This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters. It’s a risk-on day as stimulus talks and vaccine progress lift investor sentiment from Tokyo to New York.

We also have a big stock market debut today. DoorDash begins trading in a few hours, and the bidding so far has been fierce. The IPO share price is above 100 bucks, the Wall Street Journal reports, citing sources in the know.

Let’s see where else investors are putting their cash.

Markets update

Asia

- The major Asia indexes are mostly higher in afternoon trading with Japan’s Nikkei up 1.2%, continuing its impressive run. Investors are cheering a $708 billion stimulus package to revive Japan’s COVID-hit economy.

- SoftBank was up 5.6% on news the tech conglomerate/investment group is mulling a plan to quietly buy up shares and go private, Bloomberg reports, citing sources.

- Here’s good news for automakers. Car sales in China, the world’s biggest market, climbed again in November, further evidence the two-year slump is over.

Europe

- The European bourses are bouncing back this morning with the Stoxx Europe 600 up 0.4% at the open.

- Dinner in Brussels. Boris Johnson heads to Belgium in a few hours for a dinner date with Ursula von der Leyen to see if the two can salvage post-Brexit trade negotiations.

- Meanwhile, Britain resumes its national COVID vaccination program, a rollout that went smoothly yesterday. Americans could be next in line.

- The Wirecard scandal has claimed yet another scalp as Deutsche Bank’s head of accounting stepped aside as prosecutors in Munich step up their investigation into the insolvent payments company.

U.S.

- U.S. futures are a touch higher after the S&P 500 and Nasdaq finished Tuesday again in record territory despite little progress on reaching a deal on a $908 billion (or larger) stimulus package. But the fact the two sides are still negotiating is a good sign, the markets reckon.

- Tesla shares closed 1.3% higher yesterday after it emerged the EV maker would tap the capital markets for a third time this year, hoping to raise close to $5 billion in a share-sale.

- Apple shares are flat in pre-market trading, suggesting investors aren’t blown over by its new $550 headphones. Why so expensive? They go over your ears so it’s less likely you’ll keep misplacing them, a lá the AirPods.

Elsewhere

- Gold is down, trading below $1,870/ounce.

- The dollar’s slide continues today.

- Crude is up, with Brent futures trading above $49/barrel.

- Hold onto your hats, Bitcoin bulls. The virtual currency is down 6.3%, trading below $18,000.

***

A view from the C-suite

When will the wider economy catch up to the stock markets? It’s a question that’s been top-of-mind since equities started their impressive comeback in April, even as the global economy sputtered and wheezed.

We’ve seen GDP climb back, but it’s been an incredibly uneven recovery, and economic output is still well behind pre-pandemic levels.

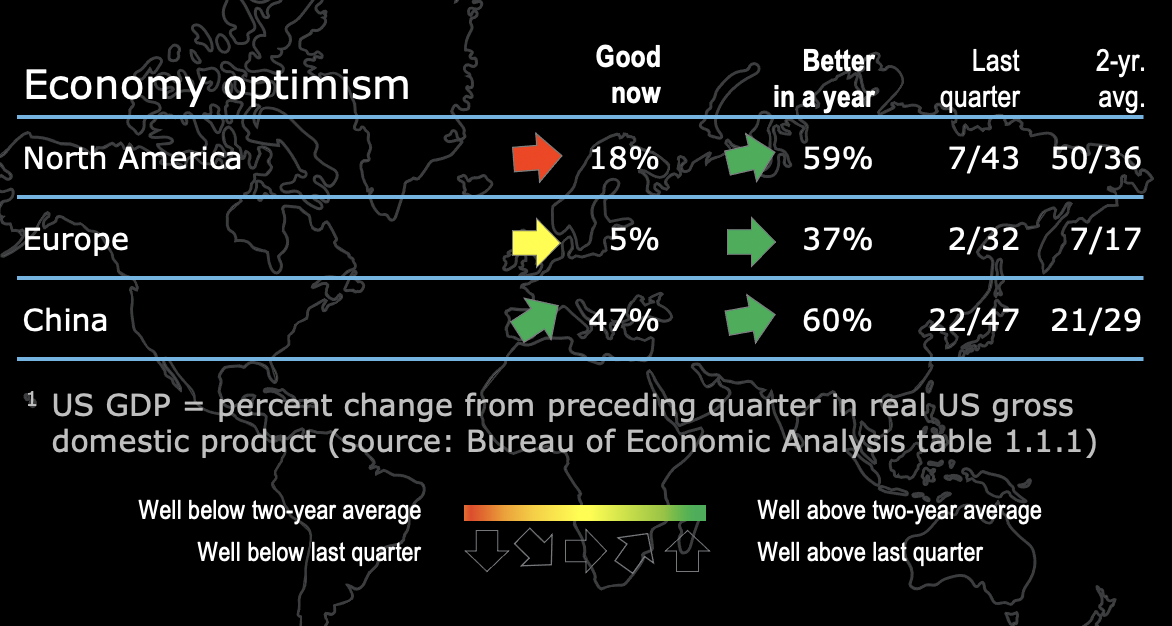

So, it’s particularly timely to get a check-in with the finance chiefs at the world’s biggest companies. Deloitte’s quarterly CFO Signals survey—which we’ve covered in this space before—shows an improved outlook as we head into 2021. Even those downers in Europe see better times in 2021.

The most bullish subset of CFOs can be found in China where nearly half (47%) say the economy is “good now,” and 60% say it will be even better a year from now. CFOs in North America have a similarly rosy outlook, as the graphic above shows. But those same CFOs are concerned about the first half of 2021 as stimulus talks continue to bog down and they maintain cautious optimism about the speed of the vaccine rollout.

The survey was conducted in mid-November when the S&P was trading around 3,500. (It closed at 3,702 yesterday). At that mid-November level, nearly 60% of survey respondents expected the benchmark to climb further by the year-end. But here’s the thing—”80% also say it is overvalued.”

80%!

Given the mid-November timing, just as Joe Biden was being named President-elect, the CFOs reflected on policy matters, too. They have a big wish list for Washington. “As a new administration takes over, CFOs overwhelmingly support a new stimulus package, infrastructure investment, de-escalating US-China trade tensions, less protectionist trade, and the federal government leading a COVID-19 response,” the report reads.

“Although there are industry differences, CFOs’ hopes for Washington center largely on improved bipartisanship and cooperation in getting important things done, and on unifying the country with more ‘moderation,’ ‘transparency,’ and ‘decency.'”

Let’s hope Washington is listening.

***

Have a nice day, everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Share price hacked. Cybersecurity specialists FireEye disclosed yesterday it had been hacked by a sophisticated "nation with top-tier offensive capabilities," sending its shares bombing lower. It's down nearly 8% in pre-market trading this morning.

"A new kind of gold rush." What's the value of a brand's lapsed trademarks—names like Aunt Jemima, Uncle Ben and Eskimo Pie? All three brand names are now defunct as consumer goods companies face a reckoning from activists pushing for more racially sensitive branding. But those names may not go away, Fortune's Beth Kowitt reports. There's a cottage industry bidding for such trademarks. "Trademark abandonment," says one bidder, is "a new kind of gold rush."

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Tangled up in red

Bob Dylan fans no doubt noticed the news this week that the songwriter had sold his massive music catalog to Universal Music Group in a deal speculated to run around $300 million. Fortune's Geoff Colvin looks into whether the deal's timing could have been the brainchild of his accountants. If the sale were to close this month it would be safe from any prospective capital gains tax-hike being mulled by President-elect Joe Biden. "Bottom line: The tax on a deal like Dylan’s could almost double if it doesn’t get done by New Year’s Eve," Colvin writes.