FORTUNE Analytics brings readers business insights from proprietary data and exclusive surveys. It will launch as a premium newsletter in early 2020. Sign up for the debut below:

As long as American consumers—the lifeblood of the economy—keep spending away, recession speculation is unlikely to turn into reality. Maybe you shouldn’t feel guilty for that $5 coffee after all?

But this means we should keep a close eye on Americans spending habits and their personal economic outlook, especially when considering manufacturing is contracting. That’s why Fortune and SurveyMonkey teamed up to conduct a poll of more than 10,000 Americans.*

The big numbers you should know:

88%

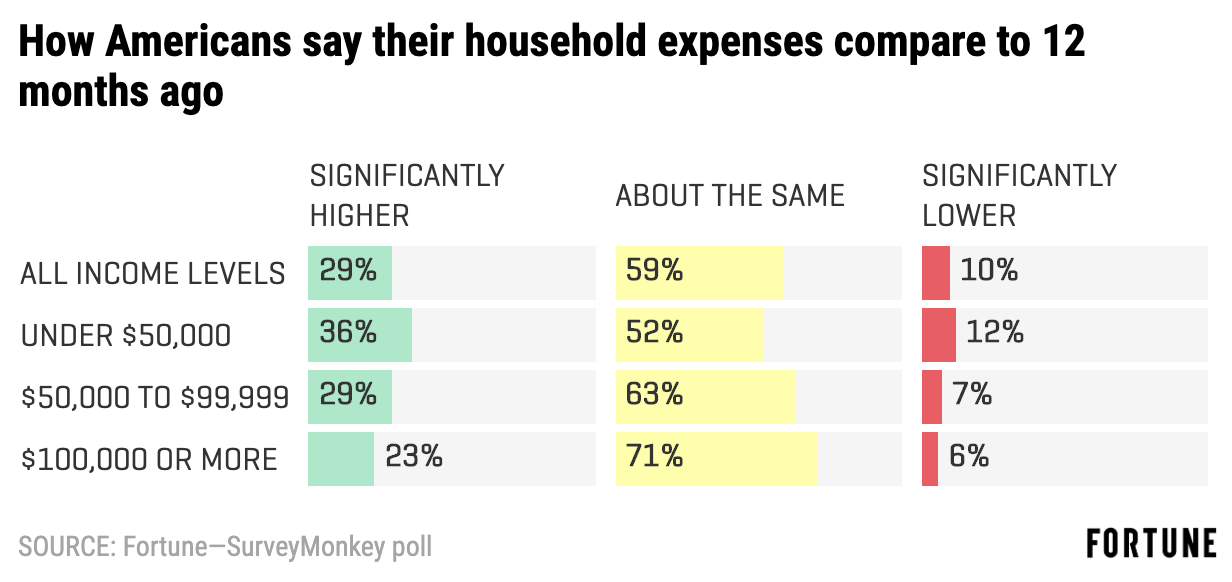

- … of Americans say their spending levels are either up (29%) or flat (59%) compared to 12 months ago. While only 1 in 10 respondents have cut their spending budget year-over-year.

66%

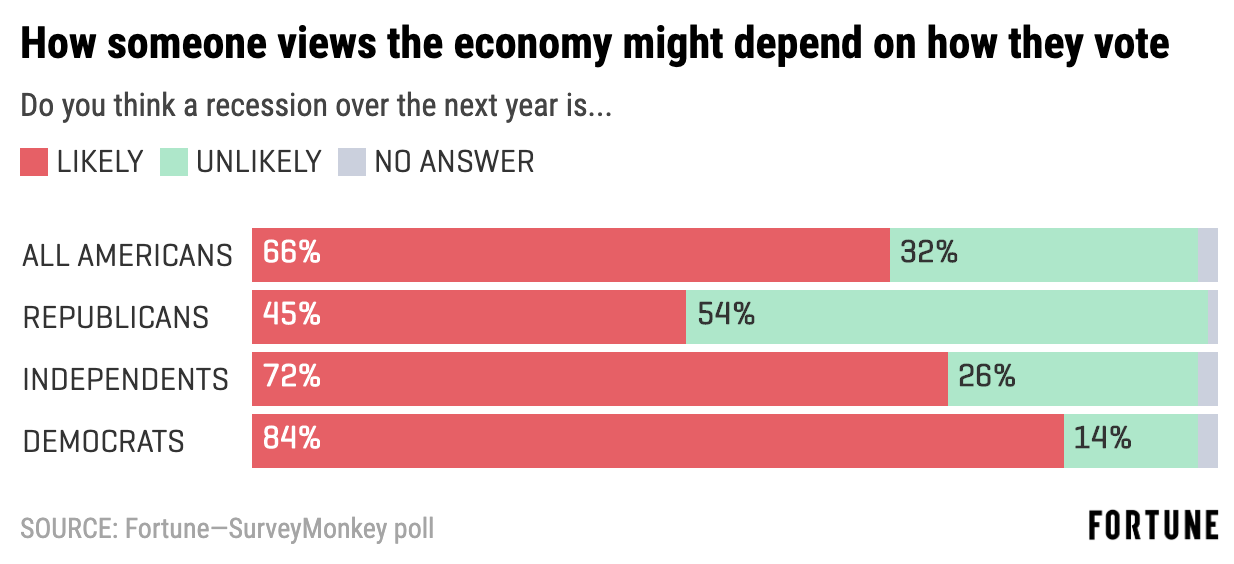

- … of Americans think a recession will occur over the coming 12 months.

45%

- … of Republicans think a recession will occur over the coming 12 months, compared to 84% of Democrats.

Big picture takeaway:

Americans are still throwing down money for the latest gadgets and buying big ticket items, however, their outlook of the economy is souring with the majority foreseeing a 2020 recession. And that growing pessimism is something economic onlookers need to watch.

“If not for consumer spending, we’d be in a recession… Consumer spending accounts for more than all of the growth in the economy. The rest of the economy is contracting,” says Scott Hoyt, head of consumer economic research at Moody’s Analytics.

In the third quarter, U.S. gross domestic product growth slowed to 1.9%, with key components like exports falling 5.7% and private investment down 1.5%. Yet consumer spending rose 2.9%, including a 5.5% jump in spending on goods, according to the U.S. Bureau of Economic Analysis.

Three deep takeaways:

1. Spending is up across the board

Among every demographic—whether it’s race, income, or region—households are more likely to be growing their spending levels than cutting back. And the importance of strong spending figures cannot be overstated: Over the past 50 years, consumer spending has risen from 59.5% of GDP to 68.1% in the latest quarter.

Some concerning responses did come from Americans who work in the agriculture industry, with 18% saying their household spending is lower now than a year ago—that’s the highest figure among the 29 industries we looked at. Perhaps workers in the agriculture business are feeling the impacts of the U.S.-China trade war.

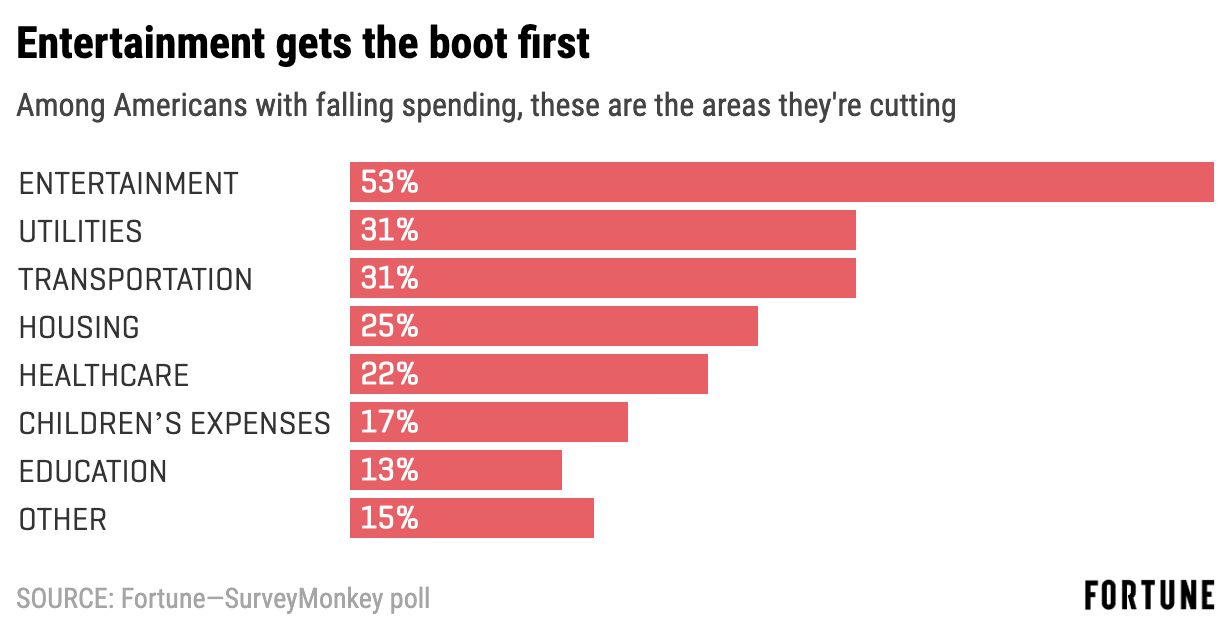

2. Necessities over luxuries

The minority of households (10%) who are actually cutting household spending, are targeting entertainment expenses first. That makes sense: if you have a budget gap you’d likely drop a streaming service or scale back weekend getaways before cutting necessities.

3. The partisan divide

Americans’ economic outlooks are dividend along partisan lines. Around 8 in 10 Democrats/Democratic-leaning voters think a recession is coming in the next 12 months. Meanwhile, a slight majority of Republican/Republican-leaning voters think a recession is unlikely.

One might assume those outlooks would be flipped when considering spending rose in 33% of Democratic households versus 24% in GOP households. So are people viewing the economic outlook with a personal politics lens? The economy is front and center during presidential election years, so obviously a downturn would be bad for an incumbent president and helpful for a challenger.

One interesting number:

35%

- … of Americans say they’ve made changes to their finances to prepare for a downturn.

*Methodology: The Fortune-SurveyMonkey poll was conducted among a national sample of 10,372 adults in the U.S. This survey’s modeled error estimate is plus or minus 3 percentage points. The findings have been weighted for age, race, sex, education, and geography.

More must-read stories from Fortune:

—These are the jobs artificial intelligence will eliminate by 2030

—Why Trump is bad for business

—Can Goldman Sachs CEO David Solomon get the bank to grow again?

—Ford’s Mustang Mach-E is a radical gamble on an electric future

—Give these world-class experiences as gifts this holiday season

Subscribe to Fortune’s Eye on A.I. newsletter, where artificial intelligence meets industry.