On Tuesday, British Columbia declared a state of emergency, as nearly 300 wildfires rage through the Canadian province. It’s already hitting its crown jewel: Lumber. Later that day, British Columbia forestry titan Canfor Corporation announced it would curtail production at sawmills amounting to 115 million board feet of production capacity as a result of the wildfires.

“The wildfires burning in Western Canada are significantly impacting the supply chain and our ability to transport product to market. As a result, we are implementing short-term production curtailments at our Canadian sawmills beginning July 26,” said Stephen Mackie, executive vice president of North American Operations at Canfor, in a released statement.

What does losing 115 million capacity mean for the industry? “Not that much normally but in this market it makes a difference,” Stinson Dean, CEO of Deacon Lumber, told Fortune on Tuesday. More importantly, he said, it suggests more curtailments are on the way.

If this turns into an ugly wildfire season in British Columbia—the North American lumber mecca—it would undoubtedly increase lumber prices. Among the six largest North American lumber producers, three are located in British Columbia: West Fraser Timber (No. 1), Canfor (No. 2), and Interfor (No. 6). Over 90% of British Columbia’s lumber output is exported, with the U.S. receiving most of it.

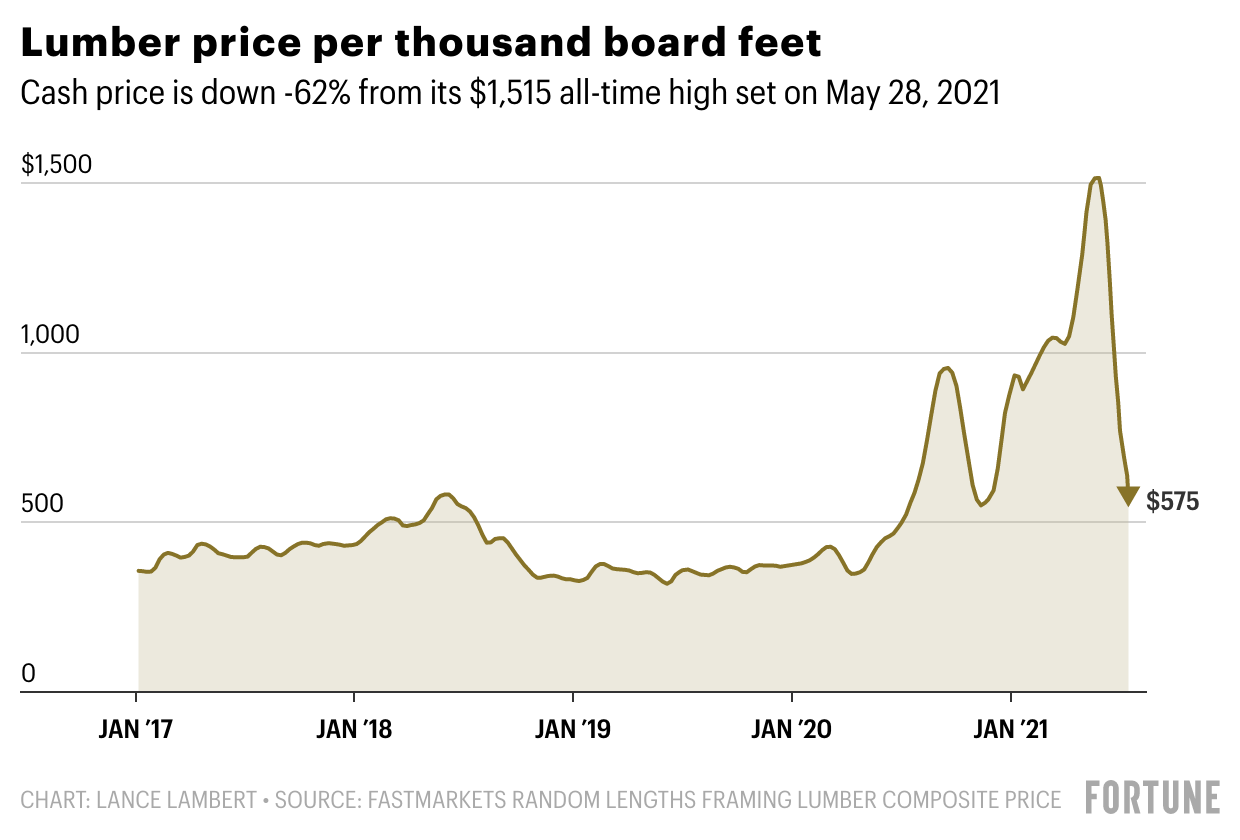

While 115 million board feet of production is a drop in the bucket for an industry with over 70 billion annual capacity, it’s happening at a really bad time for buyers. In recent weeks, cooling demand coupled with rebounding lumber supply are finally giving buyers relief. This spring prices were up over 300%, however, since late May, lumber prices have dropped 62%. Losing capacity threatens that pullback.

“It will help [to] tighten supply, but as of right now, 100 million board feet of timber won’t rebalance the market…it will take more curtailments to sway the market,” Dustin Jalbert, a senior economist at Fastmarkets RISI, where he covers the lumber market, told Fortune.

This announcement comes just as lumber prices hit their lowest point of the year. Last week, the cash market price of lumber fell $114, to $575 per thousand board feet, according to data provided to Fortune by Fastmarkets’ Random Lengths, an industry trade publication. While that’s still up 61% from its pre-covid price, it represents major price relief from the all-time high of $1,515 hit on May 28.

As Fortune has previously reported, Canadian softwood lumber—not the plentiful Southern Yellow Pine that dots the U.S. South—is the clear favorite among U.S. homebuilders. Even before the pandemic, softwood production in Western Canada was limited by a combination of past fires, beetle infestations, and the slow growth rate of spruce trees. As a result, lumber producers are struggling to meet the enormous demand from a boom in housing and DIY projects set off by the pandemic—and that has helped to create a huge increase in the price of lumber that only recently eased.

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.