Many investors are giddy that Republicans are poised to pass a once-in-a-generation tax reform bill, and are hiking up stock prices accordingly. But not everyone is happy.

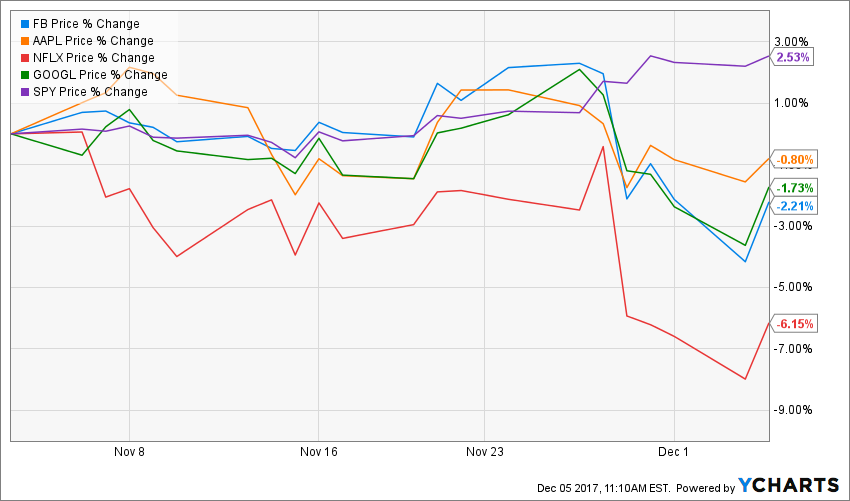

As you can see from the charts below, even as the overall market rises on the prospect tax reform will pass, tech investors are taking a bath.

Here’s how the famous FANG stocks (Facebook, Apple, Netflix and Google) have fared in comparison to the S&P index, which is in purple below. Take particular note of the drop since late November when the Senate clinched a tax deal.

Part of the recent tech stock sell-off may simply be the result of profit-simply after the sector’s bang-up performance this year. But many analysts, including those at Goldman Sachs, believe the drop is due to provisions in the proposed law that will lead tech sectors to pay more tax.

Under the current tax regime, tech firms like Apple have perfected the art of parking intellectual property overseas so they can declare their profits in low-tax jurisdictions like Ireland. Such gimmicks, however, will be less effective under the Senate’s tax proposals, which would force tech companies to pay more on foreign earnings.

The closing of the overseas tax loopholes will be partly offset by the proposed reduction of the U.S. corporate tax rate. But unlike sectors like banking and telecom (see the price of J.P. Morgan and Verizon below), the market is betting tech stocks will emerge as net losers in that trade-off:

Meanwhile, tech stocks tanked anew on Monday in response to what Bloomberg called an “unpleasant surprise“—namely that the Senate tax plan intends to preserve the Alternate Minimum Tax (AMT), which would further limit companies’ ability to reduce their tax bill. But tech shares prices have recovered somewhat on Tuesday, perhaps in response to a fierce pushback by the overall corporate to the inclusion of the AMT.

Get Data Sheet, Fortune’s technology newsletter.

Finally, to underscore the different fortunes the tech sector could face compared to other industries if tech reform passes, here is a look at the performance of two companies that have been especially battered of late—star chip-maker Nvidia and Netflix:

The market’s predictions for the tech sector might not come to pass, of course. The Republicans’ proposed tax legislation still has several hurdles to clear before it becomes law and, if lawmakers can’t get it done by Christmas, all bets are off.