If financial results from Wall Street banks have revealed any trend this month, here’s what the coming earnings season holds: Thin returns for most, with more ample rewards for those who have diversified into growing business lines.

Wall Street’s giant banks are typically the first companies to stride through the quarterly earnings parade, as they did last week. Given that their success depends on anticipating both consumer trends and corporate spending, these banks are in a position to anticipate near-term changes in the economy. In that sense, they can be a herald for what the rest of the earnings season may bring.

How did they fare? On the whole, the financial sector underperformed the broader market during its first earnings week of 2020. The portion of the S&P 500 dedicated to finance—which includes giants like JP Morgan, Bank of America, Morgan Stanley, Wells Fargo, and Citigroup—rose a modest 0.5% in the past week when these financial giants reported earnings. That’s about one-third of the 1.4% increase in the broader S&P 500 Index.

On first blush, that underperformance may not be as bad as it appears. Banks are especially sensitive to interest rates because they collect higher interest from loans, while offering lower interest for deposits. With interest rates overall falling during the past year, thanks in good part to the Federal Reserve’s more dovish actions, it’s gotten harder for banks to eke out significant profits from their various interest-dependent business lines.

That’s the bad news for shareholders. The good news for them is that some of the conglomerate banks last quarter did a decent job of finding other ways to make money.

“Firm bank earnings came amid challenges for the industry when you consider the low-interest-rate situation,” says JJ Kinahan, chief market strategist at TD Ameritrade. “Banking is the sector that had to work against the macroeconomic environment more than any other after the Fed cut interest rates three times last year.”

Those Fed cuts appear to have been a mixed, but overall positive, move for the biggest, most diversified banks. On the one hand, the Fed’s rate cuts hurt their net-interest income—a key bank metric that tracks the difference between the interest rates that banks pay to depositors and the interest rates they take in from borrowers.

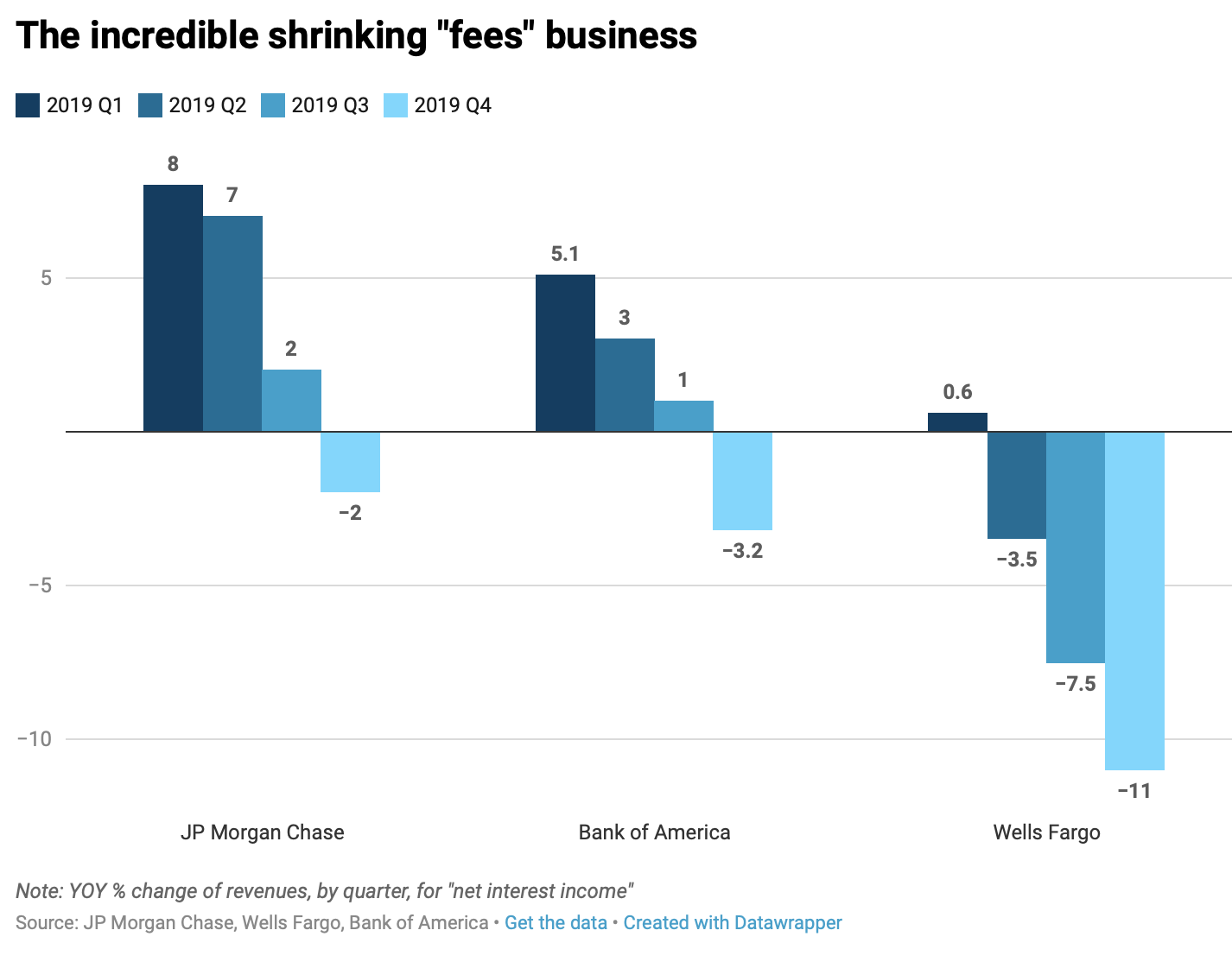

In early 2019, net-interest income was relatively high for many big banks. The more the Fed cut, the more this metric declined. Net-interest income at J.P. Morgan, perhaps the most robust Wall Street titan in recent quarters, shrank 2% at the end of 2019, well below the 8% growth rate it enjoyed in the first quarter of the year. At Bank of America, meanwhile, net-interest income fell 3.2% last quarter. At Wells Fargo, it fell a startling 11%.

For each of these banks, the trend doesn’t bode well as this vital indicator shrinks quarter by quarter.

The silver lining for many of these banks was that they were able to find other areas of growth beyond interest income. If bank stocks were vacillating and underwhelming this past week, it’s probably because investors were parsing out the winners from the losers: Morgan Stanley fared the best, rising 10%, while Goldman Sachs, Citigroup, and J.P. Morgan Chase each rose about 2% and Bank of America was flat.

Wells Fargo, meanwhile, brought up the rear, closing down 6% in the past week. Charles Scharf, who became the bank’s third CEO in the past year, claimed last week that many of the bank’s struggles still have to do with the turmoil that Wells Fargo has faced in the wake of a scandal involving fabricated consumer accounts. Still, he added, lower rates still took a bite out of its earnings.

“It’s the rates, right? They dropped in 2019,” Scharf told investors. “And we expect them to be relatively flattish in 2020.”

Contrast Wells Fargo’s challenges with those outlined by the hard-scrabble optimism of other big banks. There may be uncertainty and even turmoil in some parts of the global markets, but these can present trading opportunities for clients, which can in turn mean more revenue for the banks themselves.

“While we face a continued high level of complex geopolitical issues, global growth stabilized, albeit at a lower level, and resolution of some trade issues helped support client and market activity towards the end of the year,” said J.P. Morgan CEO Jamie Dimon.

Those words might sound like Wall Street exhaling a sigh of relief in late 2019. The key phrase, though, is “client activity.” In the low-interest world of 2020, the name of the game isn’t so much companies borrowing at those reduced rates, let alone those trying to retire on them. It’s the growing niche of wealth management, or reaching out to families with enough money to actively trade on opportunities that a low-interest world provides.

Take Morgan Stanley, the clear winner from the earnings season so far. It saw a steady but moderate growth in its profits from managing money for wealthier households. “We have increased the profitability of our wealth-management business,” Morgan Stanley CEO James Gorman said on last week’s earnings call. That unit. which yielded 10% profit margins a few years ago, will deliver a 30% profit margin in coming years, he said.

In short, the tried-and-true business model of banks—borrowing money from depositors, loaning it back out to other clients at a profit—offers pretty thin returns these days. But low interest rates can create trading opportunities for firms willing to capitalize on such shifts in an ever-churning market. Which in turn is giving bank stocks just enough fuel to keep their rally going.

More must-read stories from Fortune:

—Forget policymakers. Greta Thunberg and her allies are targeting CEOs now

—Investors see a 2020 recession coming—but think they’ll make money

—The Carlos Ghosn affair: A look inside the motivations of a fugitive CEO

—Laws meant to close down tax havens and shut loopholes could have opposite effect

—What a $1,000 investment in 10 top stocks a decade ago would be worth today

Subscribe to Fortune’s forthcoming Bull Sheet for no-nonsense finance news and analysis daily.