This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters.

Washington must be losing its magic touch. There was a time when a multi-trillion-dollar fiscal stimulus spending plan would send stocks soaring. That’s not the case today, even as we learn the Biden Administration is ready to push for a $3 trillion infrastructure spending plan.

U.S. futures have been ticking lower all morning, as has, more interestingly, the yield on Treasuries.

In today’s essay, I dig into what a $3 trillion fiscal spending bill (and accompanying tax hike) would mean for your portfolio.

But first, let’s see what else is moving markets.

Markets update

Asia

- The major Asia indexes are mostly lower in afternoon trading, with the Hang Seng down 1.5%.

- Chinese search giant Baidu made its Hong Kong listing debut today. Investors weren’t impressed.

- The global chip shortage had already been hitting the auto sector hard, and then came a huge fire at a Japanese chip-production facility which supplies many of the country’s top automakers. Shares in Toyota, Nissan and Honda all fell on Monday, and didn’t fare much better today.

Europe

- The European bourses were lower out of the gates with the Stoxx Europe 600 down nearly 0.5%, rattled by Germany’s new Easter lockdown measures. Utilities and telecom are among the few sectors in the green.

- Economists in Europe are big fans of America’s recently passed $1.9 trillion stimulus plan. ECB chief economist Philip Lane sees it boosting the global economy, even lifting the slow-growth eurozone.

- AstraZeneca shares were down nearly 0.9% in early trading after a U.S. agency called into question the trial data the drugmaker supplied American authorities for its COVID-19 vaccine.

- Once again on Tuesday, stocks on the Borsa Istanbul sank at the open, and the Turkish lira stuttered as fears of a currency crisis—on top of spiraling inflation and a bruising debt crisis—grip the markets there.

U.S.

- U.S. futures point to a weak open. That’s after all three exchanges closed higher yesterday, with tech leading the way. The Nasdaq has now strung together five positive closes over the past six trading sessions.

- Treasury yields are again quiet this morning. Investors apparently aren’t spooked by the latest mammoth spending bill in the works, a mere $3 trillion plan that would be financed by tax hikes on corporations and wealthy.

- Attention 💎💎 hands. Chief meme stonk GameStop reports today its first set of quarterly results since the Reddit brigade sent its shares on a gravity-defying ride 🚀🚀. Management has been largely mum throughout all the tumult. That silent treatment should end today.

Elsewhere

- Gold is flat, trading around $1,735/ounce.

- If futures are down, then the dollar must be—yep—it’s up.

- Crude is down with Brent trading 3% lower, below $63/barrel.

- Bitcoin is off 6%, trading below $55,000.

***

Fiscal graffiti

As any property owner knows, home renovations don’t come cheap. And that’s particularly true if you’re fixing up a place that’s been neglected for ages.

That’s the story of America in a nutshell. Sub-standard infrastructure—bridges, buildings, roads and airports all in need of a major upgrade—isn’t just a nuisance, it’s a roadblock to America’s competitivity.

Every occupant of the White House, it seems, vows to invest in infrastructure, triggering the weighty debate: just how are we going to pay for the trillions required to properly spruce up the place?

Details leaking out of Washington suggest the Biden Administration infrastructure plan will be paid for by taxing Corporate America and wealthy America.

Why aren’t the markets freaking out about this? For starters, none of this is a surprise. We’ve known for months that a mega-infrastructure bill could be coming, and that it would be funded by tax hikes.

The worst case of such a move? That the proposed tax increases, according to Goldman Sachs, would shave about 9% from the collective EPS of S&P 500 firms. The more likely scenario, however, is far less scary—that a more watered-down tax hike passes through Congress which only shaves 3% off corporate earnings, and that the hike would be phased in over years.

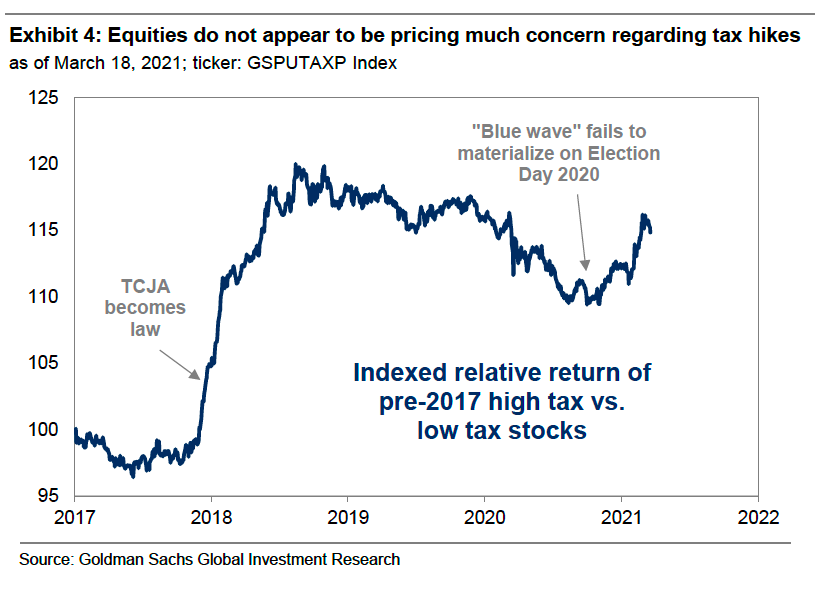

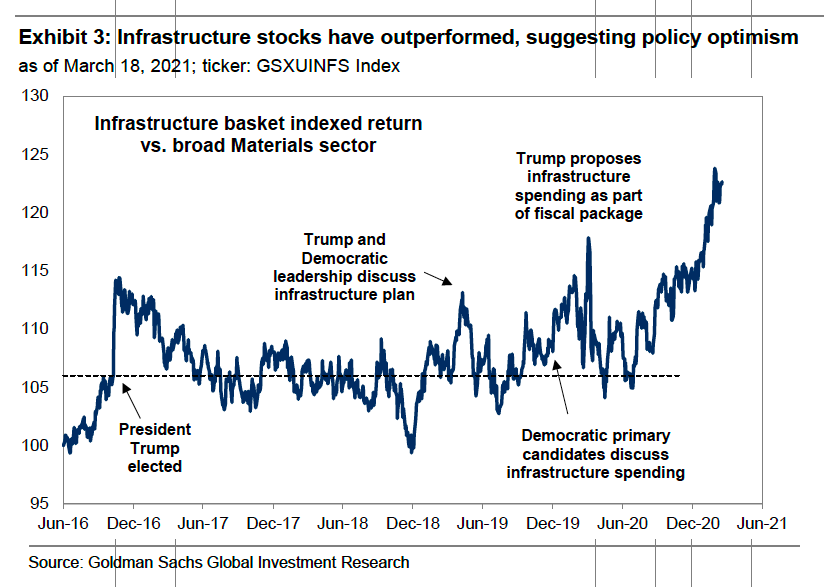

So far, investors are choosing to believe the not-so-scary scenario. As Goldman says, “equities appear to be pricing infrastructure optimism but little concern about tax risk.”

There must be something to that. In case you haven’t noticed, stocks have been doing pretty well since Biden won the presidency. The benchmark S&P 500 is up 12.3% since the Nov. 6 market close.

Now, it’s important to remember that whenever you’re talking about a tax-and-spend bill of this magnitude, there will be winners and losers to consider for your portfolio. (Incidentally, Goldman reckons the ultimate price tag could balloon to $4 trillion if health care, education and child care initiatives are ultimately included.)

Obvious winners will be—surprise—the infrastructure stocks including: construction, materials, and, if there’s a heavy emphasis on green initiatives, renewable energy companies.

Here’s how so-called infrastructure stocks have performed since infrastructure upgrades became a pet cause of both the right and the left. Spoiler: they’re going up.

The other winners include financials, consumer and industrials.

And which stocks land in the “losers” category? Tech and health care sectors stand to lose, primarily if the the tax policy is changed to include a tax hike on foreign income.

This little breakdown is worth keeping in mind as more firm details emerge in the coming weeks before it heads to Congress. Goldman reckons we could see a vote as early as September.

Now, it’s worth remembering one more thing: just because the Democrats and Republicans agree on the need for a big investment in infrastructure, don’t expect any cross-the-aisle unity on this package.

As David Bahnsen, founder and managing partner of the Bahnsen Group, told me in the run-up to Election Day, “not a single President in American history has had a tax plan in their campaign that then got photocopied and became a tax law. Ever.”

Expect a big fight over this one too.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

The wolf of crypto. Jordan Belfort, better known as the real-life "Wolf on Wall Street" sat down for an interview with Fortune's Shawn Tully recently. In a fascinating one-on-one, Belfort unloaded on meme stonks such as GameStop (buyer beware), commission-free trading (don't be silly; there's nothing free about it) and cryptocurrencies (the rally ain't over). It's a great read.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quiz time

Which automaker owns the best-performing stock out of this quartet? Is it...?

- A) Tesla

- B) Volkswagen

- C) Ford

- D) General Motors

The answer is B, Volkswagen. The stock was up roughly 85% YTD as of Monday's close. Investors sent the shares into overdrive yesterday after Deutsche Bank valued its EV business at a staggering $230 billion. Last year's EV wonder, Tesla, is down 5% so far in 2021.