A late winter stock market rally and a series of good reports on the job market have quieted fears about a coming recession. But that doesn’t mean all the economic news is rosy.

Just take a look at the real estate market. We learned this week that new home sales fell in February by 6.1% from a year earlier and that existing home sales fell 7.1% from the previous month.

This is despite the fact that home values remain relatively strong, as evidenced by the Case-Shiller home price index.

With home prices reaching, or even surpassing, their pre-bubble peaks in many markets, weak home-sales numbers are likely not the result of weak demand. Indeed, the U.S. economy has created more than 13 million new jobs since the 2010, and more Americans are forming new households, pushing up the price of housing rents to all time highs.

So what’s wrong with homebuilders?

Economics 101 tells us that homebuilders should respond to higher prices by ramping up production, but as you can see from the chart below, they are moving very slowly:

There are profits to be made from building relatively affordable homes, but America’s homebuilders aren’t constructing them. This suggests there’s a serious supply problem in the American housing market. For years, homebuilders have complained that the cost of building homes is prohibitive due to a lack of labor and land.

Some economists have scoffed at these complaints. After all, with the labor force participation rate at 30-year lows and overall wages stagnant, there’s little evidence of a lack of willing workers, if only you’re willing to pay them enough. But as the home building industry continues to ramp up construction at a snail’s pace, the evidence speaks for itself. If there are profitable building opportunities out there in a competitive market, no capitalist worth his salt will pass it up just because he doesn’t want to give his workers a raise.

On top of that, even liberal economists like Jason Furman, President Obama’s Chairman of the Council of Economic Advisors, has argued that the housing market is being held back by supply constraints, pointing out in a recent speech that land use regulations are holding builders back from constructing homes that average Americans can afford.

It’s Also Really Tough to Get a Mortgage

The lack of new home construction isn’t the only thing holding back the housing market. After all, the fact that Americans are forming new households and paying record high rents shows that many can afford high monthly payments each month for housing. But for some reason, people aren’t willing or able to turn rent checks into equity-building mortgage payments.

According to Laurie Goodman, director of the Housing Finance Policy Center, the reason for this phenomenon is that financiers are simply unwilling to lend to even qualified borrowers:

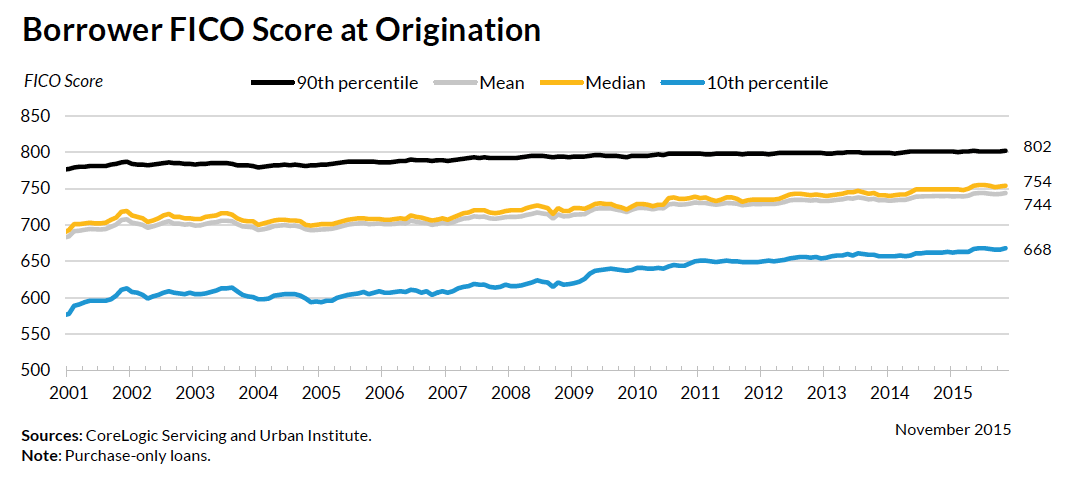

As you can see from the chart above, the lowest 10th of borrowers typically had a FICO score of around 600 before the housing bubble, but the same cohort needs a score of 668 today. “The banks have pulled back from this market. They have all paid multi-million dollar fines, and are afraid of the reputational risk of making lower quality loans,” Goodman says.

After the financial crisis, government-owned Fannie Mae and Freddie Mac were very aggressive in forcing banks to buy back loans with faulty underwriting, even if the mistakes were minor. The Federal Housing Administration and the Fannie Mae and Freddie Macs conservator, the FHFA, have made changes to try to give lenders more certainty over what sort of loans they will keep on their books, but the reform effort is a work in progress.

Blame the Millennials

As with just about any problem in America today, there has been an effort to blame the problems in the housing market on Kids These Days. One common explanation for the weakness of the housing market is that older Millennials can’t afford to buy a home. These folks, who are in now in the prime, first-time buyer age range of one’s late twenties and early thirties, are waiting longer to buy a home than their parents’ generation had. Many analysts assume that high student loan debt has kept home sale figures low.

But recent research from Jason Houle of Dartmouth College and Lawrence Berger of the University of Wisconsin have shown this is not the case. They looked at data from the National Longitudinal Study of Youth’s 1997 cohort and tracked a group of young people through their young adulthood to pinpoint the effects of student debt on homeownership. They found that the average student loan debt—just $15,000—is not high enough to overwhelm the wage premium that college graduates receive or to dissuade banks from lending them enough money to buy a house.

The Millennial generation is taking longer to marry and set down roots, which leads them to wait to buy a home.

The Affordability Crisis

More than there being a division between young and old, the real split in the housing market is between rich and poor. The financial crisis has not only made banks less willing to lend to people with low credit scores, it has also dealt lasting damage to many Americans’ credit and put many American homeowners underwater.

This dynamic, paired with stagnant wages for less wealthy Americans, has gummed up the works in the nation’s more affordable housing markets. Homeowners with cheaper homes are more likely to owe more on their mortgages than their homes, making it difficult for these people to trade up to more expensive homes, as is the case in normally functioning markets.

“America is experiencing a housing shortage. Not only are there fewer homes available to buyers of all income levels, those just starting out or making their first foray into home ownership are worse off than they’ve been in years,” writes Ralph McLaughlin, chief economist at online real estate firm Trulia. “There are fewer homes available, and even if they can find a home, it’s likely to be more expensive.”

All of these factors—supply constraints, tight credit, changing homebuying habits, and income inequality—have conspired to keep the American housing market weak and unable to lead the American economy to higher growth, as it has done in the wake of previous recessions. The height of the real estate credit binge was a decade ago, but it looks like we’ll be suffering from the hangover for many years to come.