” Other Asian gaming stocks were tanking, too. If this gamer crackdown works, I’m using it on my kids. Spoiler: it won’t work.

Europe

- The European bourses were mixed out of the gates with the Stoxx Europe 600 up 0.2% in early trading.

- Shares in shipping giant A.P. Moller-Maersk climbed 1.8% after it raised its full-year profits outlook as rates to ship goods around the world soars.

- BP is the latest oil giant to raise its dividends and up its share-buy-back commitment. Investors cheered, sending the stock 2.7% higher in early trading.

U.S.

- U.S. futures are rebounding this morning.

- The U.S. 10-year is hovering around 1.186%, up a tick after falling nearly 10 basis points on Monday. I feel bad for bond traders who are working this week.

- What’s on the earnings calendar this week? We have Conoco Phillips (today) Booking Holdings (tomorrow) and Berkshire Hathaway (Friday), to name a few.

Elsewhere

- Gold is off, trading around $1,810/ounce.

- The dollar is down.

- Crude is down with Brent trading below $73/barrel.

- Bitcoin is down 4.5% to trade above $38,000.

***

Winners and Losers: July edition

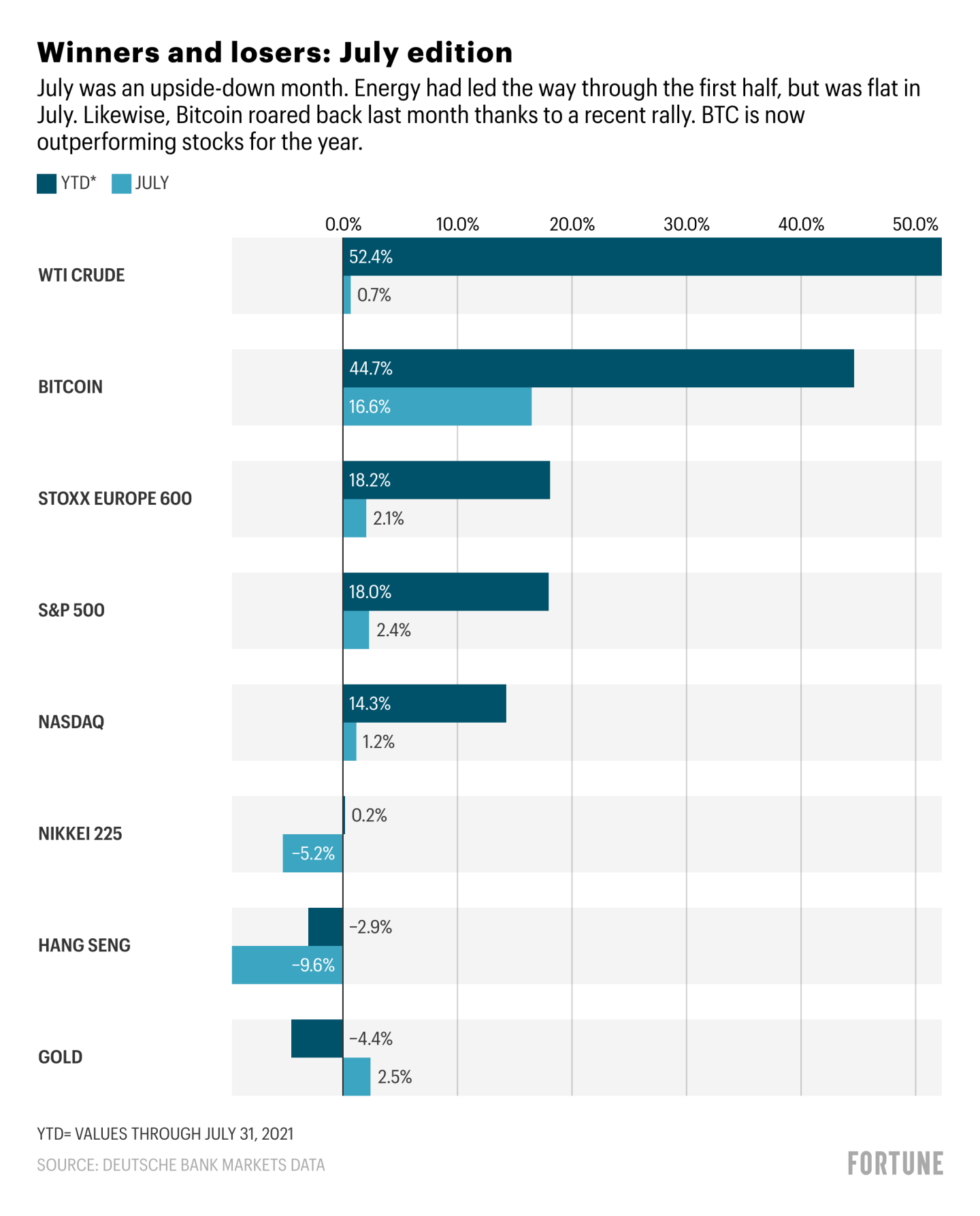

Yes, we’re well into the second trading day of August, but there’s still plenty of time to review the big gainers and disappointments from last month.

While I was on break, Bitcoin roared back, and Asian shares—particularly Chinese tech stocks—continued to take it on the chin.

As you’ll see in this month’s chart, there have been a number of reversals. Mainly, energy’s impressive first-half run has all but stalled. Crude prices have barely budged, with WTI up a mere 0.7% in July. You can see that weak crude prices are really weighing on energy stocks. The S&P 500 Energy sector (not in the chart) has been far and away the worst performer over the past month, down more than 10%. But it’s still Numero Uno, YTD.

Speaking of losers… Asian shares had a brutal July with Japan’s Nikkei finishing down 5.2%. So much for an Olympics bounce. Investors in Hong Kong fared even worse with the Hang Seng off 9.6% in July, sending the regional powerhouse negative for the year.

Yes, China’s repeated regulatory crackdowns are hurting stocks in the region, but Deutsche Bank, for one, thinks there’s more afoot.

“The best way to understand the current market turmoil in China is to look beyond specific regulatory surprises and place it in the context of the broader macro environment,” Deutsche Bank wrote in an investor note yesterday. They say the combination of China’s lackluster first-half economic performance, that Delta clusters are on the rise, and the softer property market is giving investors the blues.

Meanwhile, European and U.S. stocks had a fine month, notching decent gains. Nasdaq underperformed the S&P 500 after a killer June. But zoom back over the past three months, and you’ll see tech has been the big winners in equities.

But nothing beats crypto (for the moment). As Bull Sheet pointed out multiple times in June and July, stocks had been outperforming Bitcoin for the year. That’s no longer the case. The rally in Bitcoin over the past 10 days has pushed it back into the lead.

Alas, the crypto prices dashboard is a sea of red this morning. August should be another fun month.

A note on the chart: the price data runs through July 31.

***

Postscript

The last I left you, I was writing the Bull Sheet from a rural Sicilian village. Today, I’m back on the continent, as the Sicilians say of those who leave the island and return to the Italian peninsula.

For much of the next month, Bull Sheet will come to you from Fortune‘s Amandola bureau. Being up here in truffles country, I’ve set myself a big task: to train our truffle dog, Scilla, on how to unearth these prized fungi. A reminder: last year, Scilla and I headed into the woods in search of white truffles. It didn’t end well.

This year will be different, I’ve vowed.

Gulp.

The training bit, from what I’ve gathered, is a fairly involved, several-step process. I’ve hit up the local truffle hunters for tips, and I’ve combined that with some online research.

I’ll make a diary on our progress, and I’ll share some of the results here sporadically throughout the next few weeks.

I can, however, happily report that I’ve completed Step One: get training truffles.

These beauties are summer truffles, the tartufo scorzone. They’re fairly plentiful around here this time of year. I bought this batch from a guy in town. Set me back €12.

They’re now sitting in a jar in the fridge. I’ll explain what I’ll do with them in the next Postscript dispatch.

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Before that, I want to extend a huge thanks to Anne and Rey who filled in for me last month while I was traveling around Sicily. Mille grazie!

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

Now there’s worry the chip shortage will turn into a chip glut—Fortune

The fastest Indian tech startup to reach unicorn status is now eyeing an IPO—Fortune

Goldman Sachs Is Giving Entry-Level Bankers a Nearly 30% Raise—Wall Street Journal

A Wall Street Dressing Down: Always. Be. Casual.—New York Times

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

National champions

I've been geeking out on the latest Fortune Global 500 list, which went live yesterday. This impressive list spans 31 countries. As this cool graphic shows, the biggest firms in each of those 31 countries employ a combined 8.4 million people and racked up $3.9 trillion in sales last year.

Our mission to make business better is fueled by readers like you. To enjoy unlimited access to our journalism, subscribe today.