This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters. How’s this for a matchup? The pessimism around China-Hong Kong tensions and U.S. jobless claims is facing off against investor euphoria over stimulus packages. So far the bulls have the upper hand.

There’s plenty of green on the screens.

Let’s see where investors are putting their cash.

Markets update

Asia

- The Asian indices are mostly higher in afternoon trade.

- The Nikkei is up more than 2% after the Japanese government approved what some are calling the “world’s biggest” coronavirus stimulus package (in GDP terms).

- Hong Kong’s Hang Seng is that lone patch of red in Asia. It was down at the start of the trading session after U.S. Secretary of State Mike Pompeo said in a Tweet Hong Kong is no longer considered fully autonomous, throwing its special trading status into question.

- The Hang Seng then fell further, down as much as 1.2%, after the legislature in Beijing approved, as expected, the new national security law that’s tailor-made for Hong Kong.

Europe

- European bourses climbed out of the gates again this morning. Germany’s Dax was up 0.55% two hours into the trading day.

- The continued momentum behind European equities comes down to yesterday’s European Commission announcement of a more-generous-than-expected €750 billion coronavirus stimulus package. Promoting green tech is at the heart of the recovery plan.

- Bloomberg crunched the numbers on the EU’s full recovery bill, putting it at €2.4 trillion ($2.6 trillion).

U.S.

- The Dow and S&P 500 futures are in the green, as I type, though they’re off their highs following the latest China-Hong Kong news. The Nasdaq appears set to open flat.

- On the same day the U.S. officially surpassed the 100,000 COVID-19 death toll, the S&P 500 climbed to an 11-week high, closing above 3,000.

- Want more evidence Wall Street and Main Street are worlds apart?… The gulf between consumer sentiment data and the gains in the S&P 500 are at an all-time high. A hint: consumer sentiment is really low; investor exuberance sky-high.

- We get another update on the brutal U.S. labor market before the bell today. One set of economists predicts that between 2.1 million and 2.4 million unemployment claims were filed in the past week.

Elsewhere

- Gold is up.

- The dollar is flat.

- Crude is one of the few assets in the red today. Brent is off 2%, trading below $35 per barrel.

Russellmania

The Russell 2000 yesterday closed 3.1% higher, extending its incredible two-month run. If you’d completely overlooked the daily swings of this small- and mid-cap index, don’t feel too bad. The Russell doesn’t get a lot of attention day in, day out.

But ignore it at your peril.

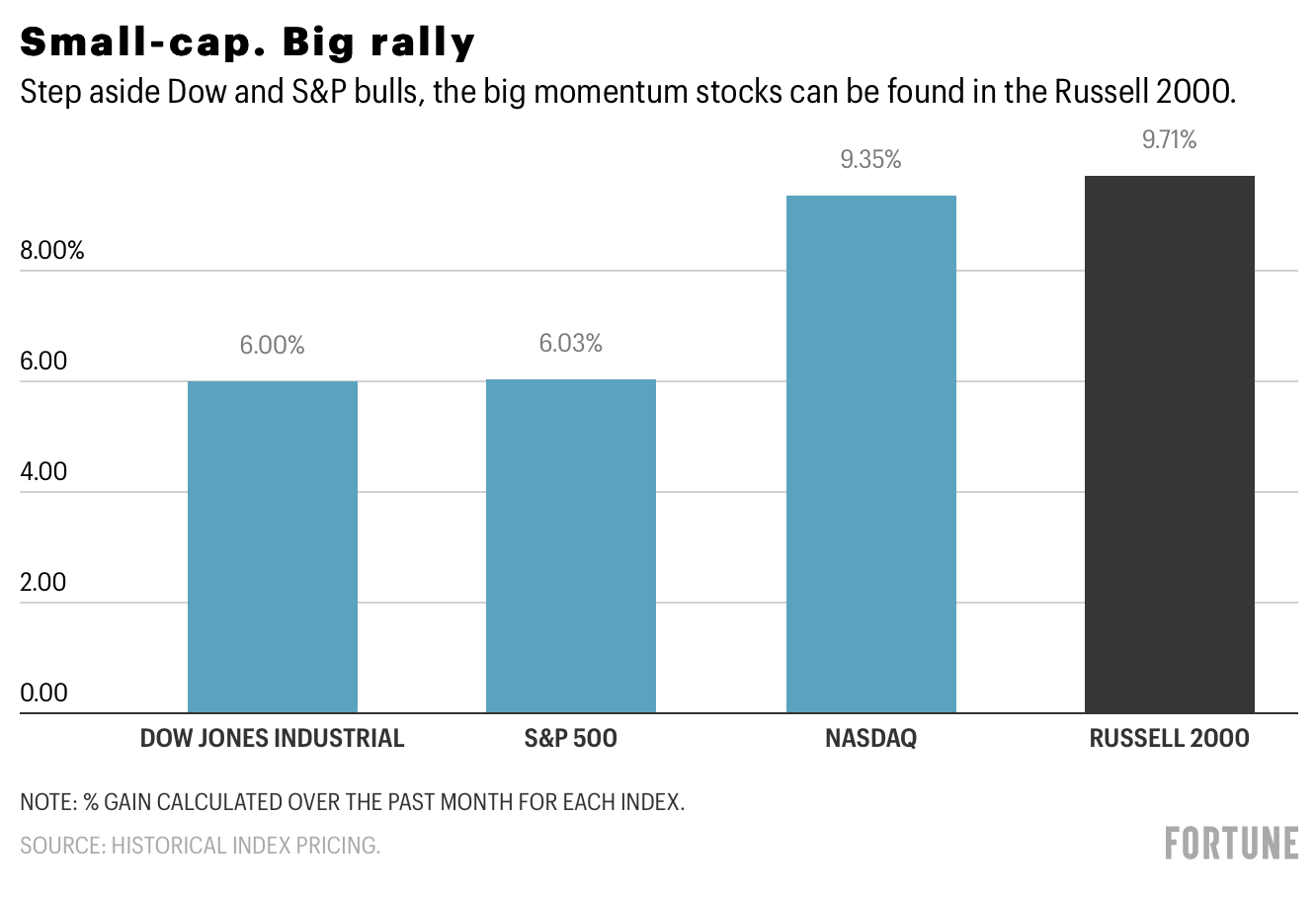

As Fortune reported last month, the Russell often acts as an important bellwether for the broader U.S. markets. That’s often true on the way down, amid market slumps, and on the way up, as we’re now seeing. Today’s chart shows the Russell vs. its peers over the past month. The Russell 2000 is even outperforming the Nasdaq.

“When things really turn around… stocks on the Russell frequently lead the large-caps,” Erik Sherman wrote in Fortune last month.

That’s because the small- and mid-caps are, by definition, riskier assets. When investors look to buy there, they’re clearly in a risk-off mood. And these days, risk-off = buy everything. As Dan Wantrobski, associate director of research at Janney Montgomery Scott, told Sherman, “you’ll know we’re getting close to a bottom when we see small-caps starting to outperform large.” And that’s certainly what’s happening right now.

Russell 2000 companies are also highly tied to the American consumer. They grow when the U.S. economy grows. And that’s where a big warning flag should come in right about now. The economic indicators show the U.S. economy, at best, may be off its lows. It’s certainly not growing at a rate that could easily explain the Russell’s near 10% rally this past month.

Some market commentators have taken to describing the Russell 2000 rally as something of a curiosity, as Russellmania.

A mania? By that measure, it would have good company.

***

Have a nice day everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune’s Outbreak newsletter will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Fancy duds. Shares in Walmart have been on a tear since the market's mid-March swoon. Now the retailing giant is looking to become a player in fashion through a new tie-up with clothing resale specialist, ThredUp. It's all part of a strategy that's been years in the making, Fortune's Phil Wahba explains.

The F-word. Analysts are growing increasingly pessimistic about equities, and yet investors keep pushing markets to new heights. What gives? I'll give you a hint. It starts with "F," and rhymes with "bed." The Times' Matt Phillips digs into the numbers of the Fed effect.

(Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.)

Market candy

This day in history

83 years ago on this date, a consumer brand for the ages was born: Gesellschaft zur Vorbereitung des Deutschen Volkswagens mbH—later shortened to Volkswagen. The German automaker managed to shake off its Nazi roots to become a big-seller the world over. (In the 1980s, my oldest brother cycled through used VW Bugs as often as he bought a new pair of shoes.) At the end of 2019, VW was the world's No.2 carmaker behind Japan's Toyota, selling 10.8 million vehicles. It also came up with the best car ad of all time, imo.