This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. The streak of gains is in jeopardy this morning.

Here’s what’s moving markets.

Markets update

Investors have witnessed a rarity this week: a two-day rally in equities. The Tuesday-Wednesday gains marked the first time in the past six weeks we’d seen consecutive “up” days. It was touch and go for a while. “Despite a hectic last few minutes of trading on Wednesday prompted by Bernie Sanders threatening to stall the $2 trillion stimulus bill, indexes managed to stay in the green,” my colleague Anne Sraders detailed.

This morning, the equities picture is not looking quite so rosy.

Asia is mixed. Japanese stocks are selling off, and the Chinese and Hong Kong indices are edging down, as I type. Singapore announced a new emergency stimulus package today worth $33.2 billion that includes tax breaks for hotel operators and retailers, a move that barely budged shares.

Europe too is in the red. The major European bourses in Frankfurt, London and Paris are all down about 2% in the first hour of trading. That’s despite some progress on getting emergency lines of credit open to the Euro zone’s most fragile economies. Here’s a bit of promising news: some market watchers say European equities may have already bottomed.

***

The Dow, S&P 500 and Nasdaq are all set to open down. But, as I type, they’re gaining some ground. Progress in Washington on a $2 trillion stimulus package has propelled the Dow to a two-day 13.7% gain. A historic aid package full of all kinds of goodies—loans, tax breaks and direct injections of cash into Americans’ bank accounts—has taken the attention off of corporate America’s struggles for now.

***

The Nasdaq didn’t fare quite so well yesterday, but Apple’s 9% pop on Wednesday was enough put it back into the $1 trillion valuation club.

***

Elsewhere, the dollar is lower on Thursday, as is oil. Earlier in the week, Brent crude had climbed above $30 a barrel. It’s since slid down to 26 and change. So much for the Trump Administration’s efforts to get the Saudis to call a truce in the oil price war.

***

It may be looking like a risk-off day, but investors can’t complain about the equities rally over the past week. Most global markets hit multi-year lows last week as lockdown measures went into effect across much of Europe and the U.S.

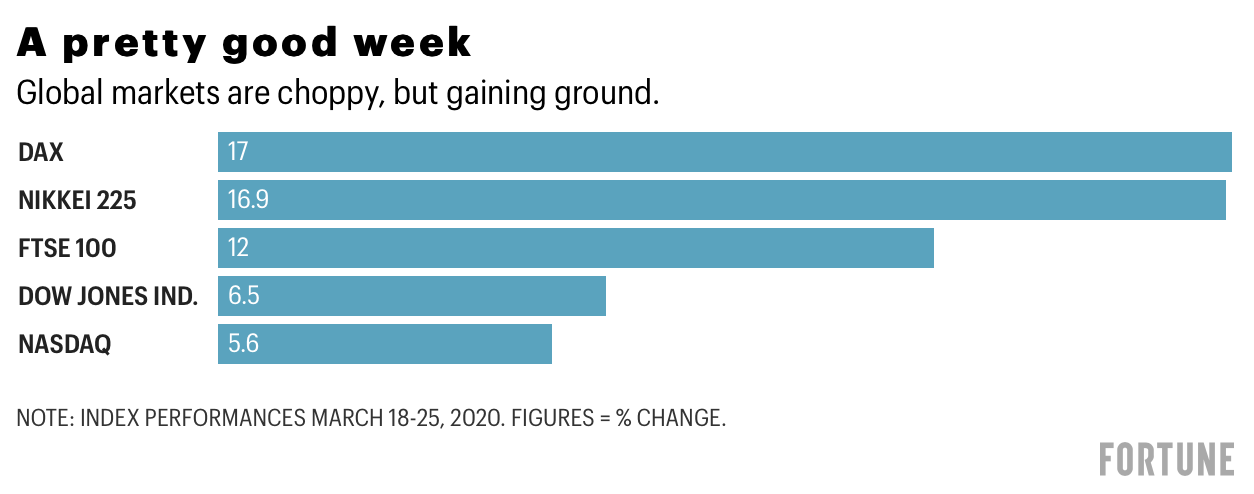

If you were bold enough to put some spare cash back into stocks last Wednesday, on March 18, you’d be seeing pretty impressive gains in your portfolio today. German and Japanese equities are leading the way, as today’s chart shows.

***

Bear market bounce, or a comeback?

Now, a word of caution: even with the 17% climb on the DAX over the past seven days, it’s still down 26.2% year-to-date. And it’s giving up further gains this morning.

But the moves by central bankers and lawmakers over the past seven days cannot be overstated in bringing some calm—and even a glimmer of hope—to global markets. The trillions in fiscal stimulus measures and pledges by central banks to buy corporate and government debt is a sign that policymakers will do everything in their power to avert a wave of corporate insolvencies, which would set off an unemployment time bomb and a deep global contraction in trade. We saw all of those things the last time, during the Great Recession of 2008.

Postscript

A friend in Bengaluru (aka Bangalore) sent my wife and I a note, sharing his thoughts about India’s “total lockdown” orders. He’s never been a fan of Prime Minister Narendra Modi. True to form, he finds these latest steps to curb the coronavirus contagion to be particularly cruel on the country’s most vulnerable. “He is not ‘pro-poor,’” my friend wrote of Modi. “Even at this stage he has no heart for the lower middle and economically backward people whose daily survival is a big challenge.”

A former priest, my friend is now an activist for India’s poor. I spent a lot of time with him in the spring of 2017, shooting a short documentary film on India’s Dalit women. I slept (or tried to) most nights in a kind of orphanage. Former street children bunked on the floor below me. The beauty of the people and the place overwhelmed me, as did the unceasing clamor of street life.

Here’s what I want to know: how do you lock down nearly one-fifth of the world’s population, particularly when so many of them live in the most humble of dwellings—no electricity, no plumbing, no doors? How do you practice social-distancing in a country of 1.3 billion, for that matter?

I have to make a confession. These days I spend more mental energy worrying about the fate of the beautiful people I’ve met over the years in places like India, Kenya and the DR Congo than I do about my portfolio.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune has a new pop-up newsletter. The aptly named Outbreak will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Turn back the clock. Most of us remember the 2008-2009 financial crisis as if it were yesterday. Unemployment cratered. The S&P 500 tanked. The yields on corporate debt went to the moon. Will the coronavirus pandemic send us straight back to those conditions? In a must-read, Fortune's Shawn Tully explains how this time we're looking at a very different scenario. Let's hope we've learned a few lessons in the past decade.

Forget the thin mints. "If a 5¢ coin is a nickel, 10¢ a dime, and 25¢ a quarter, what is a $1 trillion coin? Call it an emergency plan." So begins Robert Hackett's fascinating deep-dive into one lawmaker's plan to pay for the stimulus package by minting two $1 trillion coins. Yes, it sounds crazy. But it's gaining surprising support.

When $2 trillion isn't enough. If you think the historic coronavirus pandemic relief bill will be a one-and-done move, think again. Justin Lahart of the Wall Street Journal explains why the aid package might not be sufficient to keep vital sectors of the U.S. economy—namely, small businesses—afloat. He reckons that for the U.S. government, it "might not be its last trip to the well."

Market candy

$198,000

As things stand now, that's the earnings cut-off for married couples to qualify for coronavirus relief checks. (It's $99,000 for individuals and $146,500 for heads of household). As long as you're under that threshold you'll get a $1,200 check (or a direct deposit) and $500 for each child. Fortune's Rey Mashayekhi explains the fine print—including when the stimulus money will be mailed out—right here.

Note: Most Fortune stories are behind a paywall. We are offering our newsletter readers a nice deal: one year of access for just $25.