Proof of State is the Wednesday edition of Fortune Crypto where Leo Schwartz delivers insider insights on policy and regulation.

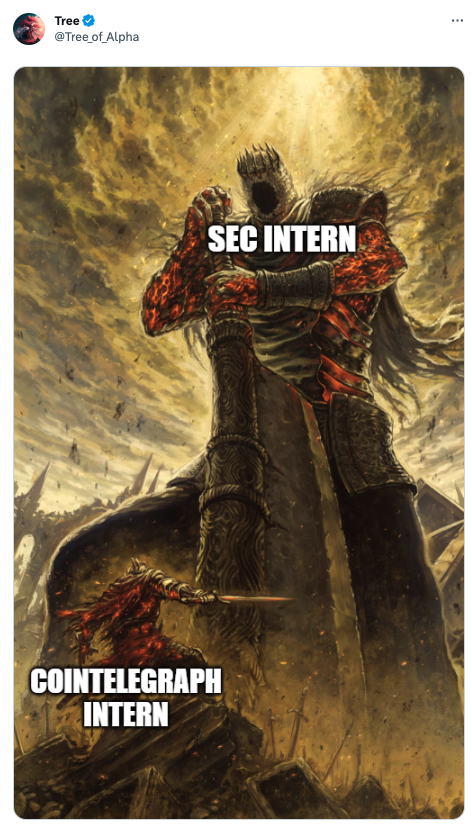

Sometimes I struggle to find a meme to feature at the bottom of this newsletter. Today was not one of those days.

After weeks of frenzied reporting and anticipation, everyone seemed to settle on Wednesday as the finish line for the great Bitcoin ETF scramble, with Gary Gensler’s SEC likely approving some—if not all—of the applications for the long-awaited financial vehicle at the close of markets.

We were all taken by surprise when the SEC Twitter/X account instead posted yesterday at 4:11 pm that it had granted approval for spot Bitcoin ETFs, with gleeful accompanying posts from the biggest accounts on Crypto Twitter announcing that every single application—including the SEC nemesis Grayscale—had been given the green light.

It all seemed too good to be true. In the aftermath, I spoke with one prospective issuer who told me they were immediately dubious. They were expecting to receive word from their listing exchange partner after the SEC moved its 19b-4 from pending to approved, or else they would get a call from SEC staff granting an order of effectiveness on its S-1. It’s the kind of mind-numbing bureaucratic legalese that has permeated this process, but ultimately reflects that its conclusion is unlikely to take place on a social media platform run by Elon Musk. After the SEC had followed all of the correct procedures for months, it just didn’t feel right, the issuer told me. “That was my gut,” they said.

So what happened? The Fortune newsroom looked like a scene out from an Oscar-bait movie about a bygone era, with my editors and myself shouting back and forth across cubicles about whether the Twitter account had been “compromised,” as Gensler’s Twitter account soon announced, or hacked. In other words, did some poor staff member set the wrong day when they scheduled a Tweet, or had someone gotten access to a key governmental social media account?

As the smoke has cleared, the latter seems most likely, although conspiracies will continue to swirl. Around 6:32 pm, an SEC spokesperson emailed reporters that there was “unauthorized access and activity” on its Twitter account, which had been terminated, and that it was working with law enforcement to investigate what happened.

A few hours later, the “Safety” account for Twitter—if there is such a thing anymore—reiterated the assertion, posting that an “unidentified individual” had seized the SEC account by obtaining control over a phone number associated with the account through a third party. It included a cheeky reminder for users to enable two-factor authentication, which the SEC apparently had not done.

As many have pointed out on Twitter, the real upshot of the episode is a pervading sense of irony. For years, the SEC has cited market manipulation as a reason not to approve spot Bitcoin ETFs, which would grant investors the ability to trade the popular cryptocurrency in the form of shares on major exchanges. On the eve of its approval, spurred by the agency losing a landmark court case against Grayscale, the SEC is the one who fell victim to manipulation, with the tweet spurring $90 million in liquidations due to Bitcoin price volatility.

As always, observers will view the scandal as a Rorschach test and retreat to their tribal corners. Crypto critics are claiming this is evidence that crypto is too immature to handle an ETF, while advocates—including prominent lawmakers—are taking the opportunity to escalate their denunciation of Gensler’s SEC.

The only thing we can all agree on is that this is another embarrassing misstep for Gensler in the Bitcoin ETF circus. As Georgetown finance professor James Angel astutely pointed out in Capitol Account, all the SEC has done with its drawn-out process of litigation and approval is to create a marketing cyclone for the financial vehicle, which otherwise could have just been a niche way for investors to gain exposure to Bitcoin. While the agency’s laborious approach, such as working with issuers on the mechanics of cash vs. in-kind creates and redemptions, is no doubt constructive, it has also invited a degree of scrutiny and attention that seems wholly unnecessary.

The latest scandal is just the cherry on top. You can bet that if the SEC finally grants issuers the green light tonight, it won’t be on Twitter.

Leo Schwartz

leo.schwartz@fortune.com

@leomschwartz

DECENTRALIZED NEWS

The once-prolific trading firm Jump has largely retreated from the crypto industry, including sitting out the recent Bitcoin ETF frenzy. (Fortune)

A shadowy advocacy organization is leading crypto lobbying efforts in Washington, D.C., and beyond, although its backers remain unknown. (CNBC)

A relentless crypto promoter named "Bitcoin Rodney," who sold himself as a financial guru to the stars, was taken into custody amid allegations of being involved in an unlicensed money-transmitting business. (Rolling Stone)

The crypto custodian BitGo gained in-principle approval to offer digital payment token services in Singapore as the country continues to attract key players in the industry. (CoinDesk)

A key CFTC advisory committee advanced recommendations on DeFi, urging increased knowledge for policymakers, new regulatory frameworks, and enhanced enforcement. (The Block)

MEME O’ THE MOMENT

This is the web version of Fortune Crypto, a daily newsletter on the coins, companies, and people shaping the world of crypto. Sign up for free.