This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Happy Friday, everyone… Down, up, down, up. The markets are stuck in another “W” cycle. How will we close out the week?

Let’s spin the globe and see.

Markets update

We begin in Asia, where the Nikkei is the only major index in the green. The Asian Development Bank has put a price tag on the coronavirus pandemic, which has now claimed 53,000 lives; more than 1 million have tested positive. The outbreak could cost the global economy as much as $4.1 trillion, ADB says.

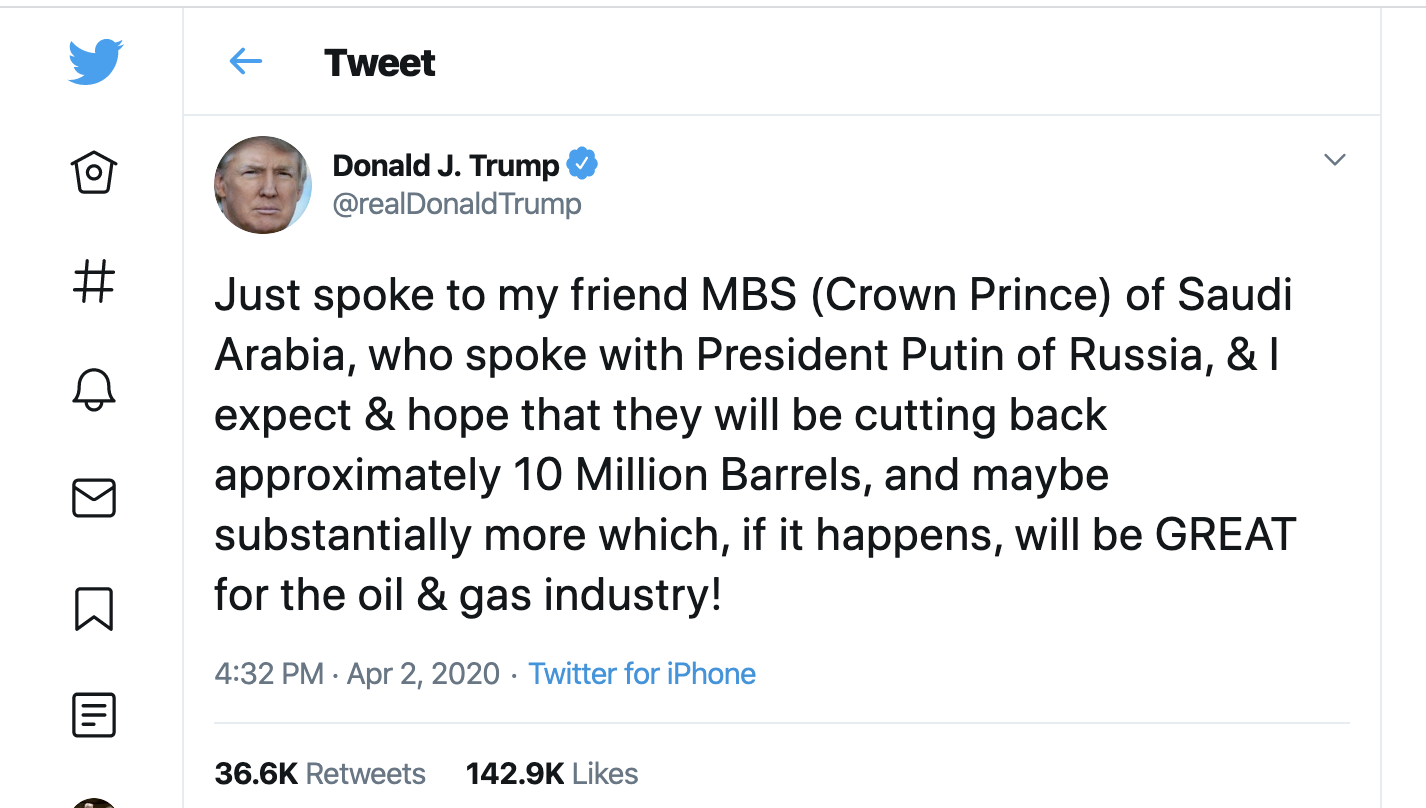

Oil fell swiftly during Asian trade today, before recovering. Crude had shot up by more than 40% at one point yesterday following a tweet from President Trump suggesting the Saudis and Russians had buried the hatchet and would cut output.

To skeptics, the tweet read like an April Fool’s gag. But the prices are holding steady as OPEC+ has scheduled a virtual meeting on Monday.

***

Europe opened Friday in the red with the benchmark Euro STOXX 600 trading down 0.4% in the first half-hour of trade. Germany’s Dax is down nearly 1% as Berlin is forecasting a 5% coronavirus hit to the economy.

With each passing day, we get more detail on how the most battered companies are recalibrating their businesses. British Airways reports it will furlough more than 30,000 employees, while Adidas will reportedly seek more than €1 billion ($1.1 billion) in aid from the German government.

***

The Dow and S&P futures are both pointing downward around 1% at the moment, but it’s been creeping up all morning. The U.S. markets yesterday shrugged off a truly historic unemployment claims report. (More on that below).

***

Elsewhere, the dollar is up. Gold is flat.

***

We have more numbers for you, as we do every Friday.

***

By the numbers

10 million. In the past two weeks some 10 million Americans have filed for unemployment benefits. Yesterday’s 6.6 million number was more than 3 million above consensus estimates. The worst part, as my colleague Lance Lambert points out, is this figure almost certainly undercounts the numbers of those out of work. The jobs market has never seen a hit like this, as Lambert’s chart points out.

It’s the first Friday of the month. That means the U.S. jobs report is due in a few hours. But that’s a lagging indicator that almost certainly won’t reflect the full fireworks of the past two weeks.

41. Exuberant oil traders sent crude futures prices soaring 41% at one point yesterday. It’s been a choppy ride today as cooler heads point out the shock to the market is demand-driven. Grounded flights, shuttered factories, shelter-in-place orders have created an historic backlog of crude stocks. Even with the price of Brent crude again hovering above $30-per-barrel this morning, it’s down 54% year-to-date.

17.1. This data point should make you a feel bit better about your portfolio. The S&P 500 is flat this week (down 0.5%, actually). Looked at another way— it’s managed to hold just about all of last week’s gains. Since the March 23 close, the index is up 17.1%.

Postscript

Judging by the reader mail I’m getting, these little snapshots of life under lockdown are becoming a popular feature on The Bull Sheet.

I’ll be back here next week with more observations, no doubt. But I want to flip the script and ask you: as we’re all in this together, how are you getting through this ordeal? I’m very curious. I want to hear your stories. Drop me a line.

Stay safe and sane. Have a good weekend!

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune has a new pop-up newsletter. The aptly named Outbreak will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Growth or value? In a market downturn, should you put your money into high-growth stocks or stable stalwarts? The conventional wisdom states, the stalwarts. Right? Well, Fortune's Rey Mashayekhi talked to a number of markets pros. Turns out you might want to rethink that strategy.

Checking on stimulus checks. Treasury Secretary Steven Mnuchin declared last week that Americans would get their coronavirus stimulus checks "within a couple of days." Don't wait by your mailbox. Paper checks won't start mailing until next month, and it will take a full 20 weeks from there for the whole lot to be delivered. That means some of you won't see the checks until September.

Tesla take-off. (It's been a while since I've written something like that.) The automaker closed up more than 20% yesterday after it announced it had delivered 88,400 cars last quarter, soundly beating analysts' expectations. Despite the stronger-than-expected number, Tesla is well off-pace for meeting its prediction in January that it would deliver 500,000 cars in 2020, Fortune's David Z. Morris notes.

Market candy

Shorting unicorns

From yesterday's spectacular collapse of Luckin Coffee shares, there emerges one big winner: Muddy Waters Capital’s CEO Carson Block. In January, Block tweeted he was shorting the coffee chain, saying he was in possession of a "credible" report that the fast-growing Chinese unicorn was engaged in fishy accounting. The board acknowledged it was looking into just that yesterday, sending the stock plunging 81% yesterday, making it a great day for Luckin shorts.