This is why we can’t have nice things. Just as the crypto industry was finally getting past the fallout from the FTX mega-fraud, a new scandal is brewing—this one involving Huobi, a Seychelles-registered exchange that is one of the world’s largest. Based on what we know, it’s too early to say Huobi is going the way of FTX, but there is reason to worry.

On Friday, investor and crypto watcher Adam Cochran published a series of tweets about a big selloff of the stablecoin Tether, explaining that it has been driven by events at Huobi. According to Cochran, Huobi executives are being questioned by Chinese police, and the exchange is obviously insolvent owing in part to alleged owner Justin Sun using customers’ funds as his own piggy bank. Cochran says this led others, including Binance, to sell off Tether holdings on the exchange.

Huobi and Sun have denied there is anything wrong, but Cochran, who is a credible figure in the crypto world, cites on-chain data to make a damning case against the exchange. He also raises familiar allegations of impropriety against Sun, a Peter Pan–like figure who founded the Tron blockchain and has for years been a behind-the-scenes fixer for numerous murky crypto deals. Sun, who spent millions in 2019 to win a charity auction to dine with Warren Buffett, was recently charged with fraud by the SEC.

To be clear, Sun has never been convicted of any crime, and for now, Huobi is still operating. But there have been massive outflows from the exchange, which holds many of its assets in token projects tied to Sun—a practice reminiscent of FTX, whose balance sheet was loaded with “Sam coins” tied to its crooked founder. It doesn’t look good.

That brings us to Tether, which is by far the biggest stablecoin in crypto and a pillar of the trading world. Like other stablecoins, Tether is supposed to be backed one-to-one by dollars, so its value in theory should not drop below $1. But a week ago, it broke this peg, and on Monday fell further, to 99.7 cents.

This drop is barely a blip in percentage terms, of course, and could simply reflect heavy selling pressure in response to the Huobi events. On the other hand, Tether’s operations are largely unregulated, and the company’s informal accounting practices have long made many people uneasy. While the crypto industry can probably absorb the demise of Huobi, a full-blown run on Tether would be an existential event akin to the FTX disaster.

For now, overall crypto prices are stable, and there is no reason to hit the panic button. But if things unravel, it will be owing to a lack of transparency on the part of major crypto companies, and the industry’s willingness to trust charismatic-but-shifty figures like Sun. The collapse of FTX, which took place nearly a year ago, was supposed to be a bitter lesson that would lead the crypto industry to change its ways. Recent events, though, suggest too many people failed to learn that lesson.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Royalty payments to NFT artists have fallen 98% amid slumping demand and platforms cutting payout rates—a move some feel is shortsighted. (Bloomberg)

Sen. Elizabeth Warren (D-Mass.) is leading a push to pressure the Treasury Department to implement new crypto tax reporting rules—notably forcing brokers to issue 1099s—in time for the 2024 tax year, which seems unlikely. (WSJ)

The price of Curve tokens rose 51% after the hacker who robbed $61 million from the DeFi protocol began to return some of the funds. (CoinDesk)

Coinbase asked a court to dismiss SEC charges against the company, claiming the agency has no jurisdiction since the company does not sell securities. (The Verge)

In a major development for PayPal and the crypto industry, the fintech giant launched a stablecoin. (Fortune)

MEME O’ THE MOMENT

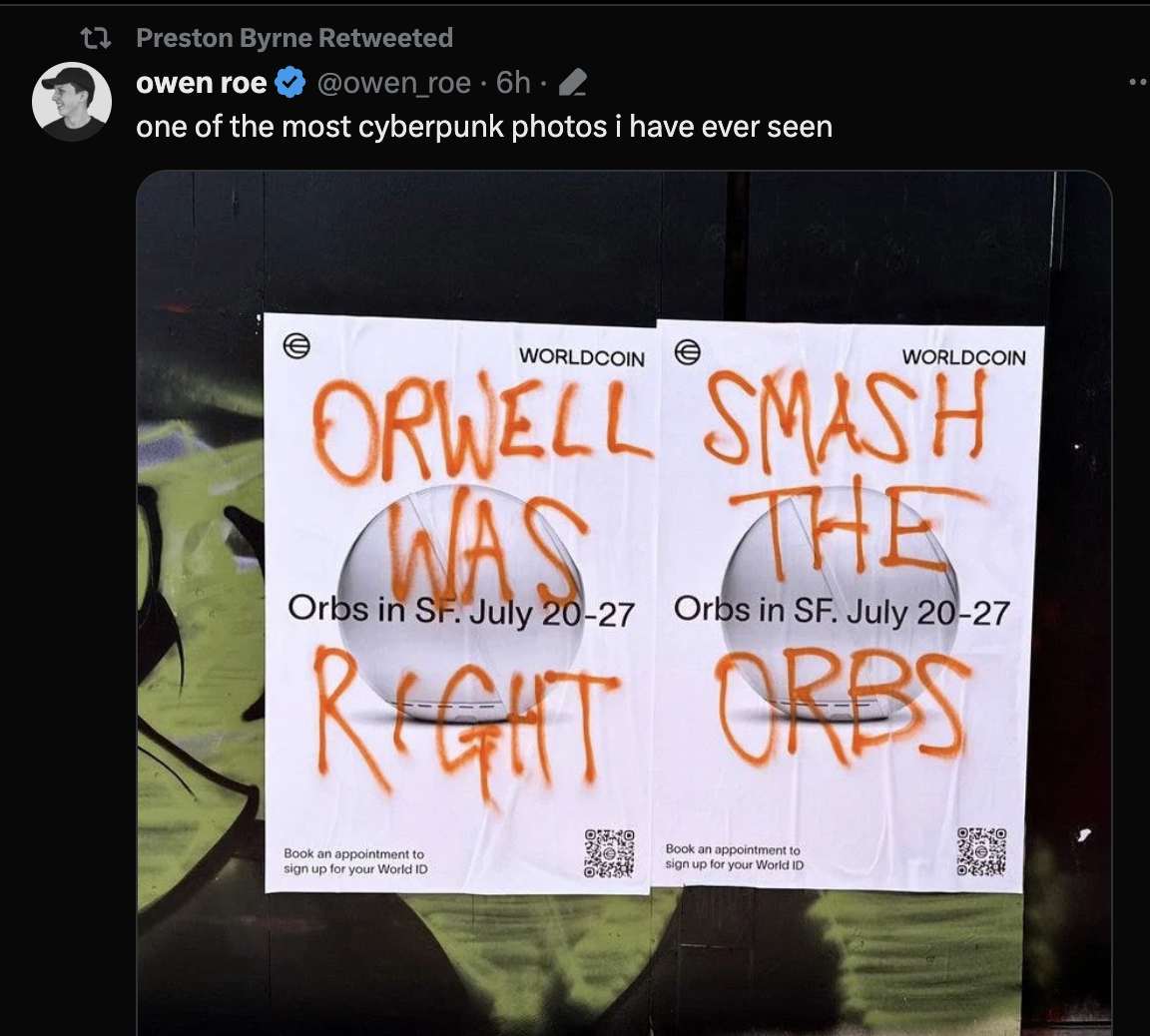

Worldcoin’s latest campaign is going just great:

This is the web version of Fortune Crypto, a daily newsletter. Sign up here to get it delivered free to your inbox.