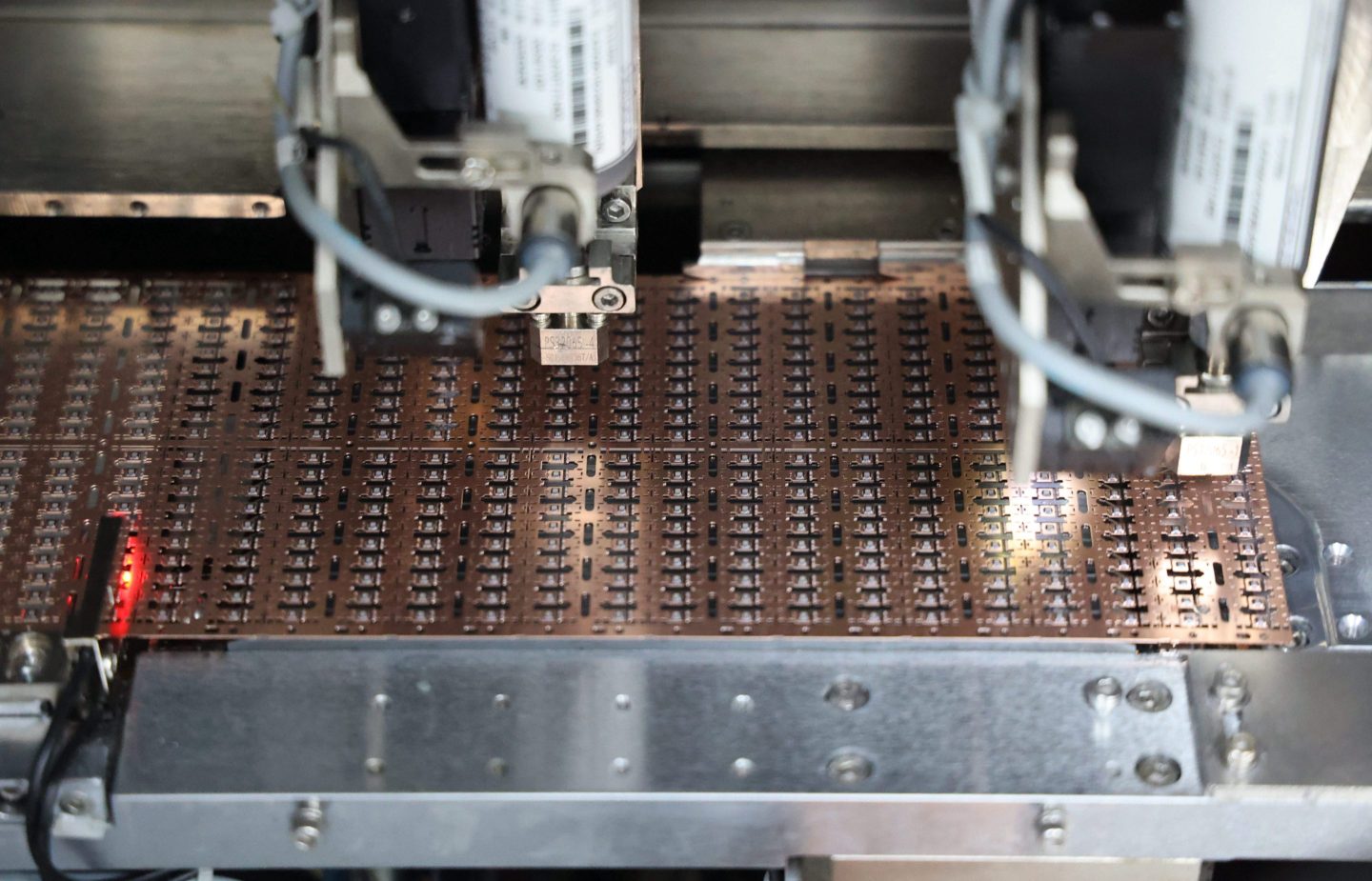

China hopes it’s found its leverage in the tech war with Washington. The country holds a dominant position in the processing of critical minerals like gallium and lithium. Chinese companies like battery giant CATL have also emerged as key suppliers to automakers around the world.

Now, Beijing may be leaning into that dominance to respond to U.S. moves denying access to semiconductors and other advanced technologies.

On Thursday, China’s Ministry of Commerce proposed new restrictions on exports of technology used to make battery cathodes, as well as those used to process gallium and lithium, key minerals used for electronics and electric vehicles. One proposed restriction concerns lithium iron phosphate batteries, which are used in several EV models including those from Tesla and BYD.

The Commerce Ministry is now seeking public comment on the new rules until Feb. 1, according to state news agency Xinhua.

If these rules are implemented, they would just be the latest in a series of Chinese export restrictions targeting critical minerals and the technologies to process them. Last month, Beijing banned the export of gallium, germanium, and antimony, key metals used in chipmaking, to the U.S. after the U.S. Commerce Department subjected more Chinese companies to export controls.

The U.S. and China blacklists

On Thursday, China also announced it would limit exports of “dual-use” items to 28 U.S. firms, including General Dynamics, Lockheed Martin, and Boeing Defense, Space & Security.

It also added 10 U.S. companies to its “unreliable entities” list, which bars them from doing business in China. Beijing cited arms sales to the island of Taiwan as its reason for the designation.

Nominations are now open:

Fortune is now accepting nominations for the 2025 Southeast Asia 500—the definitive ranking of the region’s largest companies. Start your nomination here.

These blacklists are part of Beijing’s broader response to U.S. efforts to constrain exports to China’s tech sector.

The U.S. first stepped up its restrictions on China’s tech sector under the Trump administration when it put companies like Huawei and Semiconductor Manufacturing International Corp. on its trade blacklist.

The Biden administration later upped the ante and introduced export control measures in October 2022 that curbed the sale of advanced chips or chipmaking equipment to China without permission. The Biden administration tightened those restrictions in October 2023 and once again in December 2024.

Even as Asia-based companies like TSMC and Samsung control much of advanced chipmaking, U.S. companies still play a pivotal role in the production process. For example, Nvidia is involved in chip design, while Applied Materials provides equipment and services for chipmakers.

The U.S. is also using other measures, like a ban on U.S. investment into China’s tech sector and import bans on Chinese products, to put pressure on China’s tech sector. On Thursday, the Biden administration said it was considering a new rule that will control sales of Chinese-made drones in the U.S.

Beijing is now trying to adopt these tactics for itself. The “unreliable entities” list was first released in 2020, following the Trump administration’s blacklisting of Huawei. Then, in November, Beijing introduced rules that would allow it to control exports of “dual-use” technologies, or those that could be used for military purposes, to designated companies.

Still, Thursday’s blacklisting is unlikely to have much of an effect on the companies named. The U.S. firms on both lists are primarily defense contractors, with minimal exposure to the Chinese market.