FORTUNE Analytics brings readers business insights from proprietary data and exclusive surveys. It will launch as a premium newsletter in early 2020. Sign up for the debut below:

When firms start cutting back on purchasing and reducing inventory levels, it can be the canary in the coal mine, forewarning economic woes to come.

So at a time of increased recession fears, Fortune-SurveyMonkey conducted a poll of employees who authorize purchasing at companies in every industry and for firms ranging from Fortune 500 giants to mom-and-pops. We wanted to gauge the direction of purchasing levels and economic outlooks. In all, we heard from 1,470 purchasers between September 12-19.*

Here are our top findings:

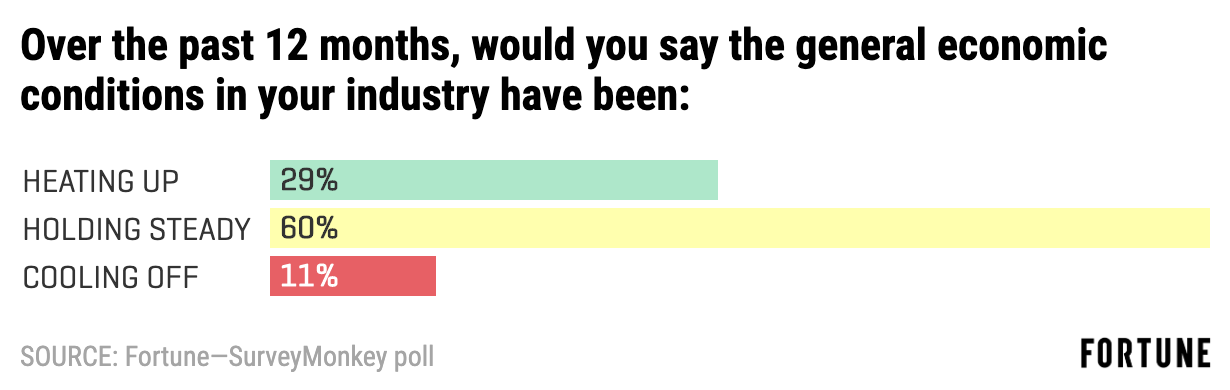

- Over the past 12 months, 29% of purchasers said their industry was heating up, 60% said it was holding steady, and 11% said it was cooling down.

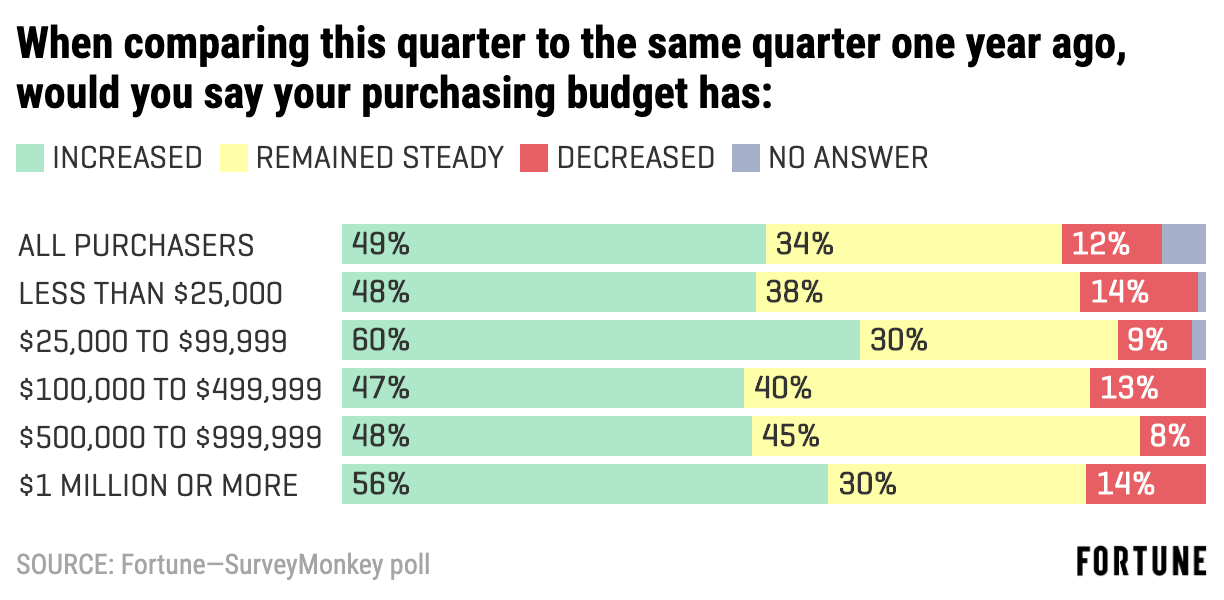

- Just under half of buyers (49%) said the amount spent on purchasing at their firm was up year-over-year in the most recent quarter, edging out those who said it held steady (34%), and purchasers who saw a decrease (11%).

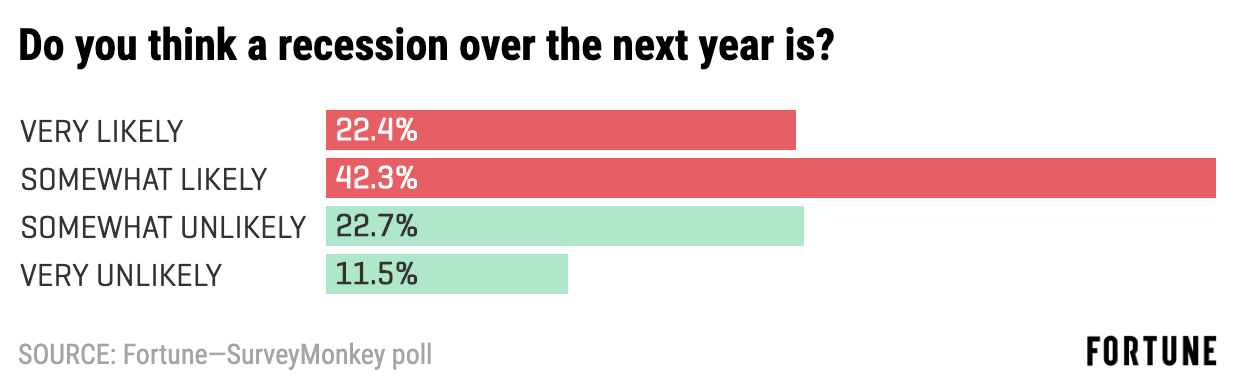

- 2 in 3 purchasers say a recession is likely within the next 12 months.

These purchasers paint a picture of an economy where there are still plenty of firms growing their purchasing budgets, but where headwinds, like tariffs, and uncertainty are growing. Industry leaders told us that during strong economic periods buying is usually up at well over half of firms—something we’re not seeing right now. And something has certainly spooked purchasers, considering two thirds predict a recession within the next 12 months.

“We’re not seeing orders canceled, but we’re seeing them pushed out. ‘We’ll take that in two months.’ It is a tap of the brakes,” says Tom Derry, CEO of the Institute for Supply Management, which puts out the Purchasing Managers Index. Their latest PMI came in at 47.8% in September, its lowest figure since June 2009, and second straight month under 50%—the level at which manufacturing is considered in contraction.

To get an even more detailed reading of purchasing, Fortune conducted detailed interviews with just under a dozen purchasing managers, CEOs, and heads of global supply chains. That’s in addition to the 1,470 purchasers who took our survey.

Jeff Smith worked as a purchasing manager in the mid-2000s for an Idaho manufacturing firm that sold heavy equipment trailers to homebuilders as fast as they could build them. That breakneck pace would slow in 2006, and he watched as more and more unsold trailers covered the lot. Soon homebuilders quit buying altogether. Much of the staff had already been let go by the time Smith was shown the door in October 2007—a full two months before the Great Recession hit.

Now a purchasing manager at Bode North America in South Carolina, Smith knows first-hand how purchasing can forewarn a recession. He is seeing some concerning developments, like buyers pushing back orders and a supplier he worked with shut down without notice, but overall he still feels good about the economy.

The majority of purchasers are still seeing their budgets rise, despite headwinds. But our data couldn’t pin down how much firms are increasing these budgets in aggregate. That’s why SourceDay, a procurement platform for supply chains networks based in Austin, Texas, ran an exclusive analysis for Fortune to measure the total amount spent on purchase orders across more than 15,000 manufacturers and suppliers. Over the first nine months of 2019, those firms saw an aggregate 2.3% increase in purchase orders, compared with the same period a year prior. This uptick is moderate compared to past 5% growth years, but not low enough to be alarming, says SourceDay CEO Tom Kieley.

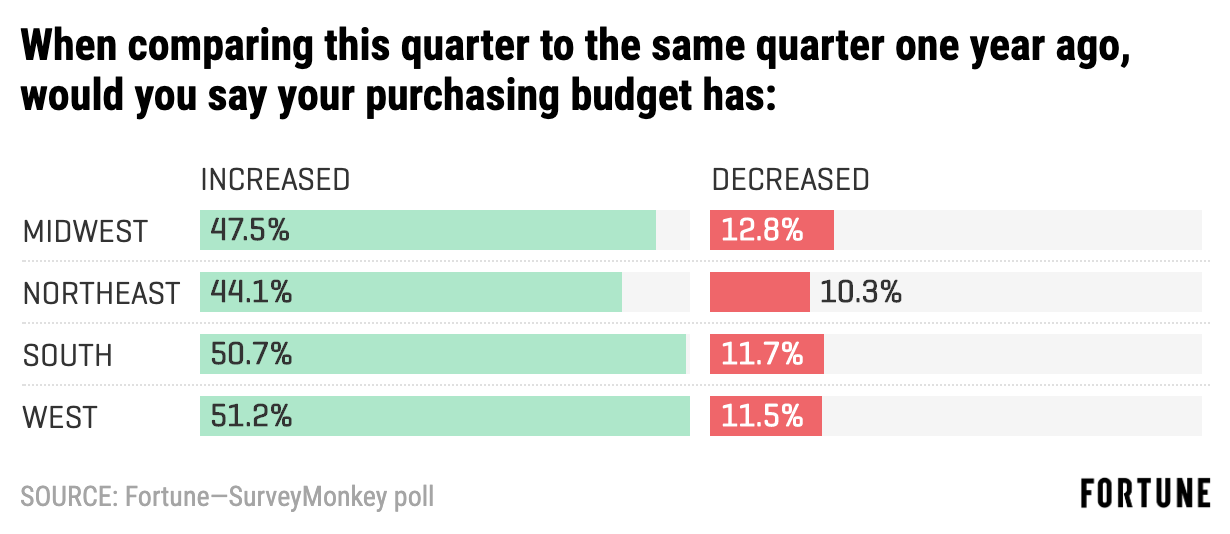

United Auto Workers are actively striking against General Motors, something that is already disrupting supply chains throughout the Midwest, where purchasing growth is already slightly behind levels found in the South and West.

But the biggest purchasing differences aren’t by region. Instead they’re at an industry level or within niche businesses. Among purchasers who work for healthcare and pharmaceuticals firms, 53% saw an increase in buying levels, while only 44% of buyers in the construction industry saw an uptick.

“Our whole industry is in contraction…We’ve shut down three plants. We laid-off 100 workers. And dramatically cut back on investment,” said Gene Gebolys, CEO of World Energy, a Boston-based producer of biodiesel. World Energy cut back on purchasing after recently revised regulations by the U.S. Environmental Protection Agency allowed more firms to bypass biodiesel, he says.

While purchasing levels are up, purchasers are by no means seeing an economic boom. Over the past 12 months, 29% of purchasers said their industry was heating up, 60% said it was holding steady, and 11% said it was cooling down.

And many purchasers told us they’re seeing warning signs of a slipping economy, like orders pushed back or inventories being winded down. That might explain why 65% of purchasers told us they expect a recession in the next year.

“They are on high alert, but not panicked,” said Peter Bolstorff, an executive vice president at the Association for Supply Chain Management in Chicago. Some firms are making decisions that would help them brace for a downturn, like pushing back big-ticket investments, but that hasn’t become widespread, he says.

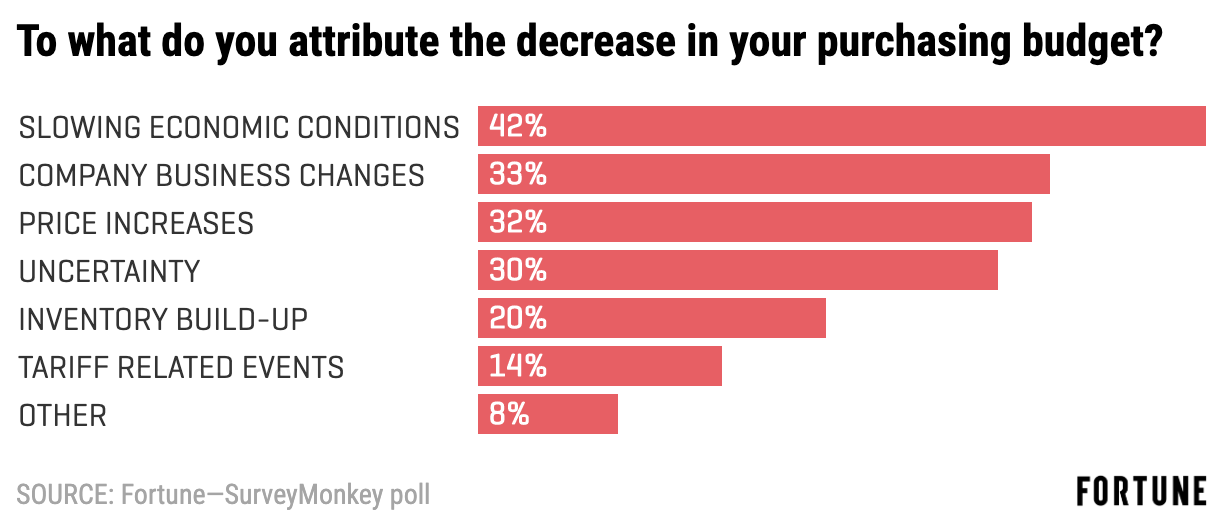

Only around 1 in 10 firms are seeing their purchasing budgets decline. Among this group, 42% cited slowing economic conditions as a contributor; that factor was followed by business change (33%), price increases (32%), and uncertainty (30%).

Meanwhile, just 14% of purchasers cited tariffs as a cause for their decline in purchasing. But that doesn’t mean firms aren’t experiencing the pinch of tariffs. Instead, the firms hardest hit by the tariffs are likely to be spending more on purchasing—not less. That’s because they’re paying the tax or buying goods with higher price tags as a result of the tariffs. And in some cases they’re even stockpiling inventory to lock in prices of goods.

A global supply chain director at a Fortune 100 technology firm, who has asked not to be named, told Fortune the firm is seeing half of the goods it buys getting hit by tariffs. Their purchasing cost are moving up at a time when the company expected them to be flat. To offset this, the firm is pushing some production from China into Southeast Asian countries and refurbishing more components—both moves come at a higher cost.

Purchasers are paying close attention to tariffs resulting from the U.S.-China trade war that are impacting mid-sized firms, corporate titans, and small businesses alike. Vincent Mihalek, a purchasing manager at Libra Industries, an Ohio-based manufacturing firm, says has a spreadsheet that details these tariffs down to the penny, and tries to make sure the firm is absorbing as little cost as possible.

*Methodology: The Fortune-SurveyMonkey online poll was conducted September 12-19 among a national sample of 10,372 adults, including 7,704 who are employed. Of these respondents, 1,470 have jobs that include authorizing purchasing—these are the folks included in the above findings. This survey’s modeled error estimate is plus or minus 3 percentage points. The findings have been weighted for age, race, sex, education, and geography.