This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters.

It’s Earth Day. How do I know this? The PR industry has cluttered my inbox with all manner of planet-saving claims over the past two weeks. I can only imagine the carbon footprint of such zealous attempts to get my attention.

Speaking of green… global stocks are trading higher for a second straight day, led again by strong corporate results. One exception: the battered Swiss lender Credit Suisse, which continues to tally up the losses from its exposure to last month’s collapse of Archegos Capital Management.

On the other end of the green spectrum is bitcoin. Let’s leave aside the carbon impact of mining crypto coins (though I get into that in more detail below) for a moment. The big thing on investors’ minds is the huge sell-off this week. BTC is down again this morning.

Let’s check in on the action.

Markets update

Asia

- The major Asia indexes are mostly higher in afternoon trading with the Nikkei bouncing back, up 2.4%.

- India has set an ignominious record, reporting a world-topping 314,000 new COVID infections yesterday. The country has delivered 132 million vaccine doses, but that means less than 5% of the country is fully vaccinated.

- In a rare swipe at a trading ally, the U.S. is calling out Australia for dragging its feet on setting clear climate goals.

Europe

- The European bourses were higher out of the gates this morning with the Stoxx Europe 600 up 0.3% at the open, before climbing.

- ASML Holding soared more than 6% on Wednesday after the Dutch semiconductor equipment maker posted monster earnings, and forecasted a rosy outlook. Why is demand so strong? “Just read the papers, there are chip shortages everywhere,” CEO Peter Wennink reminded analysts, an early candidate for “understatement of the year.” Shares are higher again this morning.

- Investors are punishing Credit Suisse again. The troubled Swiss lender revealed on Thursday further massive losses from the Archegos meltdown. Shares fell more than 4% at the open, before sinking further.

U.S.

- U.S. futures are flat. That’s after the three main averages snapped a two-day losing streak yesterday, with tech and small caps leading the way.

- Today’s big batch of earnings include: AT&T, American Airlines and Intel. Also on deck: existing home sales and the latest jobless claims figures.

- In IPO news, software automation specialists UiPath had an impressive debut yesterday, closing up 23%. That’s not Snowflake-like success, but CEO Daniel Dines tells Fortune this is still “a very good market to raise money.”

Elsewhere

- Gold is down, trading around $1,790/ounce.

- The dollar pushes lower as equity futures tick upwards.

- Crude is down with Brent trading below $65/barrel.

- Bitcoin is stuck in neutral, trading just above $54,000.

***

Buzzworthy

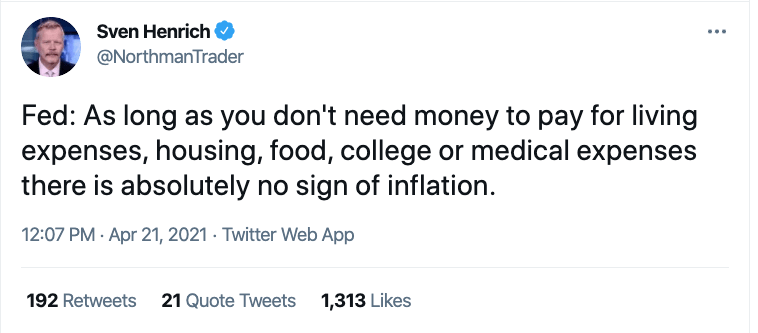

Inflation? What inflation?

🙄

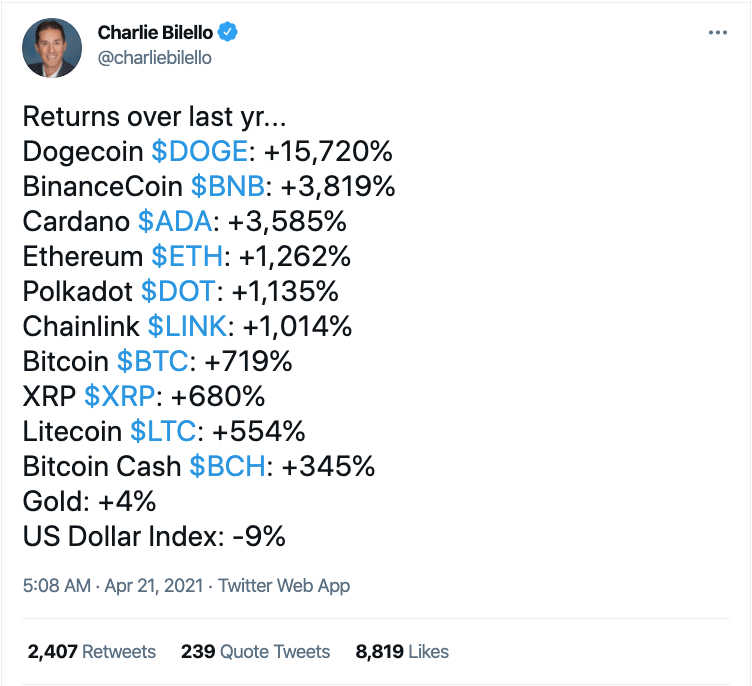

Raiders of the lost ARK

😬

2021 bull market, explained

🚀

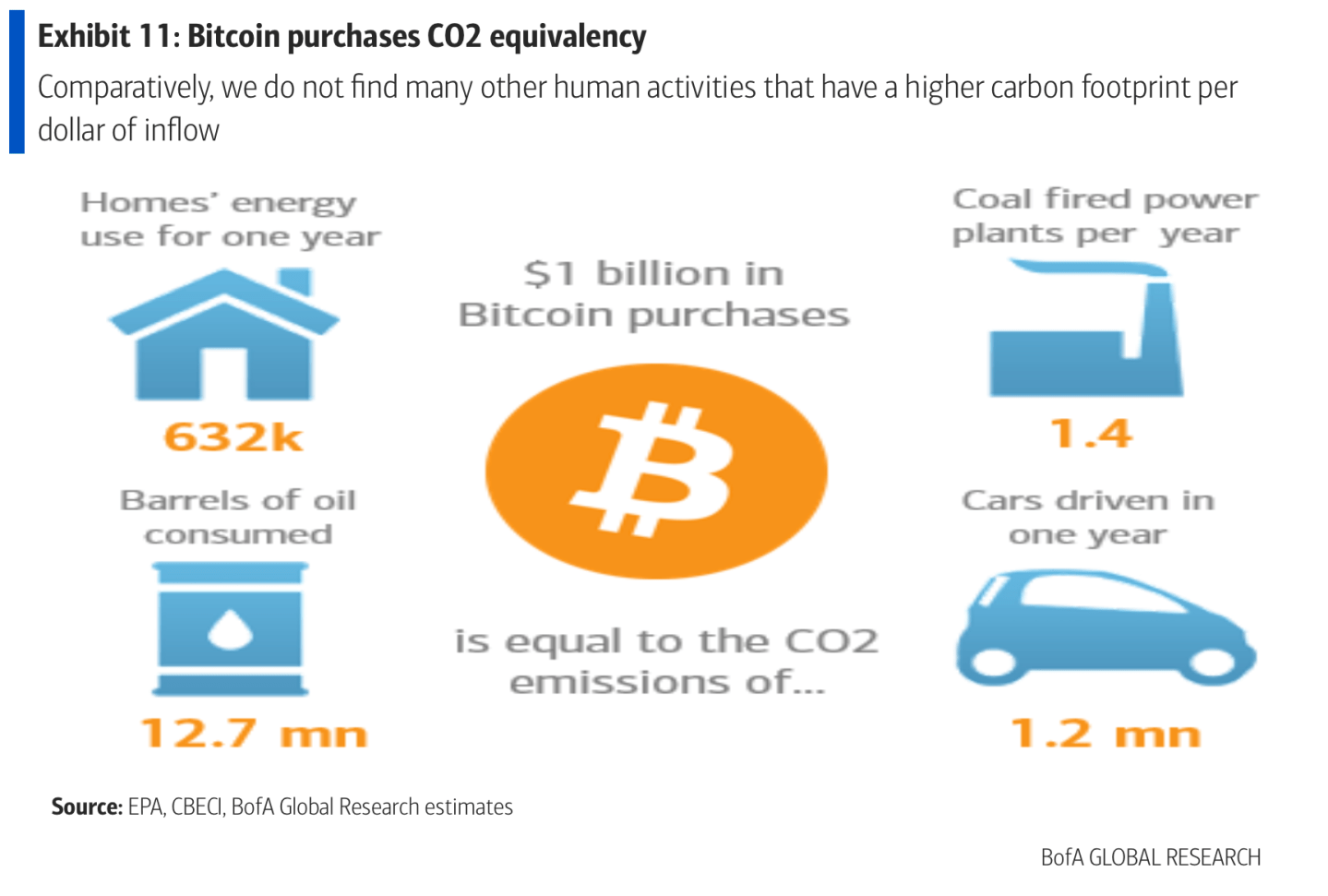

Happy Earth Day, crypto miners

BofA Securities calculates the carbon footprint of Bitcoin mining to be pretty staggering. Every $1 billion in BTC purchases is equivalent to the following:

Yes, $1 billion in bitcoin purchases is a lot. But the combined market cap of BTC is just north of $1 trillion, even after this week’s huge sell-off.

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Correction territory. Bitcoin is down roughly 12% in the past week as it trades below $53,500. There have been plenty of self-offs before, but this time round an increasing number of crypto watchers are calling the end fo BTC's epic bull run.

Spend like Europe, tax like Europe? The markets have been all too eager to buy up U.S. debt as Uncle Sam pushes out trillions in spending plans. But, at some point, somebody will have to pay for all this borrowing. "The U.S. is moving inexorably towards a future of far higher taxes," concludes Fotune's Shawn Tully. "And the middle class will bear the brunt of the burden."

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day

We have a 1975-era regulatory regime governing a 21st century economy, and it’s high time it was fixed.

That's Leo Strine Jr., a former chief justice of the Delaware Supreme Court who is now a corporate attorney at Wachtell, Lipton, Rosen & Katz, speaking to the Wall Street Journal about the U.S.'s relatively lax financial disclosure rules. All kinds of Wall Street watchdogs are calling for stronger disclosure rules in the wake of the Archegos Capital Management collapse. After getting burned, Credit Suisse no doubt would like to see tough new measures some time soon.