Big investors poured $81 million into cryptocurrency products offered by Grayscale Investments in the third quarter of 2018 and $330 million so far this year, according to a new report from the crypto asset manager.

The figures reflect record levels of interest among institutional investors, and come as a piece of good news for the cryptocurrency market, which has been mired in a prolonged price slump since last December.

Grayscale, which is a subsidiary of the crypto conglomerate Digital Currency Group, offers a series of funds dedicated to individual cryptocurrencies, including Bitcoin and XRP. The funds sell the currencies in the form of shares in a trust, and provide a means for institutional investors, many of which are barred from buying cryptocurrency directly, with exposure to the market.

The report suggests that, even as consumer interest in cryptocurrency has waned, demand is stronger than ever from the likes of pension funds and family offices.

The $330 million figure is remarkable given that the total inflow into Grayscale’s products for the first three quarters of 2017 totaled $21 million. In 2016, the comparable figure was $17 million.

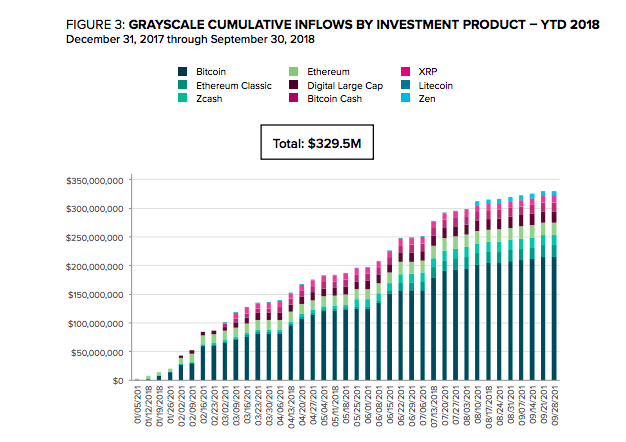

While Grayscale has added new types of cryptocurrency in recent months, including a privacy-focused coin called Zen, Bitcoin remains by far its most popular asset choice, accounting for 73% of total inflows.

Here’s a chart from the report showing cumulative investments:

“These figures are evidence that interest has not dwindled as a result of prices decreasing. What we’ve witnessed is the strongest inflows we’ve ever experienced over 5 years from both existing investors and new investors,” said Michael Sonnenshein, managing director of Grayscale.

Grayscale’s report is consistent with other recent findings, including an investment note this week from Morgan Stanley, which show strong institutional interest in cryptocurrencies:

Still, as MS identifies, the retail market appears to be standing still while institutions wade in pic.twitter.com/x2UsrXhua0

— Frank Chaparro (@fintechfrank) November 1, 2018

Meanwhile, as Fortune reported in September, more than half of trading volume at exchange behemoth Coinbase, which made its name serving retail investors, now comes from professional traders and institutional investors.

All of this suggests that institutional capital could serve as a stabilizing long term force for volatile cryptocurrency markets. According to Sonnenshein, large investors are attracted to the market in part because it provides a means to gain exposure to new protocols and technologies associated with blockchain.