This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters. A risk-off mood hangs over the markets today as investors contend with rising Treasury yields and inflation concerns, which I dig into in today’s essay.

Elsewhere, tech futures are weaker, bruised by Warren Buffett’s decision to pull money out of Apple.

What’s going up? Bitcoin and crude (though those moves are not necessarily linked).

Let’s see what’s moving markets.

Markets update

Asia

- The major Asia indexes are mixed in afternoon trading, with the Hang Seng up 1.1%.

- Japan‘s Nikkei may be slipping this morning, but the bluechip index has hit a milestone this week, topping 30,000 for the first time since 1990 on the back of strong corporate earnings and rising GDP.

- This won’t go over well in Washington: China has become the European Union’s biggest trading partner, dethroning the United States last year.

Europe

- The European bourses were mostly lower with the Stoxx Europe 600 down 0.2% at the open.

- Shares in Adidas were down 0.8% mid-morning after the sporting goods giant unloaded its fitness brand Reebok after a rough 15-year run.

- Speaking of slimming-down deals, Nestlé announced it’s agreed to sell its North American bottled-water business for $4.3 billion. PE firm One Rock Capital Partners will be the new owner of the Poland Spring, Pure Life and Deer Park brands.

U.S.

- U.S. futures are trading sideways this morning. That’s after the Dow closed at an all-time high on Tuesday.

- Warren Buffett‘s Berkshire Hathaway cut its holdings in Apple at the end of 2020, and instead poured its cash into Verizon and Chevron. The latter two are gaining pre-market while Apple is off.

- The big news yesterday was in the Treasury market. Yield on the 10-year note topped 1.3% yesterday, a 12-month high. That’s triggering a debate on Wall Street about whether it’s time for investors to increase their exposure to bonds. Alas, nobody is saying the 60-40 split is back.

Elsewhere

- Gold is close to a three-month low, trading below $1,790/ounce.

- The dollar is up.

- The crude market is much less volatile this morning. WTI continues to trade above $60/barrel in the aftermath of powerful winter storms hobbling Texan refineries.

- At 10 a.m. Rome time, Bitcoin was trading above $51,200.

***

Reflation, revisited

Yesterday in this space we examined the implications of stimulus checks, Round 3. Today, let’s look at the reflation trade, which assumes that a big, fresh injection of fiscal spending is inevitable.

As we’ve seen in recent days, the market reaction to a promised $1.9 trillion in helicopter money arrives long before the dough gets to our doorsteps. While the Biden Administration crafts the spending bill, investors are already banking on its passage, and that’s pushing up 10-year Treasury yields to a one-year high. The spread between short-dated (2-year Treasuries) and longer-dated notes (10-year) tend to rise when investors think rates will be higher in the future. And that spread is growing.

What does that mean?

If the Fed is expected to lift rates in the future, there’s a good chance the economists there see signs of inflation on the horizon. That makes plenty of sense given we could see yet another mammoth stimulus package, the third in a year. Give Americans more money, and they’ll spend it, sending consumer prices higher.

The dominoes continue to tremble from there. The I-word of course gives investors jitters that the equities rally may be coming to an end, as it suggests central bankers will step in and raise interest rates to keep the economy from overheating.

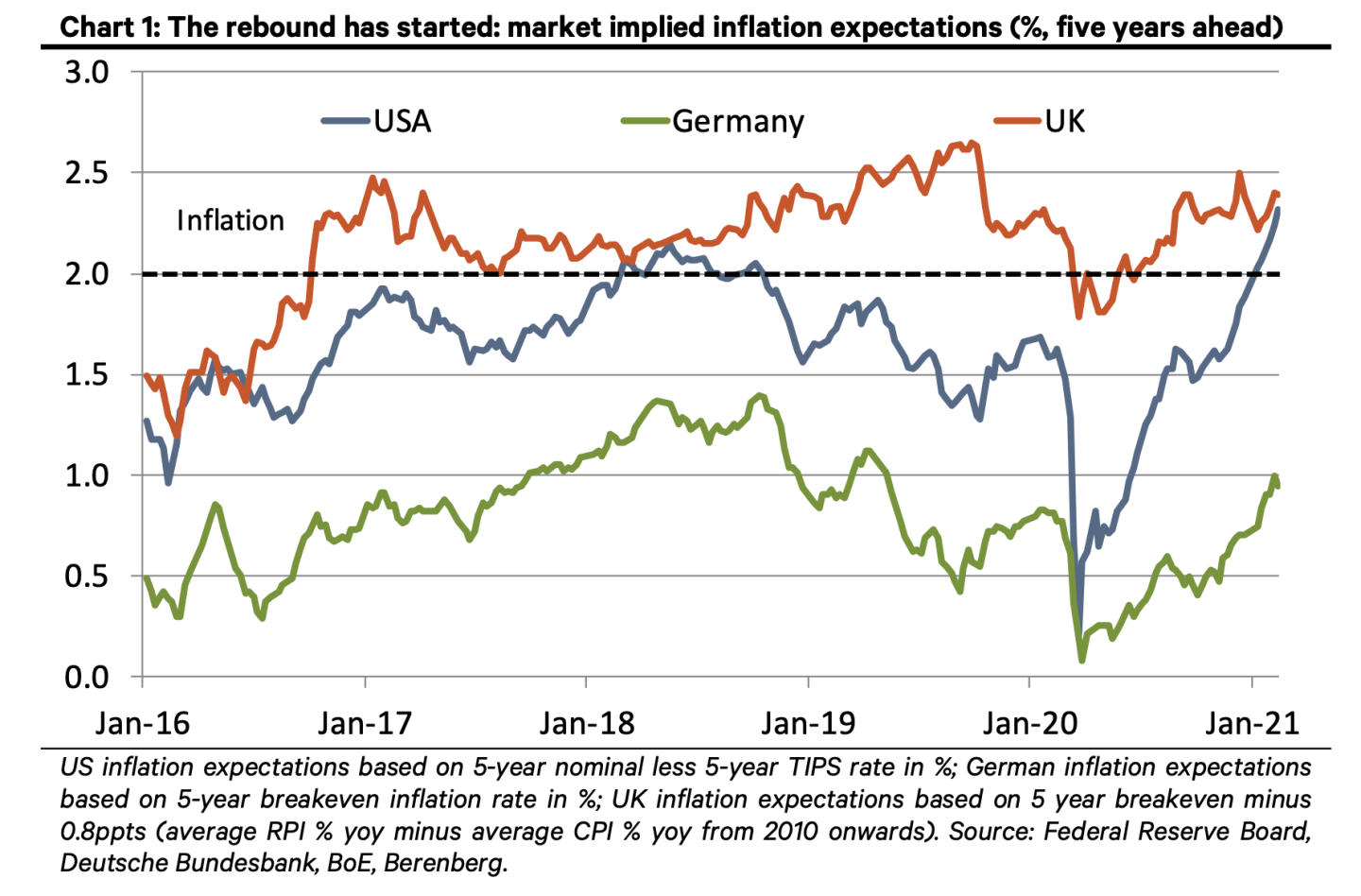

But let’s first come back to present day. Inflation expectations are indeed beginning to rise quickly, as the German investment bank Berenberg points out in the chart below. We’re still talking relatively tame implied inflation rates of below 2.5% in the U.S. and Britain. Still, it’s the trend line that’s getting attention.

Now, it’s important to remember that rising inflation on its own is not a bad thing. It can even be beneficial to an economy as long as it comes out around a central bank’s target of 2%. But, Berenberg writes, “a sustained rise in inflation beyond levels that central banks are inclined to tolerate would force them to step firmly on the brakes eventually. High financing costs and the subsequent plunge in economic growth would be a recipe for a major selloff in equity markets.”

There’s a phrase for this phenomenon: taper tantrum. The last taper tantrum was in 2013. The Dow fell back then, but it rebounded fairly quickly.

Still, it messed with the psyche of investors, which is why you’re bound to hear more about it in the weeks ahead should 10-year Treasury yields climb.

Berenberg notes that since the 2008-09 global financial crisis, markets have come to expect central bank intervention when investor alarm bells sound. They argue we won’t get such a response this time around should the markets sink even as the economy improves.

“Losses for cash-equity investors do not have severe negative consequences for the real economy when underlying activity is strong,” the Berenberg economists write. “Central banks may even welcome occasional corrections if financial markets run too hot relative to underlying economic fundamentals.”

That could provoke a different kind of investor tantrum altogether.

***

Postscript

Years ago I wrote a column on innovation, which gave me the excuse to pore over a lot of scientific journals and speak to researchers and scientists working in the labs—my favorite kind of interview.

I came across one piece of research literally in my backyard, about the extraordinary raw materials that built the Roman Empire. Specifically, the 2013 research had to do with ancient Roman concrete, a building material that has lasted the test of time (a far cry from ubiquitous Portland cement, which degrades after a few decades.)

At the time, I spoke with Marie Jackson, an American geologist who led an international team of researchers in reverse-engineering the formula for Roman concrete, a discovery she hoped would usher in an era of greener, longer-lasting construction. What surprised me was the reader response. For years, I got emails from readers asking me what’s the latest news on Roman concrete.

Turns out, there’s a lot to say. I spoke to Jackson again a few weeks ago. She told me the story of how the U.S. Department of Energy is funding her project to bring Roman concrete to the marketplace. We published her story yesterday on Fortune, part of a fascinating package of articles we’re calling Blueprint for a Climate Breakthrough. If you have a moment, you should check out the package. It’s well worth your time.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

Finders keepers. Yes, the "no give-backs" rule of the schoolyard applies to the business world as well. A federal judge ruled yesterday that the investment firms representing Revlon do not have to pay back the roughly $500 million it erroneously received from Citigroup last summer in an errant wire payment. My 11-year-old kids will be overjoyed there's legal precedent strengthening the honorable finders keepers law of the jungle.

Lumbering along. Commodity prices are decent bellwethers of the recovery trade. None more so than lumber, which is on a tear amid a building/remodeling boom. This reminds me of the time I brought my wife to the U.S. for the first time, to visit the family in the American suburbs. "Why are all your houses built of wood?," she asked with genuine puzzlement.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day

It turns out to be a powerful idea that can guide every business leader who wants to help solve climate change.

That's Microsoft founder, philanthropist and climate champion Bill Gates explaining how his concept of "green premiums" can help businesses (and consumers, too) calculate the costs of adopting eco-friendly measures. It's a fascinating accounting exercise with big implications. "You can see where we have workable solutions now, where we have to do some inventing, and which breakthroughs deserve the most focus," he writes in Fortune.