The S&P 500 closed down 1.16% yesterday, marking four straight losing sessions for the index, which is now off 2.6%% from the all-time high it hit on Dec. 11. The decline was led, as usual, by technology stocks. Oracle was down 5.4% and its AI data center rival CoreWeave lost more than 7%.

Two things pummeled the tech sector:

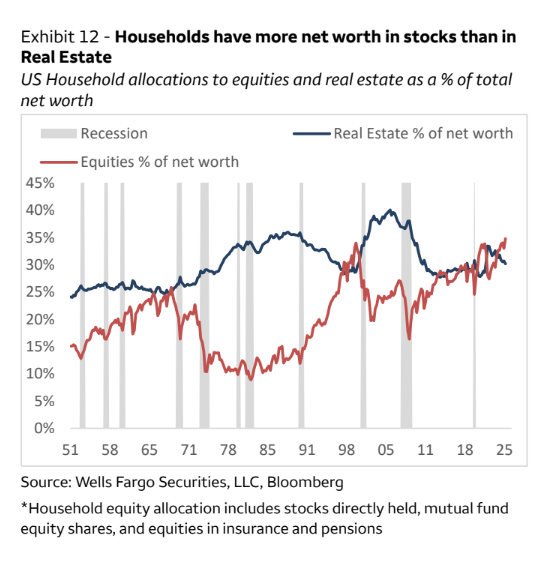

First, “Big Short” investor Michael Burry published a chart from Wells Fargo on X showing that stocks now composed a greater portion of U.S. household wealth than real estate. That has happened only twice before in history, once in the 1960s and then again immediately before the dot com crash of 2000. “The last two times the ensuing bear market lasted years,” Burry said.

“Reasons for this are many but certainly include the gamification of stock trading, the nation’s gambling problem due to its own gamification, and a new ‘AI’ paradigm backed by trillions [of dollars] of ongoing planned capital investment backed by our richest companies and the political establishment. What could go wrong?” Burry argued.

Of course, Burry has a conflict of interest in the form of a $1.1 billion short bet against AI stocks Palantir and Nvidia. So take his doom-mongering with a pinch of salt.

Second, Oracle failed to close a deal for $10 billion in debt-based funding from Blue Owl Capital for a new AI data center in Michigan, according to the Financial Times. The company admitted it would not partner with Blue Owl but told the FT it was pressing ahead with the plan on schedule.

Wall Street is increasingly unimpressed with Oracle’s debt. “With over $100 billion in outstanding debt, investors continue to grow more concerned about the company’s borrowing to fund its AI ambitions,” Bespoke Investment Group told clients in an email this morning.

Jim Reid and his colleagues at Deutsche Bank noted that the spread on Oracle’s credit default swaps—the yield premium that investors demand for the risk of buying them—which was already notably wider than comparable companies, got even wider.

“That FT report … heightened concerns around a potential AI bubble, and meant that Oracle’s five-year credit default swaps climbed to 156 basis points, their highest since the GFC [Great Financial Crisis],” they said. “So tech stocks led yesterday’s declines, with the [Magnificent Seven tech stocks] (-2.12%) having its worst day in over a month, led by a -3.81% slump for Nvidia.”

The net new supply of AI-related debt from all tech companies doubled this year to $200 billion, according to research by Goldman Sachs, and now accounts for 30% of all corporate debt issuance.

KKR published its 2026 “outlook” yesterday and it was notably sceptical about AI data center construction. In a section titled “Speculative Data Center Projects with Uncompetitive Cost Structures,” the private equity company wrote: “We see some excess exuberance in data centers … estimates point to almost $7 trillion in global data center infrastructure capital expenditures by 2030, an amount roughly equal to the combined GDP of Japan and Germany. As always, unit economics are key. Developers who focus on return on invested capital after power, capital and maintenance capex costs will do well, while those who focus on theoretical total addressable markets and lose sight of unit economics are likely to suffer.”

Economist Ed Yardeni told clients that “The Mag-7 may be undergoing a correction.”

“In recent weeks, investors have started to fret that the spending is depleting the Mag-7s’ cash flows and slowing profits growth. Before AI, the Mag-7 had lots of cash flow because their spending on labor and capital was relatively low. That changed once AI forced them to spend much more on both,” he said.

“We aren’t ruling out a Santa Claus rally over the remainder of the year. However, that is unlikely to happen if the S&P 500 continues to rotate away from the Magnificent-7 toward the Impressive-493, as we expect.”

The “the Impressive-493” is a reference to all the other stocks in the S&P 500 outside the Magnificent Seven which have done pretty well this year.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were up 0.39% this morning. The last session closed down 1.16%.

- STOXX Europe 600 was up 0.21% in early trading.

- The U.K.’s FTSE 100 was up 0.29% in early trading.

- Japan’s Nikkei 225 was down 1.03%.

- China’s CSI 300 was down 0.59%.

- The South Korea KOSPI was down 1.53%.

- India’s NIFTY 50 was flat.

- Bitcoin was at $87K.