- In today’s CEO Daily: Diane Brady revisits her interview with Venezuela’s opposition leader

- The big story: Foreign investors circle Venezuela’s vast oil reserves.

- The markets: Mostly up, with big gains in Asia.

- Plus: All the news and watercooler chat from Fortune.

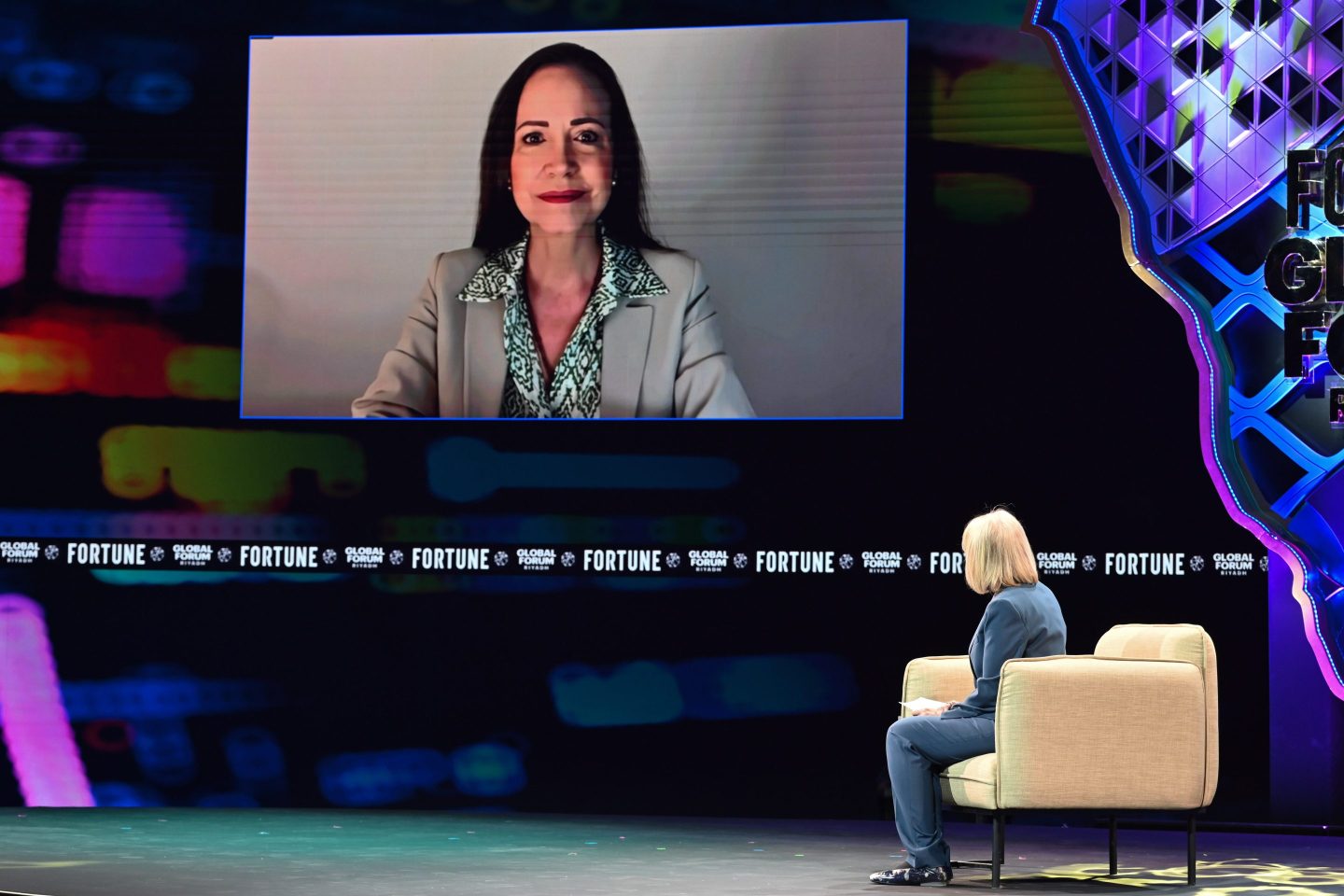

Good morning. A little over two months ago, I interviewed Venezuelan opposition leader and 2025 Nobel Peace Prize winner Mariá Corina Machado at the Fortune Global Forum. She spoke to us from an undisclosed location, later escaped to Norway, and remains in hiding. One of the most prominent advocates for reform in a country that was praised as a stable and affluent democracy just a generation ago, Machado was blocked from running for president in Venezuela’s 2024 election. Edmundo González ran in her place and won, according to independent observers.

With Donald Trump’s surprise invasion of Venezuela to arrest President Nicolás Maduro and his wife on drug trafficking charges, many might have assumed that Machado would be chosen to lead. Instead, Trump picked Maduro’s deputy, Delcy Rodríguez, saying Machado lacked the respect needed.

Of course, much can change in the coming days. Rodríguez described Trump’s move as a criminal military intervention that violated international law while Machado thanked the U.S. for its action in a letter posted on X. But anyone who leads Venezuela right now faces a Faustian choice, as Trump has said the U.S. will temporarily “run” the country and boasted that Americans are “going to be taking a tremendous amount of wealth out of the ground” from the country’s vast oil reserves.

Rodríguez refuses to accept any violation of national sovereignty, despite Trump’s threats, and Machado won’t, either. The Nobel Prize winner said as much in her letter and was clearly hesitant to endorse the administration’s methods when we spoke in October. At that time, the U.S. was deploying war ships to the Caribbean and had blown up ten Venezuelan boats because of suspected drug trafficking. When I asked her if it was right for the U.S. to take such unilateral action, she deflected to accusing Maduro of criminal actions. While Machado welcomes U.S. support—“Maduro started the war; President Trump is ending the war”—she made it clear that Venezuelans could handle it from here.

“We are ready to take over; we know what we need to do,” she told me back in October, predicting a $1.7 trillion opportunity for foreign investors. “Venezuela will be the single biggest economic opportunity for decades to come in this region.” You can watch the full interview here. And be sure to check out Jeff Sonnenfeld’s memo to CEOs on the aftermath of U.S. action in Venezuela.

Contact CEO Daily via Diane Brady at diane.brady@fortune.com

Top news

Opportunity in Venezuela

Foreign investors are already circling Venezuela as the regime change promises to unlock business opportunities in the country. A former Chevron executive is raising $2 billion for Venezuelan oil projects while a group of American investors is planning to visit Venezuela in March. At the same time, the U.S. oil majors with enough resources and expertise to tap Venezuela’s proven oil reserves—the world’s largest—were reportedly blindsided by the Trump administration’s action, plus it’s unclear if the world has an appetite for more oil.

How to ‘run’ Venezuela

The urgent question following the U.S.’s ouster of Maduro is how the U.S. will “run” Venezuela, as Trump has promised to do. Trump suggested Sunday night that the U.S. has direct control of the country, while Secretary of State Marco Rubio has said the U.S. will coerce Venezuela’s new leadership to get what it wants.

Bitcoin surges

Bitcoin hit a three-week high of just over $93,000 Monday following the U.S.’s arrest of Maduro. Investors seem to be regarding the top cryptocurrency as a safe haven amid geopolitical turmoil. Bitcoin ended 2025 down 6.5%.

Is Greenland next?

The U.S.’s intervention in Venezuela is heightening tensions between Denmark and Washington as Trump and his allies suggest that they’re eyeing Greenland, a Danish territory, next. “We do need Greenland,” Trump said Sunday. Danish Prime Minister Mette Frederiksen has demanded that Trump stop his “threats against a historically close ally.”

The risk of ‘fiscal dominance’

Former Fed Chair Janet Yellen is warning that preconditions for “fiscal dominance”—in which the Federal Reserve maintains low interest rates to minimize debt servicing costs, rather than control inflation, due to the size of the federal debt—“are clearly strengthening.” If Trump succeeds in convincing the Fed to keep rates low for that reason, the U.S. could become a “banana republic,” Yellen says.

College matters again

As white collar hiring slows and companies dismantle DEI mandates, corporate recruiters are once again relying on university credentials as a way to screen potential candidates, favoring elite institutions. A survey of employers found that a quarter are now hiring from a shortlist of schools, up from 17% in 2022.

BYD overtakes Tesla

China’s BYD is now the world’s largest seller of fully-electric vehicles after beating Tesla’s sales in 2025. BYD sold about 2.26 million battery-electric cars last year, nearly 28% more than in 2024, even as its overall auto business recorded its slowest annual growth in several years. Tesla, by contrast, has logged its second consecutive year of declining vehicle sales.

Another shutdown deadline

The U.S. Congress is back in session this week as the deadline for the next government shutdown looms less than four weeks away, though both Senate Minority Leader Chuck Schumer and Senate Majority Leader John Thune indicated over the holidays that another funding stalemate is unlikely.

The markets

S&P 500 futures were up 0.27% this morning. The last session closed up 0.19%. STOXX Europe 600 was up 0.36% in early trading. The U.K.’s FTSE 100 was up 0.13% in early trading. Japan’s Nikkei 225 was up 2.97%. China’s CSI 300 was up 1.90%. The South Korea KOSPI was up 3.43%. India’s NIFTY 50 was down 0.3%. Bitcoin was at $93K.

Around the watercooler

Behind glam luxury brands Michael Kors and Jimmy Choo lurks a troubled holding company losing millions by Amanda Gerut

Michael Saylor’s Strategy flirts again with the danger threshold at which his company is worth less than his Bitcoin by Jim Edwards

Even top CEOs check their phones first thing in the morning—these are the apps business executives are reaching for by Emma Burleigh

CEO of $90 billion Waste Management hauled trash and went to 1 a.m. safety briefings—‘It’s not always just dollars and cents’ by Amanda Gerut

Bosses are fighting a new battle in the RTO wars: It’s not about where you work, but when you work by Nick Lichtenberg

CEO Daily is compiled and edited by Joey Abrams, Claire Zillman and Lee Clifford.