Politics can make for strange bedfellows, and, according to a popular rumor in crypto circles, one of the stranger alliances involves progressive icon Sen. Elizabeth Warren (D-Mass.) and a short-seller named Marc Cohodes who cashed in on the collapse of Silvergate and Signature banks. Cohodes is very active in Washington, D.C., where he shopped a research memo about the banks to numerous lawmakers and to agencies like the Office of the Comptroller of the Currency.

I’d heard about the rumor from two people in Washington, one of whom shared Cohodes’s memo, and who say Warren’s office used it to inform an aggressive regulatory crackdown on the banks—both of which catered to crypto clients. The allegation here is that the powerful senator is so fixated on an anti-crypto vendetta that she took advice from a short-seller who cashes in when companies fail—the sort of person who, in the eyes of many progressives, epitomizes an amoral Wall Street culture they loathe.

It’s a great story—if it’s true. And the evidence for that is not conclusive. When I called Cohodes, he did not deny that he had been in touch with Warren’s office but said he “talks to all sorts of people” and didn’t provide any specifics. He described himself as “just one guy” who has a track record of exposing fraudulent companies, and, in a later email, called the two banks “Publicly traded Crime Scenes.” Cohodes insists he has no opinion on crypto but only in calling attention to what he says was the banks’ complicity in money laundering. He did confirm he made money from holding short positions in both Signature and Silvergate when the banks collapsed.

As for Warren, a staffer from her office did not deny contact with Cohodes but noted that people send the senator hundreds of emails every day on all sorts of topics and that, in any case, her policy decisions are based entirely on independent research.

Based on this, it’s hard to conclude that Warren and Cohodes are in cahoots—or even that they know each other. But if you want additional circumstantial evidence, you can perhaps find it in this New York Times article in which Cohodes is one of a tiny fraction of Wall Street types supporting Warren’s 2020 presidential run. And you can look at the fact that it’s a former Warren staffer who is behind a controversial class action lawsuit against a DeFi company—suggesting Warren’s team is happy to adopt a wide variety of tactics in its crusade against crypto.

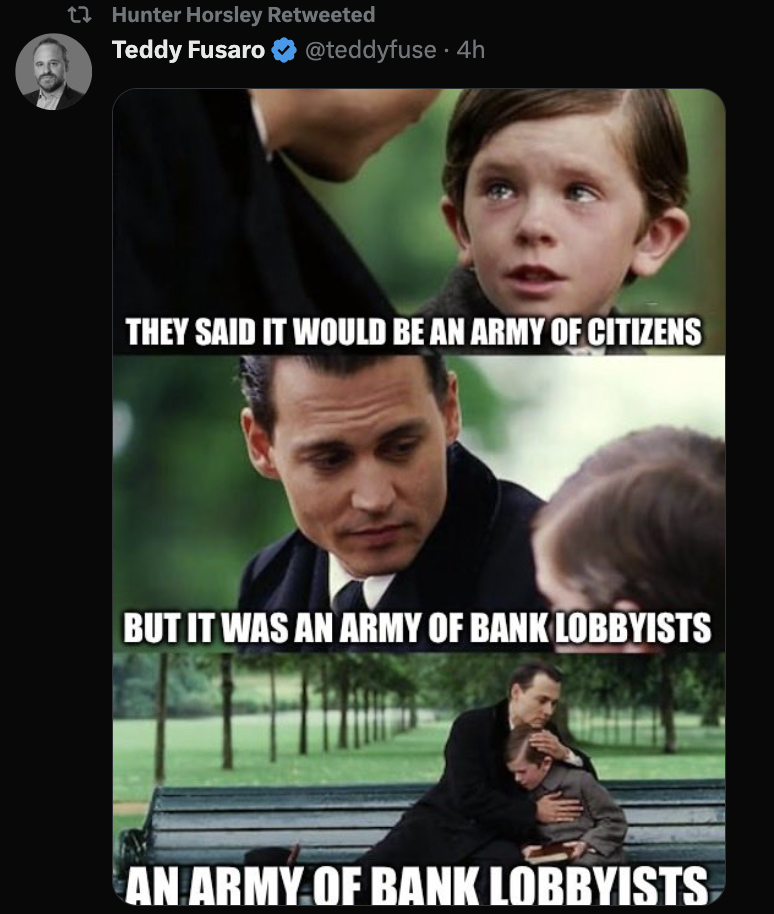

Note also that a Politico headline this week said the senator is “building an anti-crypto army.” It’s not beyond the pale to imagine this army could include a short-seller.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Crypto billionaire Justin Sun has been pursuing a risky strategy to turn around the exchange Huobi by adding clients in China, where crypto is banned. (Bloomberg)

Sam Bankman-Fried pleaded not guilty to five additional charges as prosecutors revealed they have pulled evidence from seven devices belonging to the FTX founder and others. (Fortune)

Block is pushing back against a short-seller’s report that many of its Cash App accounts are fraudulent or unverified by stating the vast majority have been vetted with an identity program. (Reuters)

Circle’s USDC market cap remains down $10 billion in the past two weeks following the brief breaking of its peg at the height of the latest banking crisis. (The Block)

EY’s Paul Brody on how 3D printing and the Internet of Things led him to Ethereum. (Fortune)

MEME O’ THE MOMENT

Here comes the anti-crypto army:

This is the web version of Fortune Crypto, a daily newsletter. Sign up here to get it delivered free to your inbox.