This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning.

U.S. futures are off their lows, pointing to a positive open ahead of today’s jobless data. Alas, stocks started strongly on Wednesday too, only to sink in the afternoon, a further sign that trade remains incredibly volatile.

It could be worse, however. You could be stuck in traffic on the Suez Canal. The source of that jam is a 200,000-ton colossus. The trick to get a tanker of this size unstuck is to make it lighter. That’s a lot more complicated than it sounds. This could snarl container traffic for days on the world’s busiest waterway, messing with global trade and the oil market.

Let’s see how the rest of the markets are faring.

Markets update

Asia

- The major Asia indexes are flat in afternoon trading, well off earlier lows. The Nikkei is the best of the bunch, up 1.1%.

- Chinese tech shares Alibaba, Baidu and JD.com took a pounding today in Hong Kong on revived fears the firms could be de-listed in the U.S.

- The Suez Canal blockage could amount to the most expensive traffic jam in history, costing $9.6 billion daily in trade snarl-ups, Bloomberg calculates. Energy stocks and crude are sinking today.

Europe

- The European bourses whimpered out of the gates this morning with the Stoxx Europe 600 down around 0.5% in the opening minutes of trade, before rebounding.

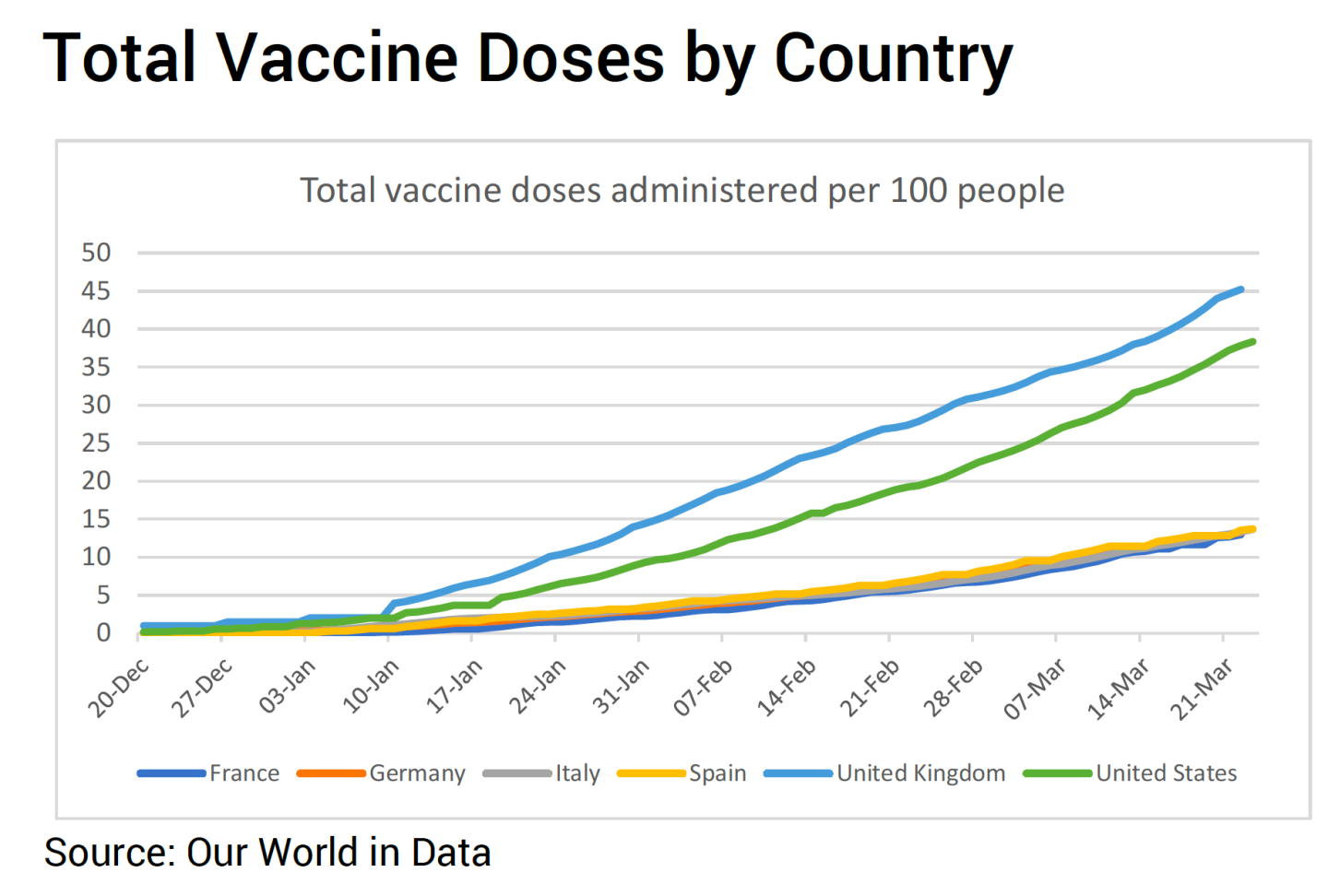

- With COVID cases still spiking across much of Europe, the EU will begin to enforce today tough new export controls on vaccines produced anywhere within the bloc. It’s not quite as tough as America’s blanket ban, mind you.

- In the latest installment of the AstraZeneca soap opera: The drugmaker has revised its U.S. trial data to show its COVID vaccine is highly effective rather than highly, highly effective. Shares were up 0.2% on Thursday morning.

U.S.

- U.S. futures are climbing this morning. I wrote something similar at this time yesterday, and then, hours later, testimony by Jerome Powell and Janet Yellen triggered an afternoon swoon. All three indexes on Wednesday ended in the red, led lower by tech stocks.

- What’s interesting is that bond yields have been trading sideways all week (and again this morning; the 10-year Treasury is at 1.622%), so we can’t blame bond bears for this sell-off. On cue, yesterday’s auction for American debt went off without a hitch.

- The big chiefs of Big Tech will testify today before Congress, addressing how they’re trying to “root out hate and anti-vaccine hoaxes,” Fortune‘s Danielle Abril reports.

Elsewhere

- Gold is down, trading around $1,730/ounce.

- The dollar is up.

- Crude is lower again with Brent trading around $63/barrel.

- Bitcoin reminds me this morning of Duchamp’s urinal. If only you could hang it on a wall. Of a museum. That’s actually open to the public. And then we could all puzzle over its significance… The cryptocurrency trades around $52,000. 🤔

***

Buzzworthy

Those were the days

So much for that Europe recovery trade

Why liquidity matters

So Suez you!

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

QQQ = cool, cool, cool. Launched 22 years ago, the ETF tied to big-cap tech stocks is still a hit with newbie investors. A number of these rookies are first learning about the fund on social media—in particular, on Reddit's r/WallStreetBets, the Wall Street Journal reports.

Speaking of social media... This survey of investors from Travis Credit Union caught my eye for this one data point: A new generation of investors are increasingly turning to Reddit, Twitter and other social media platforms to get their investing advice. In fact, social media nudges out traditional media (I guess that would include Bull Sheet) as the preferred place to get tips on stocks and other risk assets.🤔

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day.

What they may be trying to do is create a public image and opinion that is not yet fully backed up by the necessary evidence, and I do think that is problematic.

That's Caroline Wiertz, professor of marketing at the Business School of City, University of London. She's speaking about Sputnik V—no, not the Russian vaccine; Sputnik the social media star. Shaking up the staid world of vaccine medicine, the Russians have decided to invest heavily in a social media blitz for their prized medical breakthrough. The result: an in-your-face onslaught of tweets, posts and likes, plus plenty of disses on rivals.