The tech industry’s favorite bank is in full meltdown. On Friday, shares of Silicon Valley Bank (SVB) were in free fall, and trading was halted while the bank scrambled to sell itself after an earlier plan to recapitalize failed to stop customers from fleeing. By afternoon, California officials shut down the bank—and now it’s fair to say regulators have some explaining to do.

For months, banking agencies like the Treasury Department and FDIC have been vilifying the crypto industry as a threat to the U.S. financial system, even as a much bigger problem was growing under their noses. That problem comes in the form of banks’ large holdings of bonds and T-bills purchased during the environment of near-zero interest rates, and that they are now selling at a loss as customers pull their deposits.

This produced a run on SVB and fears that other lenders across the country are in the same predicament. To keep their customers from fleeing, the banks must offer high interest rates on their deposits, which puts a further strain on their bottom line. This situation is what led Silvergate—the crypto industry’s favorite bank—to wind down earlier this week, which some politicians held up as evidence of further bad behavior by the crypto sector. But the demise of Silvergate, which returned all of its customers’ deposits, is a nonevent in light of the fact SVB is 20 times as big, and that other SVB-size banks are on the ropes, too.

This situation has come about because of a policy choice by regulators. Namely, banking agencies have been fixated on a handful of large banks even as the likes of SVB were facing a looming deposit crisis. As Bloomberg notes, “They’ve forced the biggest lenders to hold ever-larger amounts of capital aside—sometimes over the loud complaints of bankers—so that their health would be beyond reproach at moments like this. Smaller lenders by contrast have been handled with ‘a very light-touch approach.’”

If the mess at SVB and other banks spirals further, regulators’ recent fixation on vilifying crypto may come to be seen as a misguided priority. More broadly, these developments may also come to validate the Bitcoin crowd, which has long held that years of printing money amid near-zero interest was a recipe for trouble. I don’t have the macroeconomic expertise to say if that’s correct, but it will be something to consider if more banks start blowing up.

A final note to readers: We value your opinion and would love to learn more about you, and what you like and don’t like about the Fortune Crypto newsletter. Please consider filling out this survey. Happy Friday, everyone.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

The Blockchain Association told Congress that stablecoins must be a top priority when it comes to future crypto legislation. (Fortune)

The New York Attorney General filed a lawsuit against the exchange KuCoin that alleges Ethereum is a security but without explaining why. (Axios)

Binance’s share of the crypto market grew to 61.8% in February despite a wave of regulatory pressure, likely because of the platform’s deep liquidity. (CoinDesk)

The Justice Department is appealing a bankruptcy court’s decision to sign off on Binance’s acquisition of Voyager’s assets. (The Block)

Coinbase’s CEO was roasted on Twitter for posting an all-bro dinner photo on International Women’s Day. (Fortune)

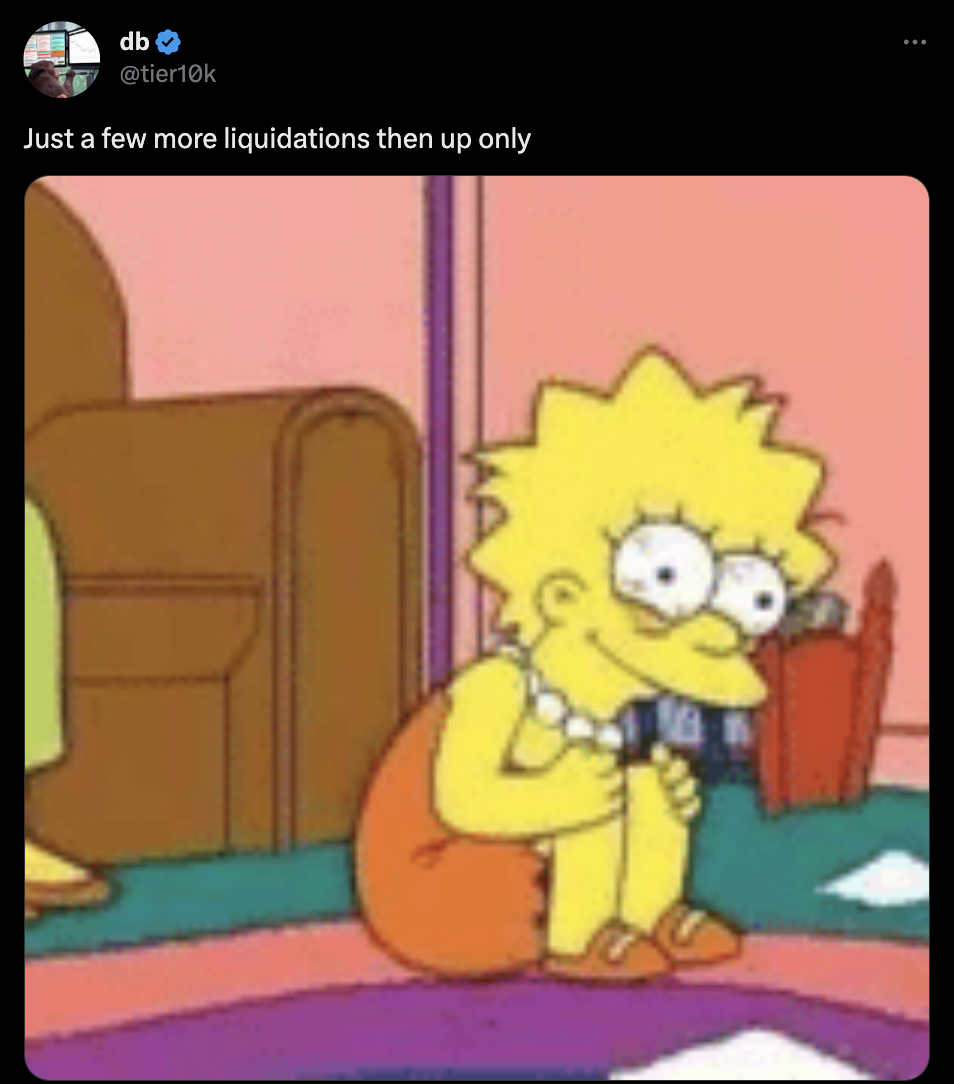

MEME O’ THE MOMENT

This is the web version of Fortune Crypto, a daily newsletter. Sign up here to get it delivered free to your inbox.