The most interesting crypto story line to emerge in 2023 so far is the public spat that’s broken out between Gemini’s Cameron Winklevoss and Digital Currency Group’s Barry Silbert. The two men are billionaires and among the longest-established and best-known figures in the industry who, until recently, appeared to be chummy business allies.

The falling out between Silbert and Winklevoss, who runs Gemini along with his twin brother, Tyler, began in November when trading firm Genesis—one of DCG’s several subsidiaries—stopped issuing redemptions to clients in the wake of FTX’s collapse. That decision left customers on Gemini’s Earn platform, which lets retail customers lend Bitcoin and crypto for up to 8% returns, in the lurch.

The simmering feud boiled over on Jan. 2 when Winklevoss published a blistering letter accusing Silbert of diverting $1.6 billion of Genesis money that should have been used to pay Gemini Earn customers to other parts of DCG’s crypto empire. For his part, Silbert calmly replied on Twitter that DCG did not borrow that sum from Genesis and that DCG was current on all interest payments; he suggested DCG would honor the next payment due in May of this year.

So who’s right? It’s complicated, as they say, but for now, neither party is looking especially good. As noted by crypto Twitter commentators who happily piled onto the spat, the optics of close ties between DCG’s various subsidiaries do not look great—though for now there is no evidence Silbert did anything illegal. (If you want a good overview of how the money sloshes around the parts of the DCG empire, check out this Financial Times piece from November.)

Meanwhile, others have pointed out that it was reckless of Winklevoss to encourage customers to lend their money to Genesis, which has been in trouble since it got burned by the collapse of hedge fund Three Arrows Capital last spring. These critics contend that no one forced Gemini to offer 8% yields, which can only be honored by making risky bets.

But even if both men share blame for the current mess, the standoff has to end somehow. Winklevoss appears to be gambling that his media campaign, including its spotlight on the intertwined aspects of DCG’s businesses, will pressure Silbert to buckle and pay Earn customers. This could be a miscalculation. Genesis, which is in the process of restructuring, is unlikely to blow a hole in its balance sheet right now by issuing redemptions. And Silbert, who can afford very good corporate lawyers, likely took care to ensure the transactions between DCG and Genesis—whatever the optics—are within the letter of the law.

In the longer term, the bigger risk for Winklevoss may not be angry Earn customers—though he’s already facing a class-action suit from them—but irrelevance. Gemini, despite its long history, has long been an also-ran in the world of U.S. crypto, and if Earn blows up, it will matter even less.

Meanwhile, the biggest worry for both Silbert and Winklevoss is emboldened regulators who are swarming the crypto industry and likely probing both Gemini and DCG already. Given this situation, the smart play for both parties would be to shut up and work this out behind the scenes rather than providing even more bad press for the troubled crypto industry.

Jeff John Roberts

jeff.roberts@fortune.com

@jeffjohnroberts

DECENTRALIZED NEWS

Shares of Silvergate plunged after the crypto bank revealed it had to sell assets at a steep discount—losing $780 million in the process—to help cover more than $8.1 billion in withdrawals amid the recent crisis. (WSJ)

In the months before its implosion, FTX planned a big push to offer crypto-based IRA products, a development that would likely have made the contagion from its collapse much worse. (Bloomberg)

New York State’s financial services overseer, which one observer describes as “the apex predator” of crypto regulators, fined Coinbase for a lack of rigor in its application of know-your-customer laws. (Fortune)

The U.S. government has mostly seized 56 million shares of Robinhood from FTX, claiming they are not part of the bankruptcy estate. (WSJ)

Inflows into crypto asset funds like Grayscale and Coinshares plummeted 95% in 2022 to $433 million. (The Block)

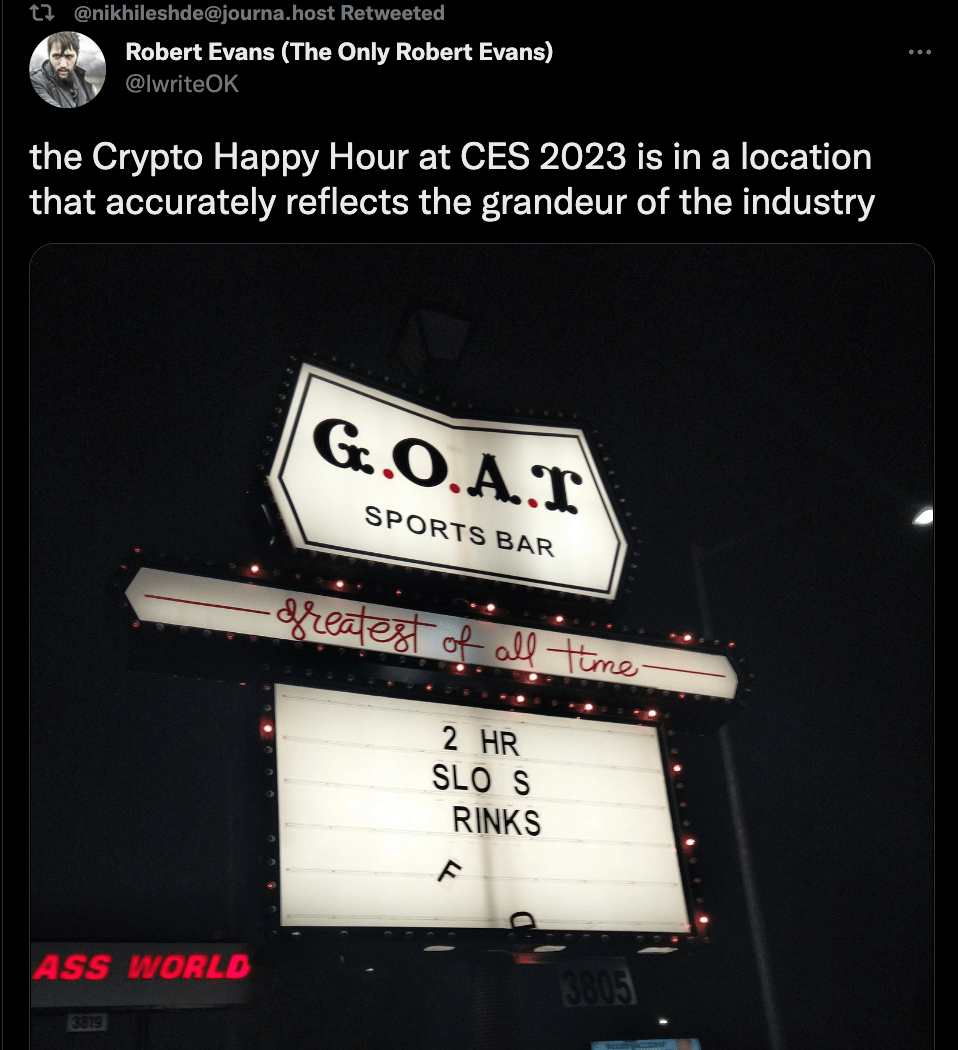

MEME O’ THE MOMENT

This is the web version of Fortune Crypto, a daily newsletter. Sign up here to get it delivered free to your inbox.