With stocks near all time highs, and the Fed signaling that after three rate cuts they’re ready to hit pause (indicating they don’t believe the economy is about to slide into recession) it may be tempting for investors to breathe easy, too.

But while many rely on a few obvious markers of economic health—the yield curve, job creation and GDP—it can pay to look a level deeper for signs of what’s really driving economic growth. Below, we asked market-watchers what metrics they are keeping tabs on. Some are already flashing yellow, some look healthy for now. But be it spending patterns or freight traffic, these little-watched signs could be the clues to when the next downturn hits—and how severe it will be.

Consumer confidence and spending

Consumers—which includes all of us—compose the engine that really drives the economy. While always important, the percentage that personal consumer expenditures represent of GDP has been growing over time. In 1980, it was about 61%. Now it hovers around 68%.

Retail sales had been growing in strength, according to Census Bureau data, but tripped in September, according to preliminary estimates, dropping by about 0.3% to about $525.6 billion. That’s still up 4.1% over September 2018 and a 0.3% drop seems tiny, but it’s potentially significant if the trend continues.

Another useful measure is the Conference Board’s Consumer Confidence Index (index because everything is based on a reference value of 100 for comparison). After a slight drop in August to 134.2, the index dropped another 9.2 points to 125 for September. But the number is subtler than it might seem.

“Confidence can be quite high and we can still have a recession,” says Brad McMillan, chief investment officer at Commonwealth Financial Network. “What’s a much better indicator is year-on-year change. When it drops 20 points year on year, that’s trouble. Two months ago, the year-on-year change was 7.9. [Now] it’s -10.2. It’s dropped 18 points in two months.” If the pace continues, watch out.

Jobs numbers

According to McMillan, although the jobs numbers have continued to show expansion, if that number drops to about 1.5% of the labor market—about 1.8 million jobs a year at the moment—it’s historically been a recession indicator. And we’re just about there. .

“We’re trending down to below the 1.8 million a year,” he says. “Even as the population has grown, the labor market has gotten more efficient over time. A smaller percentage will be moving in and out and labor force participation is down.” Fewer opportunities for people to work means less spending and, therefore, lower stimulus for GDP.

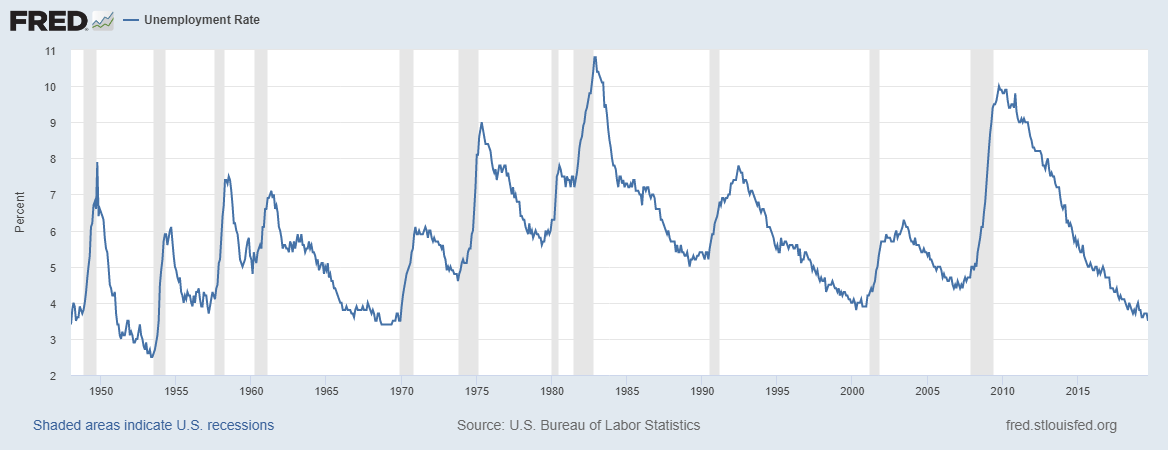

Or, offering a slightly different formulation, Craig Kirsner, president of Stuart Estate Planning Wealth Advisors, says that “every time the unemployment hit low numbers between 3.5% to 4.5% and stayed at that low rate for a while, as soon as that unemployment rate started increasing recession followed shortly thereafter.”

The pattern is actually a little more general than that, according to the graph below from the Federal Reserve Bank of St. Louis. The issue isn’t that 3.5% to 4.5% range, but a relative low that lasts for at least a few quarters. Whenever unemployment begins to rise steadily, it happens during a recession, represented by a gray bar in the graph.

The growth of unemployment is a result of a slowing economy, as companies reduce their work forces in anticipation of and reaction to lower sales.

One more take on jobs comes from Adam Morehouse, a senior economist at Dun & Bradstreet, who says to look at jobs numbers in the goods-producing industries (available at the Bureau of Labor Statistics). “Since 1988, employment in the goods producing industries has typically peaked on average 16.6 months before an official recession has been called,” he says. The good news is that they haven’t yet seen that peak in goods producing employment. But the graph below, also from the St. Louis Fed, shows how the pattern works:

Work hours

While jobs are important, so are the number of hours that people work. “We believe that the total aggregate hours worked is one of the best predictors of a recession,” says Charles Self, chief investment officer at iSectors.

The observation is that the stronger the economy, the more demand there is on businesses and the more hours employees work. When the economy is cooling—a precursor to a recession—the number of hours goes down because there’s less demand and, therefore, less to do.

To be precise, Self referred to the “compounded annual rate of change of indexed aggregate weekly hours of production and nonsupervisory employees” that can be calculated at the St. Louis Fed’s site. A compounded annual growth rate would be the percentage change necessary over a year to arrive, in this case, at the number of jobs given the number 12 months before. Here’s the graph, showing the calculation done monthly:

Positive change (above the horizontal black line) shows that the number of work hours is on the rise over a 12-month window. Below the black line is negative change, meaning there are fewer total hours of work. Notice that the trigger is an extended period where that compounded annual growth rate drops below zero for more than a single quarter in a row.

IPOs

The poor performances of IPOs from Lyft to Uber, and the collapse of the WeWork plan, are an ominous sign to some. When getting close to the end of a business growth cycle, companies rush in to do an IPO while they think the markets still might support them “and investors start cooling on them,” McMillan says. “When you see some high-profile deals roll over and even have to be withdrawn, that says investors are looking at things differently.” When investors get more cautious, businesses often do as well, which can generate the conditions for a recession.

Freight traffic

Even in a digital age, commerce requires the constant movement of goods from one part of the country to another, which usually means travel over land. Trains and trucks move massive amounts of products, parts, and bulk commodities, as Dejan Ilijevski, president at Sabela Capital Markets points out.

“Changes in rail [and truck] traffic data can be a leading indicator for changes in economic activity,” he says. The Association of American Railroads has some free interactive charts that show various weekly cargo data. Overall, 2019 is lagging in overall carloads compared to the previous three years.

Again, not one of these numbers is a definitive sign by itself. But taken together, if enough secret signs take a turn for the worse, you just might have the recipe for a recession.

More must-read stories from Fortune:

—Why active fund managers have ‘stopped yawning and started flexing their muscles’

—Why JPMorgan Chase wants to give more former criminals a second chance

—What handing out full size candy bars on Halloween says about you, according to behavioral economists

—Another wrinkle emerges in the WeWork saga

—As trade with China dries Up, the lobster business is caught between Trump and Canada

Don’t miss the daily Term Sheet, Fortune’s newsletter on deals and dealmakers.