This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Buongiorno. Global stocks are heading back to record territory this morning, and U.S. futures too are rebounding on another solid run of earnings from the likes of Twitter and Lyft yesterday.

Looking ahead, we get CPI numbers today, which gives market observers, economists and crypto bulls all an excuse to debate the existence of the mythical I-word, inflation.

I’ll believe it when I see it.

In today’s essay, TINA is back. Who (or what) is TINA? Read on.

In the meantime, let’s see what’s moving markets.

Markets update

Asia

- The major Asia indexes are mostly higher in afternoon trading, with the Hang Seng up 1.9%.

- Shares in tech giant Tencent Holdings soared to a new all-time high on Wednesday. That’s despite getting hit with a new round of anti-monopoly complaints from rivals.

- The “phase one” U.S.-China trade pact, struck last January, was in large part “a failure,” according to a new PIIE report, with American exports falling more than 40% below the deal’s targets in year one.

Europe

- The European bourses were solidly higher with the Stoxx Europe 600 up 0.3% at the open.

- Shares in Heineken were 2.3% lower after the Dutch brewer posted dreadful year-end results and delivered a lousy 2021 forecast. It’s also shedding 8,000 jobs.

- Staying with earnings, shipping giant Maersk, a bellwether for global trade, delivered a mixed outlook for 2021. Demand is strong, but bottlenecks remain, the company said.

U.S.

- U.S. futures point to a positive open on Wednesday. That’s after a late-session slump snapped a six-day winning streak on the Dow and S&P 500.

- Shares in Twitter are up 3.5% in pre-market trading this morning after the company reported big Q4 earnings and sales beats. More impressively, Twitter shares have soared 16.3% since it banned Donald Trump from its platform… Hmm, wonder what would happen to the stock if Twitter were to also give the boot to a certain crypto-pumping CEO?

- As we’ve said many times here, the recovery trade depends squarely on the vaccination rollout. And, there’s reason for optimism in the U.S. About one in ten New Yorkers have gotten a jab so far. And, COVID case data has plunged 35% over the past two weeks.

Elsewhere

- Gold is trading sideways, hovering below $1,850/ounce.

- The dollar is flat.

- Crude is up. Brent is trading above $61/barrel.

- At 10 a.m. Rome time, Bitcoin was trading at $46,685.

***

The TINA trade

Okay, Bull Sheeters. If YOLO is the “you only live once” trade, and FOMO is the “fear of missing out” trade, what, pray tell, is the TINA trade?

Yes, it’s the “there is no alternative” trade. (My wife is convinced I make these acronyms up in my spare time… Hardly! SPACs consume all my spare time.)

Why am I invoking TINA?

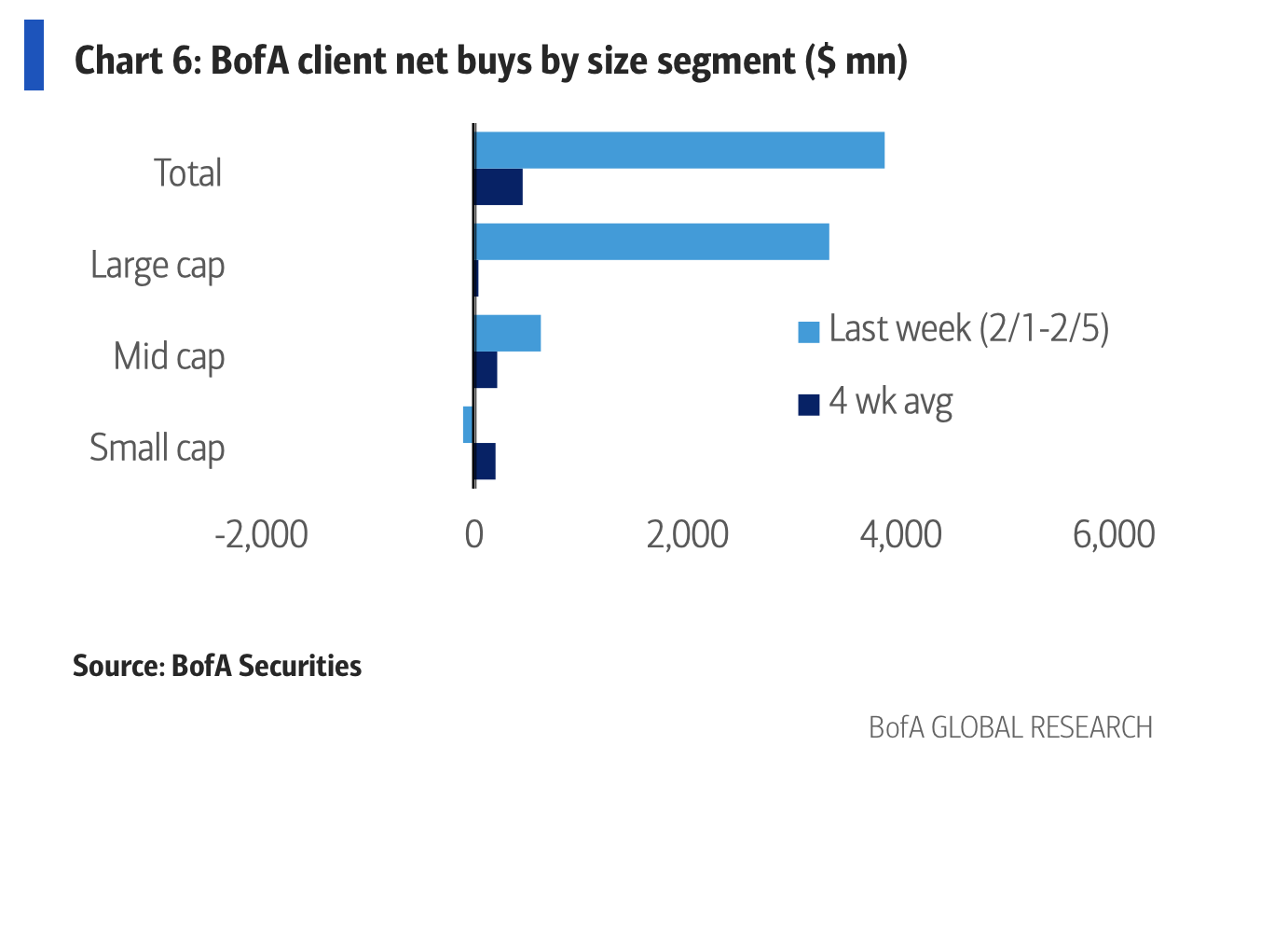

Because I got two research notes yesterday suggesting the goddess of no-alternative trading is making a comeback. Specifically, Wall Street watchers are noticing the first notable signs of 2021 that investors are reversing course on small-caps, and instead pouring cash back into big caps. BofA equity analysts are calling it the “small cap reversal,” and here’s what that looks like:

“Institutional clients,” they wrote, “drove sales of small caps last week; retail clients continued to buy them but with much more muted inflows than the prior week (while hedge fund flows were essentially neutral). Meanwhile, large caps saw the largest inflows in seven weeks, with buying across client groups.”

All in all, the lone out-flow last week—a week in which the S&P rallied 4.6%—was in small cap stocks as the chart above shows. That’s after weeks of in-flows into small-caps.

This reversal makes some sense given the fairly impressive data coming in this earnings season. With such a steady parade of beats, there is no alternative to big caps in your portfolio—and the fund flow data of the past week reflects that thinking.

Meanwhile, in another investor note, Chris Zaccarelli, Chief Investment Officer for Independent Advisor Alliance, explored why some of the big can’t-miss calls for 2021 are not quite panning out at the moment.

“Most of the consensus trades coming into the year – Short the Dollar, Value over Growth, International over US, etc. – have all been challenged recently,” he wrote, noting that growth stocks have surged back in recent weeks.

We’ve seen this with the likes of the Dow and Nasdaq 100 on a nice run at the moment.

Now, it’s important to note this data is a measure of a just a few trading sessions. Nobody is saying abandon value stocks and small-caps. Sure enough, the Russell 2000 outperformed the bluechip Dow and S&P yesterday.

But don’t forget the power of TINA, either. She’s reminding us that the investing strategy that helped your portfolio weather a rough 2020 could do wonders again in 2021.

Btw, if you’ve seen other markets-related acronyms, please share them. It amazes me how frequently anglophone acronyms pop up in casual conversation here in Italy (and then some Italian invariably quizzes me on the origin of said acronym.)

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

Microstrategy with mega gains. Tesla on Monday generated huge buzz for its $1.5 billion bet on Bitcoin. That's peanuts compared to this once-obscure software firm.

America's mortgage cliff. In April, a major CARES Act insurance measure for homeowners is set to expire. That's when COVID-socked households will once again be on the hook to make mortgage payments. Fortune ran the numbers, and the data points to a fresh housing crisis.

The savings paradox. Has your recent college grad saved next to nothing for her retirement? Not to fear. There's fascinating new research that posits it may not be such a big deal if "liquidity-strained young adults" put off retirement-saving for a while.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day

We do not yet see this type of intense trading sideshow as detrimental to the market.

That's C.J. MacDonald, client portfolio manager at GuideStone Funds, who argues in Fortune that the rise of Robinhood and the trading frenzy in so-called meme stonks will not derail the bull market. Here's why.