This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Guten morgen, Bull Sheeters. Yes, there’s going to be a bit of German in today’s newsletter.

But first….the Asian and European markets are in the red, as are the U.S. futures as I write. The Wuhan coronavirus (death toll at 170 and cases above 7,700) is dragging the markets lower. But there’s also the mixed earnings picture (Tesla good, Facebook bad) and diverging central bank maneuvers (will the BOE cut?… what’s the Fed thinking in holding pat?) that have given investors reason to hit the “pause” button.

Let’s go back to earnings. This morning, early out of the gates, we had Deutsche Bank reporting its Q4 results. And they were bad. Deutsche Bank is a stock to watch. It has a host of problems, many self-inflicted. But it’s also been hammered by negative interest rates—or negativzinsen in German. Since the European Central Bank dropped the nominal deposits rate below zero in June 2014, DB shares have sunk more than 70%. CEO Christian Sewing last year said negative rates “ruin the financial system.”

And here’s why. Negative rates obliterate banks’ loans business. This is true everywhere. If you comb through a bank’s quarterly results you’ll see a line item called “net interest income.” It’s a good indicator for how the banks’ loans and accounts business, a traditional profit-driver, is doing.

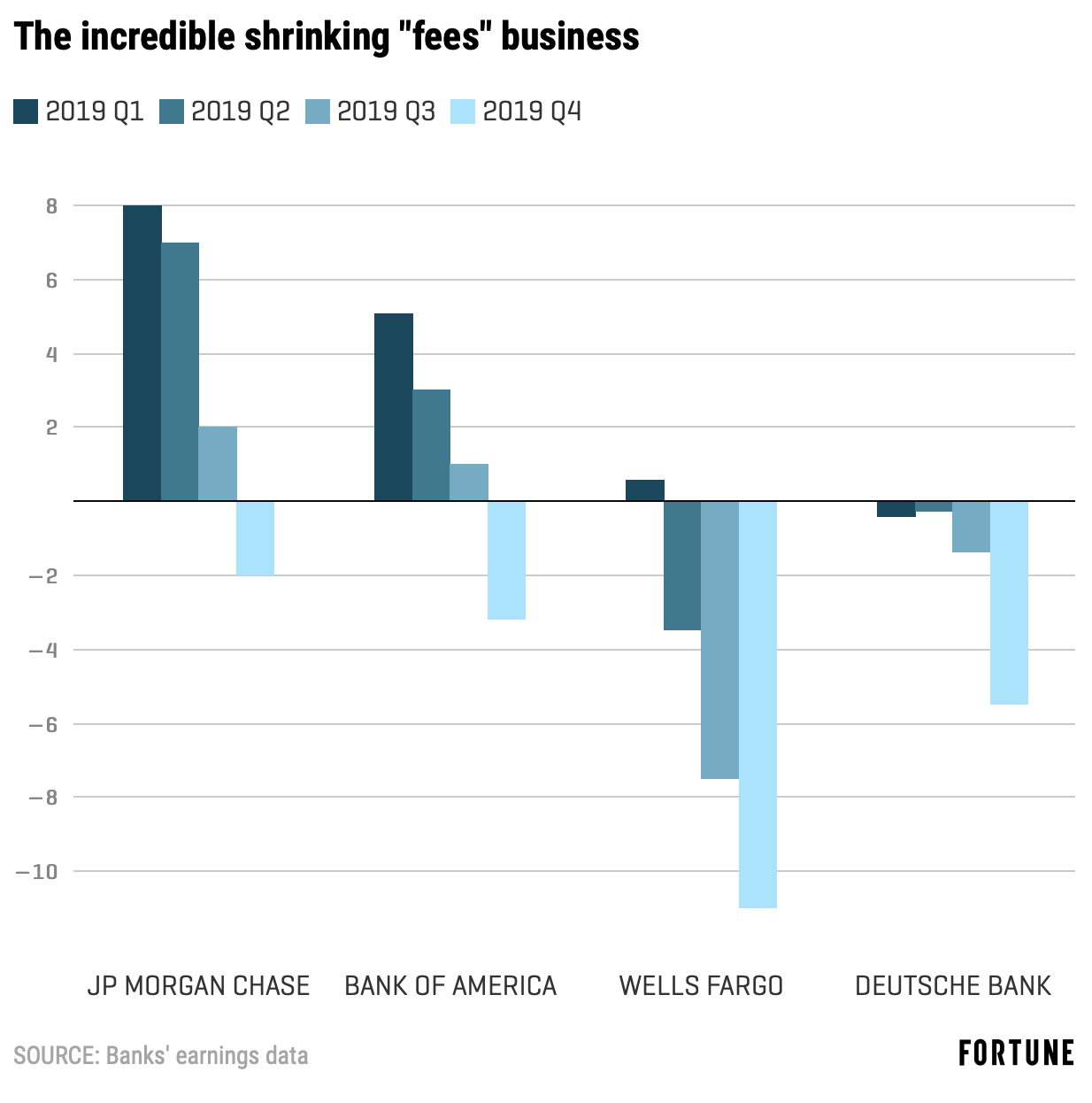

Banks’ net interest income has been falling for several quarters in Europe, and negative rates is the primary reason. But this phenomenon is also spreading across the Atlantic, as today’s chart shows, with the decline in nominal interest rates taking hold more broadly across the retail banking sector.

The cost of low and negative rates

***

I looked at the last four quarters for DB and its American peers. The trend—showing quarter-on-quarter declines (by percentage)—looks worryingly similar for all four. Net interest income—the fees collected for things like issuing loans and opening new accounts—is going down, down, down. At Wells Fargo, the trend is particularly acute with net interest income declining 11% last quarter relative to Q4 2018. JP Morgan Chase, the powerhouse of the sector, is the least exposed, but it’s not entirely immune from this phenomenon either. Its Q4 2019 net negative income came in 2% lower than the year-ago period. Deutsche Bank’s fell 5.5% last quarter.

In this low and negative rates environment, the banks have had to reinvent their core business by, for example, moving into trading and wealth management, two sectors that are less exposed to central banks’ rates policy.

At the start of today’s session, Deutsche Bank shares were trading lower this morning on the poor results. Meanwhile, JP Morgan Chase, BofA and Wells Fargo are all down year-to-date.

The Germans have a word for what some American investors are feeling about now: fremdshaeman. They feel your pain.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Today's reads

Where credit's due. Good news (for some of us). FICO is updating how it calculates consumers' credit scores, an often murky indicator that defines so much about Americans' lives. The new ratings system is supposed to be more straightforward and beneficial to those who keep their finances in line. Here's how it will affect you.

Stop the presses. Warren Buffett is a newspaper man. But you won't find them in his portfolio anymore. On Wednesday he sold off the newspaper holdings of Berkshire Hathaway, which include the Buffalo News and his hometown Omaha World-Herald, for $140 million. The reason is a familiar one: the businesses are shrinking at an unsustainable rate.

What the candidates think. In partnership with Time’s Up, Fortune reached out to all the 2020 presidential candidates with a list of questions about the economic issues that most directly affect working women and working families (such as paid family leave, sexual harassment, the gender pay gap, and more). Thirteen of the remaining 15 candidates—including President Trump—participated, with many doing exclusive video interviews with Fortune. Check it out here.

Market candy

The personal price of quarantine. In this age of super bugs and global travel, most countries have stringent plans for how to contain communicable diseases such as the coronavirus. A common measure: quarantine orders, enforced with fines and threat of imprisonment. In the U.S., if you ignore that order you could be punished by "a fine of not more than $1,000 or by imprisonment for not more than one year, or both." Such fines—not to mention government-mandated sick camps and police powers to kidnap high-risk offenders—is too steep a price to pay to fight disease, the American Institute for Economic Research argues. What do you think? Time to rewrite the rulebook for fighting disease?