This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters.

U.S. futures are gaining this morning as we head into the final trading week of May. It’s a light week for macro Econ data, and just a few companies are reporting as we wrap up earning season.

Again, the big action is in crypto. Volatility is soaring, sending Bitcoin, Ethereum and other alt-coins on yet another wild ride. They’re trading higher, well off their lows. We’ll see how long that lasts.

But first, let’s spin the globe, and see what’s moving markets.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trading with the Shanghai Composite up 0.3%.

- Tapping into mounting disapproval in Japan (and elsewhere), SoftBank’s Masayoshi Son is the latest high-profile exec to question the logic of holding the Tokyo Olympics this summer.

Europe

- The European bourses were up a tad, with the Stoxx Europe 600 up 0.14% at the open. Financial services, tech and autos were in the green.

- There’s outrage on both sides of the Atlantic after Belarus’s president Alexander Lukashenko on Sunday scrambled a MiG-29 fighter jet to divert a packed Ryanair flight, and force an emergency landing in Minsk. The objective: to snatch the activist journalist Roman Pratasevich onboard.

- Secretary of State Antony Blinken released a statement condemning the “shocking act,” saying it “endangered the lives of more than 120 passengers, including U.S. citizens.”

- Not surprisingly, some flights are avoiding Belarus air space today.

U.S.

- U.S. futures are bouncing back. The Nasdaq was the only one of the major averages to finish last week in the green—but only barely. For the month, it’s down 3.5%.

- Bond yields are again subdued as we start a new trading week with the the benchmark rate on a 10-year Treasury note at 1.613%, a two-week low. That’s usually a tail wind for stocks.

- Earnings season isn’t quite over. On Tuesday, we get Autozone and Intuit; and Nvidia and Snowflake on Wednesday, and Salesforce on Thursday.

Elsewhere

- Gold is up, trading below $1,880/ounce.

- The dollar is flat.

- Crude is up with Brent trading above $67/barrel.

- Bitcoin is trading around $36,000 after another brutal weekend sell-off. Over the past seven days, it’s down about 18.2%. Other alt-coins are even further underwater with Ethereum off 35% and Dogecoin down 40% in the past week.

***

Buy the dip, or let it slip?

Last week, I made the crack (I was hardly the first) that crypto trading should follow the dinosaur exchanges, and operate on a strict Monday-Friday schedule. These weekend sell-offs have been brutal.

At one point yesterday, Bitcoin bombed down to $31,133, which triggered all manner of crypto bulls to implore their Twitter followers to buy on the dip. On cue, BTC jumped to $35,000.

But it’s hard to say who exactly makes out on such a bottom-feeder strategy.

I’m hardly the first to point out that investors also bought on the dip when BTC fell below $60K, and again at 50K, and again at 40K. I don’t care what the asset is, repeatedly buying on the dip when the thing continues to trade well below the 200-day moving average is not a good “long” strategy. And, sure enough, according to Goldman Sachs, as of May 19, 30% of Bitcoin holdings were under water.

And, there’s a good chance the number of BTC investors in the red has only grown since then. On May 19, Bitcoin had a wild ride, trading above $40,000 at the start, crashing below $35,000, only to recover to $39,000. The weekend dip, in contrast took BTC even lower, and the recovery has been even more lackluster.

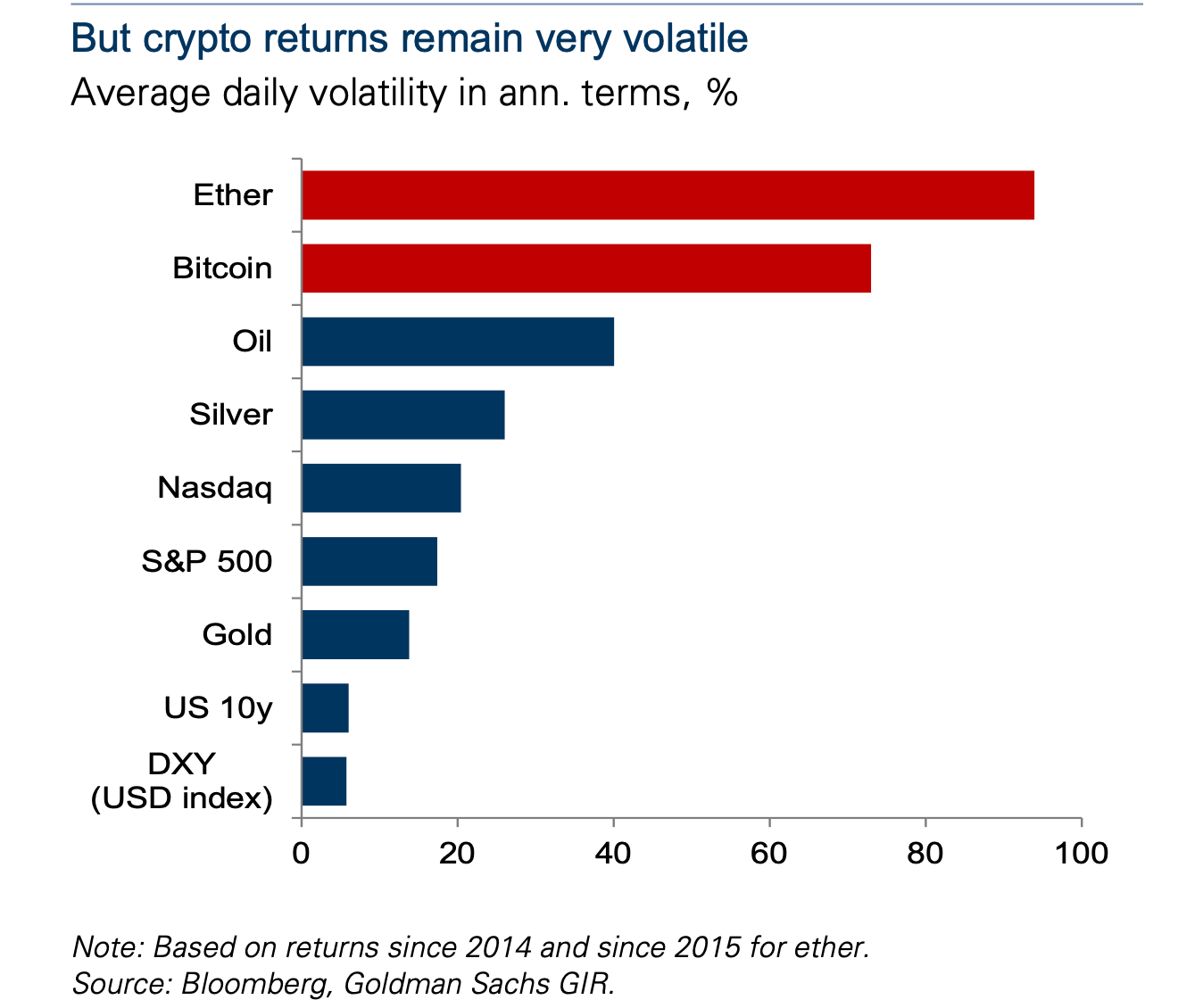

At some point, the volatility is going to dissuade investors to jump back in and buy on the dip. And, it should be noted, Bitcoin is hardly the most volatile crypto currency out there.

I get that crypto bulls don’t believe in downturns. They only see moments when BTC goes “on sale.” But let’s consider that logic for a moment.

You pass a shop window that displays a really cool shirt. Price tag: $100. Nah, you think, it’s overpriced. Good news, the next day, you notice, the shirt is back in the window, on sale for $60. I’ll come back later, you think, and buy it then. When you return, the price has changed again. It’s even cheaper now.

What’s wrong with this shirt?, you’re wondering. You eye it for a while, but your skepticism gets the better of you—can you trust this shirt? And what about the shop? Why all this manic discounting? The next day the price has changed again. By your calculation, the price has fallen by 50%, climbed 20%, fallen by 10%, climbed a further 15%, and is now down a further 25%. It’s surely not worth 100 bucks, you figure. But is it worth $60, or even $50? Could it go even lower? You have no idea how to value the shirt, and so you give up on the idea altogether of buying the shirt.

If you buy a financial asset, and it appreciates in value, there’s a good chance that will influence your buying strategy going forward. If it happens enough, and word gets out, it will attract other buyers, and a sound and healthy market forms around the belief that what we’re all buying has clearly understood value—better still if that value goes mainly in one direction: up.

Volatile pricing—whether it be for a shirt, or a stock, or a crypto asset—is the opposite. It profoundly messes with the buyer’s confidence. It gnaws at your ability to value an asset, and at your faith in the market.

If day-to-day price volatility of an asset is off the charts, you’re not going to be confident in holding that asset for all that long. More to the point, volatility is kryptonite for buy-on-the-dip “long” investors.

Sorry, 💎 🙌 BTC bulls. Repeatedly buying the dip of a volatile asset, and then HODLing, HODLing, HODLing, is just not a sound investment strategy.

You’ll be underwater before you know it.

***

Postscript

If you heard a burst of cheers coming from the south end of Rome early Sunday morning, not long after midnight, it was probably us. Casa Warner erupted—I blame it on my daughter, T.—when Italy was crowned winner of the Eurovision Song Contest, the bel paese’s first Eurovision triumph since the lira era.

What, pray tell, is Eurovision? It’s a song contest that’s been running since the mid-1950s. It’s insanely popular. The 2019 was a disappointment in that only 182 million people tuned in. Imagine the most popular Super Bowl ever, add a lot of spandex, pyrotechnics, and corny song lyrics, and then multiply that by at least a factor of two, and you get something approaching the spectacle that is Eurovision.

The New Yorker‘s Anthony Lane explained in 2010 why Eurovision is such a big deal. “Singers and groups don’t win the Eurovision Song Contest,” he wrote.” Countries do. You are entered by your proud nation, just as a swimmer or a relay squad is entered for the Olympic Games. That said, swimmers tend to be chosen for their stamina and fitness, and relay runners for the dexterity of their handoffs, whereas the criteria that govern the selection of Eurovision contestants seem altogether less exact.”

As a Yank living here, I find Eurovision to be one of the most alien of cultural events on the calendar. My earliest memory of it was in May, 2004. My wife and I were still dating back then. She came to visit me in London for the weekend. We, along with everyone else in the U.K., watched in sheer puzzlement as nation after nation awarded their points to either objectively terrible acts, or to a neighboring political rival. The Greeks would give points to the Turks. And vice versa. Ukraine to Russia, and Russia to Ukraine. If Palestine had an entry, the jury, no doubt, would bestow full points to Israel, and vice versa.

Pop music transcends politics is the idea.

Another bizarre-o thing about Eurovision? Half these countries, it seems, aren’t even in Europe. Australia? Azerbaijan? Turkey? Who drew up these borders?

In recent years, we’ve given Eurovision a hard miss. Italy has its own terrible song contest, the San Remo Festival, held earlier in the year, which saps our enthusiasm for trashy pop act after trashy pop act to out-sing and out-perform the field. But this year, San Remo was actually watchable as a young power-rock band hailing from the Monteverde neighborhood here in Rome brought the house down. My kids love Måneskin—not to be confused with moleskine—and so they were totally excited to see them go up against the rest of the euro-pop world.

I didn’t want the girls’ first experience of Eurovision to be an abject disappointment. I explained that in Eurovision, the rule seems to be that objectively talented artists rarely win. Most of the winners you’ll never hear from again. There have been all kinds of exceptions to this rule over the years. In 1974, ABBA won with Waterloo. And Celine Dion—a Canadian?—won it all in 1988.

But then the Italian who sang Nel blu dip into di blu (Volare), Domenico Modugno, lost Eurovision, in 1958. If Volare—oh, oh, oh, oh—can’t win Eurovision, then what chance do these kids from Rome stand?

I was wrong to be so overly cautious. These kids from Rome did in fact win it all. And they brought the roof down.

And they really are kids. They’re only a few years older than my girls. In a night of terrible pop music, they stood out. They’re a rock band—a thumping bass line, screaming electric guitar rifts, pounding drums—and lots of pyrotechnics.

Complimenti!

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

How do you say Fjällräven? The Swedish backpack and outdoor gear brand is on a roll. Sales are soaring across more than 70 countries, and the stock has been a winner, too. Here's the inside story of this beloved Swedish label and why it's become such a hot commodity—from the streets of Amsterdam to the trails of Zion National Park. By the way, it's pronounced Fyall-RAAH-ven.

It's the "Wild West." Robert Shiller, the Nobel prize-winning economist, sees bubbles forming—and not just in the crypto market. “In real terms, the home prices have never been so high," he tells CNBC.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Topline surprise

More than half (53%) of Fortune 500 CEOs said revenues came in above expectations—actually, "significantly stronger," they said—during the pandemic...and 51% said the bottom line, too, outperformed expectations. That's the take from Fortune's annual poll of business leaders whose companies make this year's Fortune 500 list. Here's the full run-down of what CEOs are saying about their net-zero goals, hybrid working and obligatory vaccinations for workers.