This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, and Happy St. Paddy’s Day to those of you wearing leprechaun-colored leisurewear.

It’s also Fed day.

Ahead of today’s FOMC press conference, global stocks are trading sideways, as are U.S. futures. Don’t expect much movement until Fed Chairman Jerome Powell begins speaking in a few hours.

In today’s essay, I offer a preview of what to listen for in that presser.

But first, let’s see what else is moving markets.

Markets update

Asia

- The major Asia indexes, including Nikkei, Hang Seng and Shanghai Composite, are totally flat in afternoon trading.

- Internet search giant Baidu aims to raise as much as $3 billion in a secondary listing in Hong Kong, market sources tell Reuters.

Europe

- The European bourses were mixed out of the gates with the Stoxx Europe 600 down 0.1%. Autos, telecoms and media were the lone sectors showing their Irish side—that is, they’re in the green.

- Shares in Uber were trading 1.4% lower in pre-market after the ride-hailing firm pulled a U-turn, and reclassified its 70,000 drivers in the U.K. as workers.

- BMW shares were up 1.1% at the open after the carmaker posted a bullish forecast, one that centers on its ambitious transition to EVs.

- Correction: Yesterday, I made a rookie mistake in calculating just how minuscule the so-far-unconfirmed thrombosis/pulmonary embolism incident rate is for those who’ve taken the AstraZeneca COVID jab. Upon review, the blood-clot rate is no higher than 0.000218%, and not 0.00000218% as I wrote yesterday. In any event, the European Medicines Agency says the benefits of the AZ vaccine outweigh the risks. Meanwhile, Europe is in turmoil with its vaccine rollout campaign.

U.S.

- U.S. futures are as flat as a stimulus check made out for $0.00. That’s after the DJIA and S&P 500 ended lower on Tuesday as retail sales data disappointed.

- The yield on 10-year Treasuries has ticked up to 1.644% this morning ahead of today’s big press conference by Fed Chairman Jerome Powell. The big question: with an improving economy, does this mean the Fed will slow down the printing press?

- Tesla sunk back into the red for 2021 after tumbling 4.4% yesterday. One top fund manager told CNBC yesterday this is the year rivals (and we’re seeing it today with BMW; yesterday with Volkswagen) begin to make gains with their EV strategy, putting further pressure on Tesla shares.

Elsewhere

- Gold is up, trading above $1,730/ounce.

- The dollar is up too.

- Crude is down with Brent trading around $68/barrel.

- Bitcoin is flat, trading below $56,000.

***

FOMC: What to expect

The global markets—and U.S. futures, too—are fairly subdued ahead of this afternoon’s Federal Open Markets Committee press conference. In the hours ahead, you’ll hear plenty of references to this FOMC meeting being the “big one,” or the “most important in a long time.”

On the agenda today will be the U.S. economy, and how it’s doing. No surprises there. But what everyone will be anxious to hear is where Chairman Powell & co. stand on inflation and rates.

No, there almost certainly won’t be a move on the federal funds rate today. That will stay unchanged at 0-0.25%, forecasters say.

But what about in the quarters to come?

“While we don’t expect the Fed to announce plans to raise rates anytime soon, the market has started pricing in an earlier liftoff (early 2023) than the Fed has communicated,” writes Ryan Detrick, chief market strategist of LPL Financial. “It will be interesting to see if the Fed pushes back against these market expectations.”

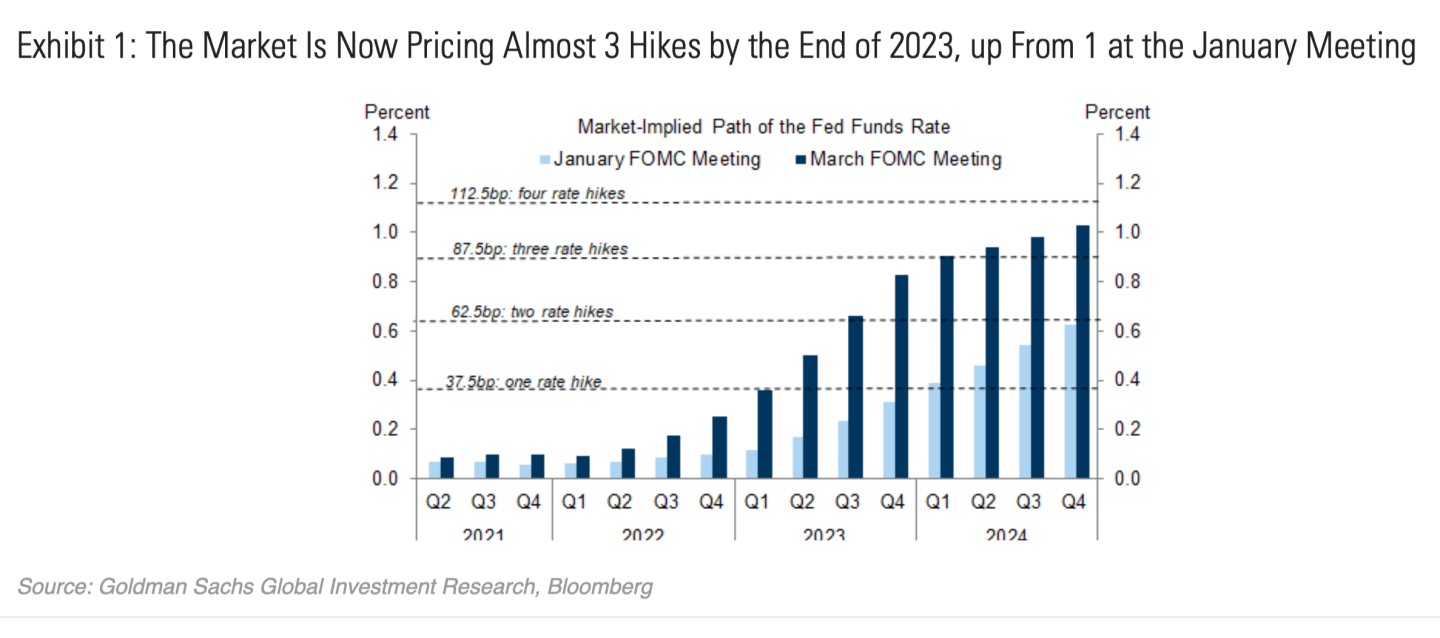

Goldman Sachs is a bit more prescriptive in how it sees the so-called tapering move going down. “We expect that the first hints at tapering will come only in the second half of this year,” its strategists wrote in a recent research note. “That tapering will not begin until Q4 or more likely 2022Q1… that the FOMC will taper gradually over the course of about a year, and that it will then pause to take stock for at least one, and ideally two, quarters. This would not put rate hikes on the table until mid-2023.”

Here’s what that looks like in a chart:

The markets are forward-looking. So, any suggestion of tightening down the road will hit markets today. You’ll see the impact on Treasury yields, and you’ll see it on stocks, particularly growth stocks.

In this way, you could say the FOMC trade is a bigger deal than the FOMO trade. It will hit both stocks and bonds.

***

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

The Biden tax. The White House has already scored a legislative victory with the $1.9 trillion stimulus plan. Next comes an infrastructure package plan, which, if passed, would run another few trillion. How will Americans pay for all this? On cue, a tax hike on corporates is gathering steam.

Stimulus just doesn't pay. It's estimated that American families in the lowest tax brackets will split roughly $540 billion through the American Recovery Plan, a sum that could greatly alleviate America's shockingly high child poverty problem. If that seems like a lot, think again. I crunched the numbers, showing just how puny the package is compared to what other rich countries spend on safety-net measures for families.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Biggest stock options award ever

Elon Musk is set to bring home an incredibly generous stock options package. How generous? Fortune's Shawn Tully calculates it will be "the largest stock options award, secured in a brief period, in the annals of capital markets: $31.7 billion since May 2020, including over $10 billion alone in the first quarter of 2021." And, to think—Tesla is down YTD.