Here’s what happened this week:

“You have to continue to evolve your capabilities, solutions, and offerings to your customers, or else you become less relevant,” Dell Technologies CFO and EVP Tom Sweet told me. The onset of the COVID-19 pandemic forced a major pivot to conducting life online. Dell garnered record financial results for its fiscal first quarter. Revenue was up 12% to $24.5 billion. “We had a very strong client business last year given the use and the fundamental importance of the PC,” Sweet said. He shared how the tech company is transforming, continuing to navigate the global semiconductor chip shortage, and maintaining its momentum. “If you look at the forecast for technology spending over the next two to three years, it’s quite strong in the sense of the market and the opportunity,” Sweet said.

“We find that companies that disclose more diversity and anti-discrimination initiatives tend to be involved in more incidents related to race and ethnicity,” said Martin Vezér, manager of thematic research at Sustainalytics, an ESG research company owned by Morningstar. New research based on an assessment of 3,343 firms found workplace and societal incidents of discrimination linked to companies increased globally in 2020. “Companies may be establishing new policies and programs in response to being embroiled in related controversies,” Vezér said. “To mitigate ESG risks related to racial and ethnic controversies, companies need to do more than come up with more initiatives. They have to implement these initiatives in a more meaningful way.”

At the Fortune Connect Summit virtual event on radical collaboration, I moderated a panel discussion titled, How (and why) to center Black Women. Thought leaders shared their perspective on how to advance Black women into leadership roles. When looking at corporate America, women of color are underrepresented in leadership roles, including in the financial sector. “There shouldn’t be just one leadership role in which Black women get moved into,” Tynesha McHarris, co-founder of the Black Feminist Fund, said. “There should be multiple pipelines of leadership.” Preparation also includes investment. “What we found in the investment strategy that was built is: women and girls of color need to be visible,” Ada Williams Prince, senior adviser for program strategy and investment at Pivotal Ventures, said. “We need to get capital to support and invest in their leadership.”

The Pittsburgh-based language-learning company Duolingo had a successful Nasdaq debut on Wednesday under the ticker DUOL. Duolingo announced it would offer 3.7 million shares of Class A common stock at $102 per share on Tuesday, an uptick from the company’s initial expected range of $85-$95. But it actually opened at $141 a share. The stock price landed at $139.01 at the end of Duolingo’s first day of trading. Going public was a natural progression, Duolingo CFO Matt Skaruppa told me. The founders, Luis von Ahn and Severin Hacker, “knew that they wanted to create a really impactful, long-lasting, and durable business,” Skaruppa said. “And in their minds, they always knew that probably ran through an IPO.” He shared what makes the company so appealing to investors,” he said.

See you on Monday.

Sheryl Estrada

sheryl.estrada@fortune.com

****

Fortune’s CFO Collaborative in partnership with Workday, “The Promise and Pressure of ESG Measures,” takes place on Wednesday, August 11. The event, created just for CFOs, will feature Brian T. Moynihan, chairman and CEO, Bank of America; Claus Aagaard, CFO, Mars Inc.; Ann Dennison, CFO, Nasdaq; Giulia Siccardo, associate partner, McKinsey & Company; and Emma Stewart, sustainability officer, Netflix. CFOs can join their peers in learning more about embracing ESG while attracting new investors and cutting borrowing costs and operating expenses. CFOs can apply here. For more information, email CFOCollaborative@Fortune.com.

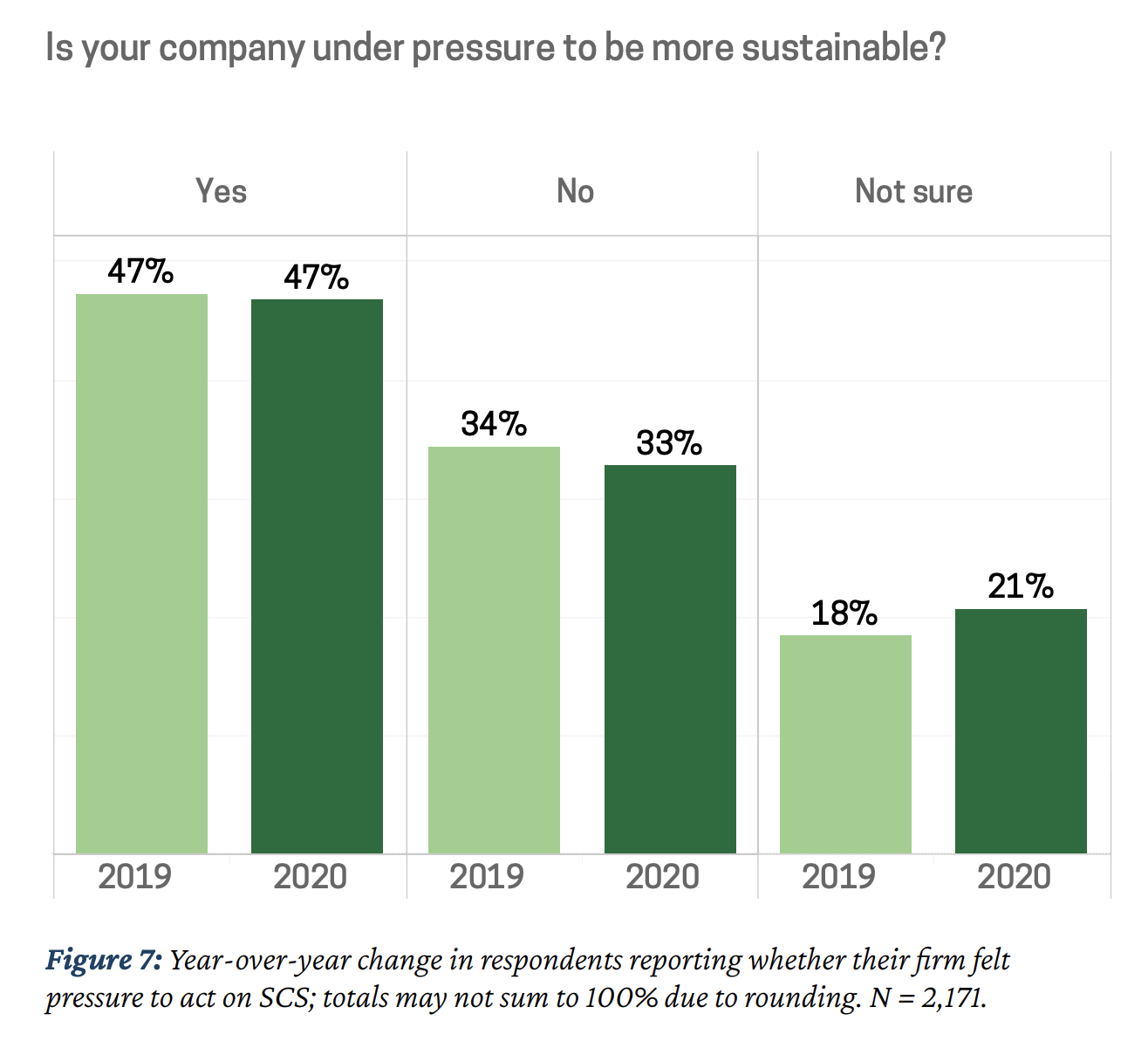

Big deal

The COVID-19 pandemic did not divert a push for sustainability, according to The State of Supply Chain Sustainability (SCS) 2021. The annual report was recently released by the MIT Center for Transportation & Logistics and the Council of Supply Chain Management Professionals. About 83% of the executives interviewed said that pandemic has either increased SCS activity or raised awareness of its urgency. About 47% of respondents reported in both 2019 and 2020 that their firms experienced pressure to increase SCS. The pressure may stem from 2019 events, including the U.S. wildfires, amplified by the environmental impacts of supply chains in 2020, according to the report.

Courtesy of the MIT Center for Transportation & Logistics

Going deeper

Here are a few Fortune reads for the weekend:

NFTy 50 by Fortune editors

What Tesla would have to earn to justify its astronomical stock price by Shawn Tully

Move fast and bank things: Crypto-based ‘DeFi’ takes on Wall Street by Robert Hackett

SEC chair: public companies may soon need to disclose their carbon footprints by Declan Harty and Katherine Dunn

Leaderboard

Some notable moves from this past week:

Julie Bimmerman was named treasurer and interim CFO at Rollins, Inc., a global consumer and commercial services company. Bimmerman joined the Rollins family of brands in 2004. Most recently, she served as VP of finance and investor relations at the company. Previous positions include managing director of Rollins Independent Brands and VP of finance/corporate controller of HomeTeam Pest Defense.

Kristian Humer was named chief business officer and CFO at Viridian Therapeutics, Inc., a biopharmaceutical company. Humer spent 20 years on Wall Street, and has experience in capital raising, mergers and acquisitions. Most recently, he served as managing director of banking, capital markets & advisory for the global healthcare team at Citigroup, Inc.

Bill Lewis was named the first CFO at Catch&Release, a platform for sourcing and licensing content from the internet. Lewis most recently served as finance director at Facebook for over four years, where he led the business and corporate planning team. Prior to joining Facebook, Lewis was the VP of finance at if(we), a social and mobile technology company.

Ajay Kataria was named EVP and CFO at Utz Brands, Inc., a U.S. snack food company, effective October 4, 2021. Kataria is currently the company’s EVP of finance and accounting. Kataria joined Utz in 2017 and worked on the company’s FP&A, commercial finance, and supply chain finance teams, in addition to overseeing the IT function. He joined Utz from Armstrong Flooring, Inc. where he served as VP of global finance and strategy.

Bill Wafford was named CFO at Next Frontier Brands, an international consumer packaged goods company. Wafford’s experience includes CFO at JCPenney, EVP and CFO of Vitamin Shoppe, a partner in the advisory practice group of KPMG LLP, and VP of finance at Walgreens.

Overheard

"There’s a mainstream recognition now that crypto is more of an architecture and operating system, and that all kinds of products and services can be built on top of crypto systems."

—Andreessen Horowitz, general partner at Katie Haun, on the crypto secor maturing into a complex industry, as reported by Fortune.