Happy Monday, especially to those of you who stayed up too late watching last night’s Super Bowl, or lay awake wondering how the 49ers blew an extra point that should have won them the game. Oh well. Fortunately, there are other things to ponder—including a new report about the Federal Reserve wringing its hands about the allegedly existential threat that stablecoins pose to the economy. In a key part of the article, titled “Why stablecoins still worry the Fed,” Bloomberg writes:

Such investments are making regulators nervous. In a September paper, researchers at the Federal Reserve Bank of New York compared stablecoins to money-market funds—noting how in 2008 investors fled funds with larger exposures to Lehman Brothers and asset-backed commercial paper. “Should stablecoins continue to grow and become more interconnected with key financial markets, such as short-term funding markets, they could become a source of financial instability for the broader financial system,” the paper says.

The Bloomberg report goes on to cite a Fed official’s speech to argue stablecoins could undermine consumer protections and quotes academics to suggest the tokens pose a threat to the real economy. Oh, puh-leeze. While there have indeed been some notable crack-ups in the world of stablecoins, comparing them to money-market funds is absurd—the total global market of the former is around $136 billion, while the figure for money-market funds is more like $9 trillion.

And as Bloomberg’s Matt Levine and others have correctly noted, the crypto economy is mostly self-contained, and not deeply integrated into the mainstream of finance. Even if stablecoin giant Tether blows up (which looks highly unlikely right now), the contagion would be mostly contained to crypto and would not contaminate the worlds of banking, insurance, and so on. This could change one day, but it won’t be anytime soon.

Stablecoin skeptics may point to last spring’s Circle debacle, which saw the world’s second-biggest stablecoin briefly depeg after $3 billion of its reserves got stranded during the failure of Silicon Valley Bank. The episode reflected bad luck and poor judgment by the company to leave so much money exposed, but the underlying fault lies with the bank—and with the Fed and other regulators for failing to anticipate the regional bank crisis, which is a key part of their job.

Meanwhile, what the Fed should be really worried about these days is the insane amount of debt the U.S. is piling up. According to new projections from the Congressional Budget Office, the country is set to spend more this year on interest than it is on both Medicare and defense—and the interest outlay is only going to get bigger if the U.S. doesn’t change course. You don’t need to be an economist to see the problem here.

Ironically, the failure of U.S. lawmakers to get the national debt under control is only to going to lead global investors to look for alternative places to park their money—including new types of currency.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

This year’s Super Bowl again featured no crypto ads, or ones from Bitcoin ETFs—a decision that one firm, Kraken, said was made owing to the event’s U.S.-heavy audience. (Cointelegraph)

New crypto projects are rebranding airdrops as loyalty points, but critics say this looks like a regulatory dodge, and are pointing out it’s often unclear what purpose the loyalty points serve. (Bloomberg)

The CIO of Valkyrie Funds predicted that, of the 10 operating Bitcoin ETFs, only seven or eight will remain by end of year. (Decrypt)

The popularity of crypto among young people, many of them priced out of the real estate and stock markets, is driven by a spirit of “intergenerational revenge,” says a Columbia professor. (Fortune)

Bitcoin hit $48,000 amid a seven-day winning run that is the longest in a year. (Bloomberg)

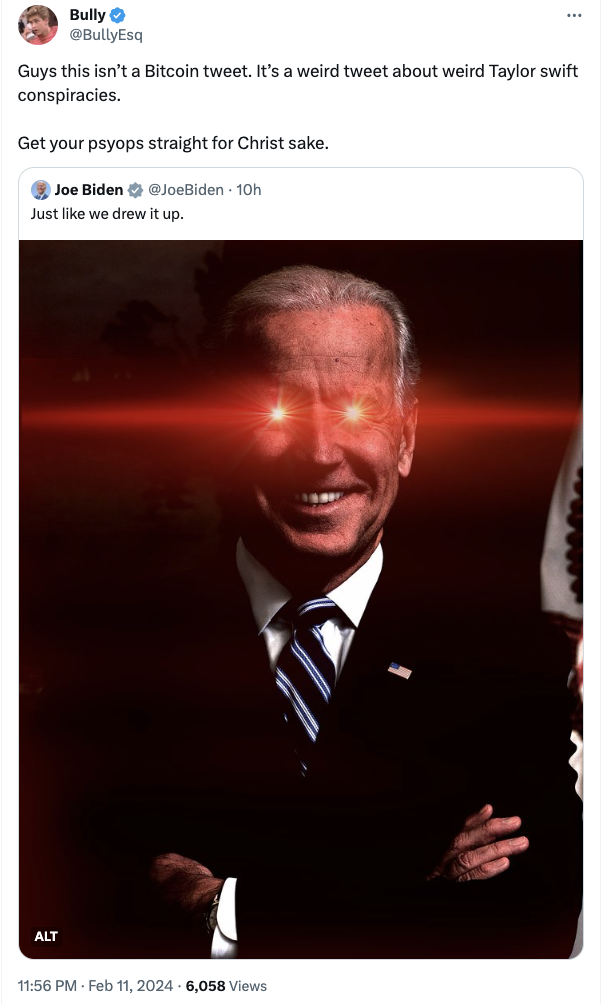

MEME O’ THE MOMENT

Biden social media team trolls MAGA, confuses crypto world:

This is the web version of Fortune Crypto, a daily newsletter on the coins, companies, and people shaping the world of crypto. Sign up for free.