Perhaps you’re one of the smart or lucky people whose money works for them. Sadly, I am not. Maybe my money is just lazy or something. But I have to do it the other way around. I have to work for it.

Nobody pays me like a Kardashian just for showing up at the party. Or rewards me with a nice slice of money pie for sitting on my fundament and advising other people which way the weather is going to turn, whether or not I get it right. Or gives me a tumbler of 23-year-old Pappy Van Winkle to sip as I search for micro shifts in global currencies.

No, my fate, it seems, is to rise at dawn, scrape my face, strap on a monkey suit, and go out the door to labor in the mines until the whistle blows and I can drag my tired carcass back to my little pallet to grab a few hours of rest. Then the next day dawns, and I start it all over again. I don’t do it because I love it all the time. I do it because they pay me. That’s why they call it a job, I guess. I don’t mind it, exactly, but I’ll tell you that I certainly do appreciate every dollar I’ve managed to assemble after years of digging that salt. And losing any of it for any reason whatsoever makes me sort of sick to my stomach.

This powerful drive never to see even a centime circle the drain if I can absolutely avoid it is the central artery that pumps lifeblood into my entire investment strategy. That, paired with my conviction that the market is an irrational monster driven at any moment by other people’s greed and fear, has produced certain operating imperatives:

1. Don’t Lose Any @#$% Money.

Like I said. This, for the most part, means bonds. Value goes up or down, but in the end you get your principal back. That means a lot to me.

2. Don’t Invest in Evil.

There are companies that do really lousy things and have a huge negative impact on the world. I don’t want to make money on them. Or worse, lose money on them.

3. Invest in What You Use.

For me, this means diet soda, cheeseburgers, and health care. And Apple (AAPL) and Google (GOOGL). Also, there’s probably a reason unicorns are extinct.

4. Don’t Diversify.

Every supposed market intellectual says to spread out one’s investments across the industrial firmament. Do you know how many people I know who lost a bundle following that BS advice? What a crock! When everything crashes, who loses the most? Idiots who listened to idiots who told them to invest in everything, that’s who. Focus! What were we talking about? Oh, yes …

5. Never Believe That the Market Is Rational.

It isn’t. The market is stupid, for a variety of reasons. Fear makes you stupid. Greed makes you stupid. Most of all, hope makes you stupid.

6. If You Want to Gamble, Go to Vegas.

Have you been? Visit sometime. Stand in the middle of a big casino. Now spend some time wondering how this is different from the investment game. Go ahead. Tell me how.

7. Love Your Money.

Would you risk your dog for a chance of getting a better one? Would you bet your kids in a poker game? Of course not. Then why would you risk your lovely, delicious, hard-won money on some aspirational bushwa?

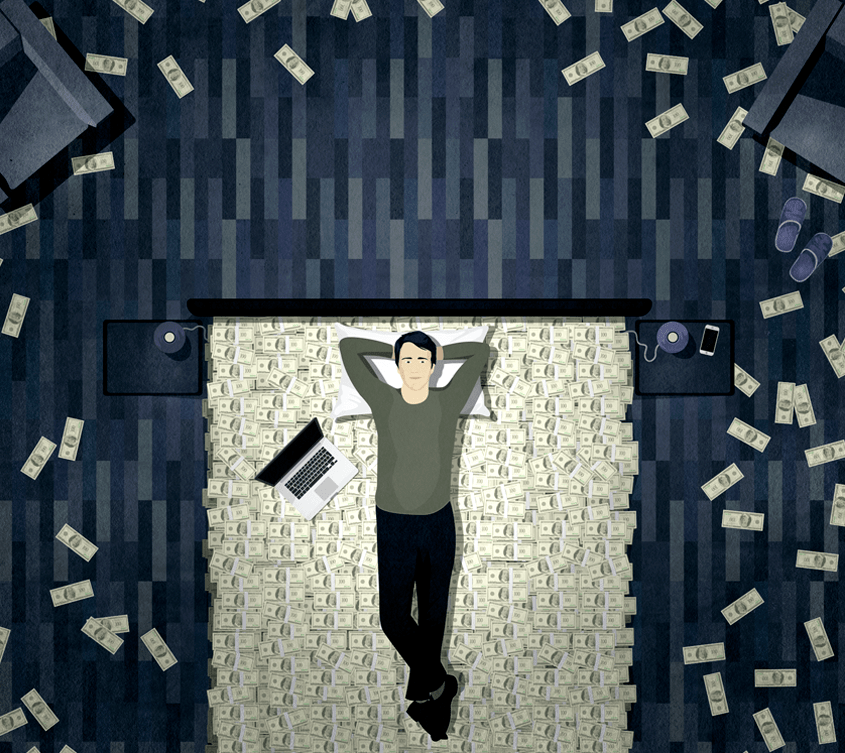

In the end, the best investments never really pay off in anything but peace of mind. That’s why I’m planning to invest in the best possible mattress I can find. It will help me sleep well, firm in the knowledge that I’m resting on the product of my own labor. There’s this handmade model by a Swedish company called Hastens that lists for a mere $49,500. Steep, I know. But man, that’s got to be one fantastic mattress. Think how much cash that baby could hold.

A version of this article appears in the December 15, 2015 issue of Fortune with the headline “Don’t Lose It.”