On Clorox’s most recent quarterly investor conference call in August, incoming CEO Linda Rendle and her C-suite colleagues had mostly upbeat news to share. But they also referenced the company’s ongoing struggles to supply the market with enough of its namesake disinfectant wipes—mentioning it not just once, but no fewer than 20 times.

It’s fair to say that rushing to replenish stores with the wipes, which have been flying off shelves in the U.S. since February when the COVID-19 outbreak started, is a Clorox obsession these days. And the company has indeed mobilized resources, lining up 10 additional suppliers so as not to miss out on a sales bonanza that could last for months longer. But the scramble has also forced Clorox to figure out how to take advantage of the crisis to more quickly implement its multiyear road map, one the company drafted well before anyone had heard of the novel coronavirus.

That’s one of the great challenges facing Rendle, who officially took the reins last month. “Where do we go from here, and how do we leverage what is an opportunity to serve so many people around the world, not just with our disinfecting products but with our broad portfolio?” Rendle asks rhetorically in a conversation with Fortune.

Rendle, 42, started at Clorox in 2003 after a couple of years at rival Procter & Gamble, making her way up in the ranks before more recently overseeing Clorox’s foundational cleaning business. In 2019, to see whether the rising star was CEO material and could formulate a major corporate strategy, Clorox’s board and then-CEO Benno Dorer tasked Rendle with coming up with the company’s next multiyear growth plan. That effort led to Rendle drafting her “Ignite” road map, unveiled a year ago, as a follow-up to Clorox’s seven-year “2020 Strategy” plan, which ended last year.

The goal of Ignite is to generate 2%-4% in annual revenue growth for the next few years, a touch above what Clorox had managed under its previous plan, and no easy feat in an industry where products quickly become commoditized and lose pricing power. That would mean introducing more new products, as well as updating existing ones and deepening Clorox’s reach in new categories. It will also mean increasing profitability, all while redoubling the green efforts that have made Clorox a darling of investors focused on environmental, social, and corporate governance (ESG) measures of performance.

Rendle’s Ignite plan dazzled the Clorox board and ultimately got the Harvard- and Stanford-educated executive named president earlier this year, setting her up to succeed her mentor, Dorer, who now serves as executive chairman. (Rendle’s ascent also earned her a spot on this year’s “Ones to Watch” list for Fortune’s Most Powerful Women in business.)

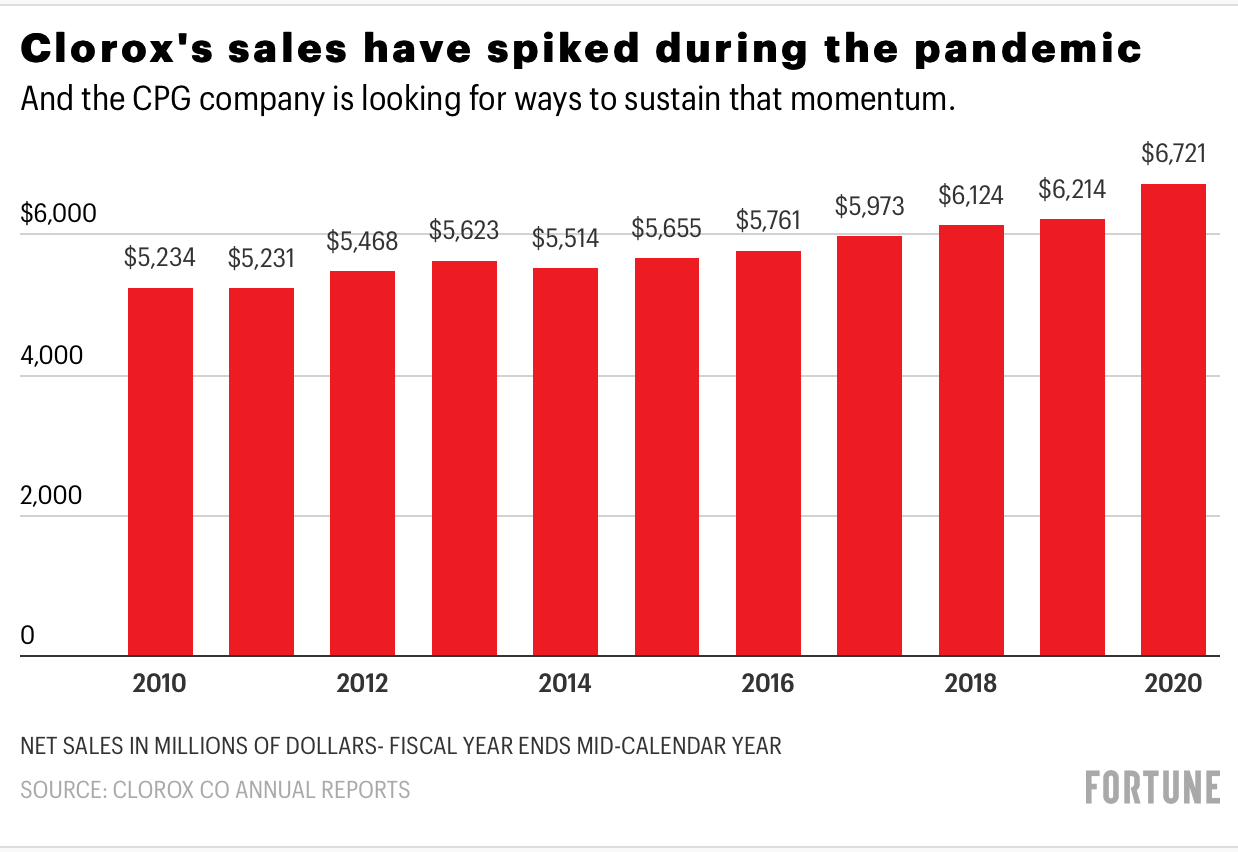

Before the pandemic struck, Clorox was struggling with anemic sales growth. Some businesses like its vitamins division were hurt by supplier issues, and Clorox was punished by retailers last winter for raising the prices on its Glad trash bags, losing shelf space in the process.

But the COVID crisis has sent Clorox company revenue through the roof, with consumers bulk-buying and hoarding any cleaning products they can find. The boon to Clorox’s business has persisted: Overall sales rose 22% year over year in the company’s fourth quarter. And for the fiscal year ended June 30, Clorox revenue hit $6.7 billion, up 8% from 2019, the company’s best annual gain in more than a decade. The company remains tiny compared to P&G, whose sales topped $70 billion. But Clorox’s shares are up 42% so far in 2020.

It’s not just wipes or disinfectants driving the growth, either. More people cooking at home has bolstered Clorox’s recently struggling Kingsford charcoal brand. A surge in pet adoptions is helping its cat litter business. And people are more concerned about germs in public places as well as at home. Now the challenge is how to leverage all this interest in Clorox’s products to maintain momentum, something that will hinge on continuing to come up with new products.

“Innovation is the lifeblood of this company,” Dorer said in an interview this summer.

Innovate or stagnate

If you’re looking for an example of Clorox’s long-standing culture of innovation, look no further than the wipes currently selling like hotcakes. The wipes came to market in 2000 when the company was trying to figure out how to give users an easier way to apply disinfectant. Fast-forward to now, and the wipes anchor Clorox’s cleaning business, a source of nearly a third of company revenue and its biggest unit.

Clorox needs innovation to keep up in a cutthroat category. Consumer packaged goods (CPG) makers like P&G, Unilever, Lysol-maker Reckitt Benckiser, and Kimberly-Clark are engaged in an arms race with the company. On Tuesday, P&G reported its biggest quarterly sales gain in 15 years, while Reckitt posted record growth. What’s more, retailers like Target and Walmart are ramping up their store brands. The product lines in the CPG category are all hotly competitive, and profit margins, already low, shrivel quickly once a brand grows stale. So Clorox’s innovation has to go well beyond a few tweaks here and there.

“The CPG universe is looking at a lot of uphill,” says David Marcotte, a senior vice president at Kantar Retail IQ. “You’ve got to be able to come to the table with something more compelling than a line extension.”

Not every innovation has to be revolutionary. Clorox managed to reinvigorate its grilling business with relatively simple changes, including introducing wood pellets for grills and offering charcoal that lights faster. Its Glad garbage bags business has gotten a boost from the addition of chemical components that give the bags a fragrance; the company also made the bags stronger by incorporating new resins that are environmentally friendly.

“Those things matter to consumers,” says Rendle, who notes that it’s important to do what she calls “small-i innovation” as well as “big-I innovation.” “If you’re too focused on just the big innovation, your core [product line] over time is not as relevant to consumers,” she adds.

And that has been Clorox’s ethos for a long time. Earlier in its history, Clorox turned its Hidden Valley Ranch salad dressing, a brand it bought in the 1970s, from a mail-order product into a $600 million brand through tactical moves such as adding snacks. A more recent product update: Its Burt’s Bees personal-care division will be adding cannabidiol (CBD) to some products this fall. Brand-new products now typically take only 14 months to get from original idea to market at Clorox, compared to 24 months previously.

Innovation adds about three percentage points to Clorox’s revenue increase every year, Dorer says, meaning that without it, Clorox sales would be stagnant. And to bolster an inventive culture, Clorox holds periodic innovation “hackathons.” Dorer ascribes this to the Bay Area’s tech-driven culture seeping into Clorox’s; the company is headquartered in Oakland.

Rendle says innovation isn’t just at the product level: It can take the form of faster processes, simplifying product assortment to speed up production of bestsellers, or squeezing out production and distribution efficiencies to boost margins—something all CPG companies are chasing.

“The truth is the business has had to become more efficient during this crisis,” says Geoff Freeman of Consumer Brands Association, a trade group, of Clorox and its peers.

Beyond new products and line extensions, Clorox is betting it can get a lot more mileage out of its existing lineup.

Exhibit A: disinfecting products. One area wide open with new opportunity is the professional market, including offices, hotels, hospitals, and anywhere outside the home. That segment makes up only 7% of company sales at present, and Kimberly-Clark is strong there, but analysts see plenty of upside for Clorox. Earlier this year, Clorox signed deals with United Airlines, Uber, and AMC movie theaters to provide Clorox-branded items to those companies. The deals help the company capitalize on people’s aversion to germs and the high name recognition the pandemic has given its products, including its namesake wipes and other lines in its arsenal like Pine-Sol and 409.

“As consumers reenter public spaces, they want to be reassured that their space is as clean as when they left home,” says Rendle. “And a lot of commercial cleaning brands are not known to consumers.” That thought, of course, brings her back to a more immediate preoccupation. “The only limiting factor right now is supply,” she says.

A healthy company

CPG companies like Clorox and P&G are “portfolio companies” that own often strange collections of disparate products. P&G is home to Tide detergent, Tampax tampons, and Vicks cough drops. Clorox, which started life in 1913, can also be seen as a hodgepodge: Its roster includes Liquid-Plumr, Brita water filters, and Fresh Step kitty litter.

About 14 years ago, a newer focus for Clorox began to emerge: health-focused products. The new emphasis started with Burt’s Bees natural personal-care products and continued in 2010 when Clorox dropped lines like STP motor oil. Since then it has added a number of more obviously health-oriented products, including vitamins and probiotics, most notably with the $700 million acquisition two years ago of Nutranext, a brand of dietary supplements.

“We are a health and wellness company at heart,” says Dorer. “Wellness is the foundation of the company, helping people keep their home safe.” But it’s also a hot area and one in which Clorox can compete well.

Clorox’s secret sauce when building new businesses has been to avoid taking on bigger rivals like P&G head-on. Instead the company goes into specific areas where it can be a market leader and aims to build a nice business without having to do a big turnaround job on a faltering brand.

“What makes them unique is they’re going into product and categories where they can be No. 1 or No. 2, and they back that up with innovation,” says Lori Keith, a portfolio manager at Parnassus Investments whose midcap fund holds $100 million worth of Clorox shares and focuses on ESG investments. “They’ve picked their spots wisely.”

Clorox entered the vitamins and nutritional supplements via acquisitions, and it plans to keep building the business. But Rendle says that on her watch, Clorox will maintain its long-held policy of not doing mergers and acquisitions for the wrong reasons, only to find itself saddled with failing businesses that drain resources. It helps that M&A is not factored into Clorox executives’ compensation.

“We do space-driven M&A, not banker-driven M&A,” explains Dorer. For Clorox executives, that means focusing on new areas, becoming experts on their own, and not having investment banks push ill-advised deals in categories too far afield. M&A is the “cherry on the top” of a successful company, Dorer says.

For now, Rendle has her plate full, what with supplying an insatiable market with Clorox wipes in the immediate term, but also living up to the goals she set forth in the Ignite plan.

“The mistake a lot of companies make is they don’t know themselves well enough,” she says. Clorox, she adds, is good at building brands, making supply chains more efficient, and finding ways to get more uses out of existing products. “The secret sauce in all this is always being really focused on your core,” says Rendle.