Jared Kushner’s Affinity Partners is exiting the takeover battle for Warner Bros. Discovery Inc. in a political and financial blow to a foundering hostile takeover bid for the fabled studio.

The private equity firm withdrew its backing of Paramount Skydance Corp.’s proposal to buy Warner Bros., which the studio plans to reject.

Paramount is seeking to scupper Netflix Inc.’s $82.7 billion deal for Warner Bros. in a bidding war that stands to reshape the entertainment industry, whichever company wins.

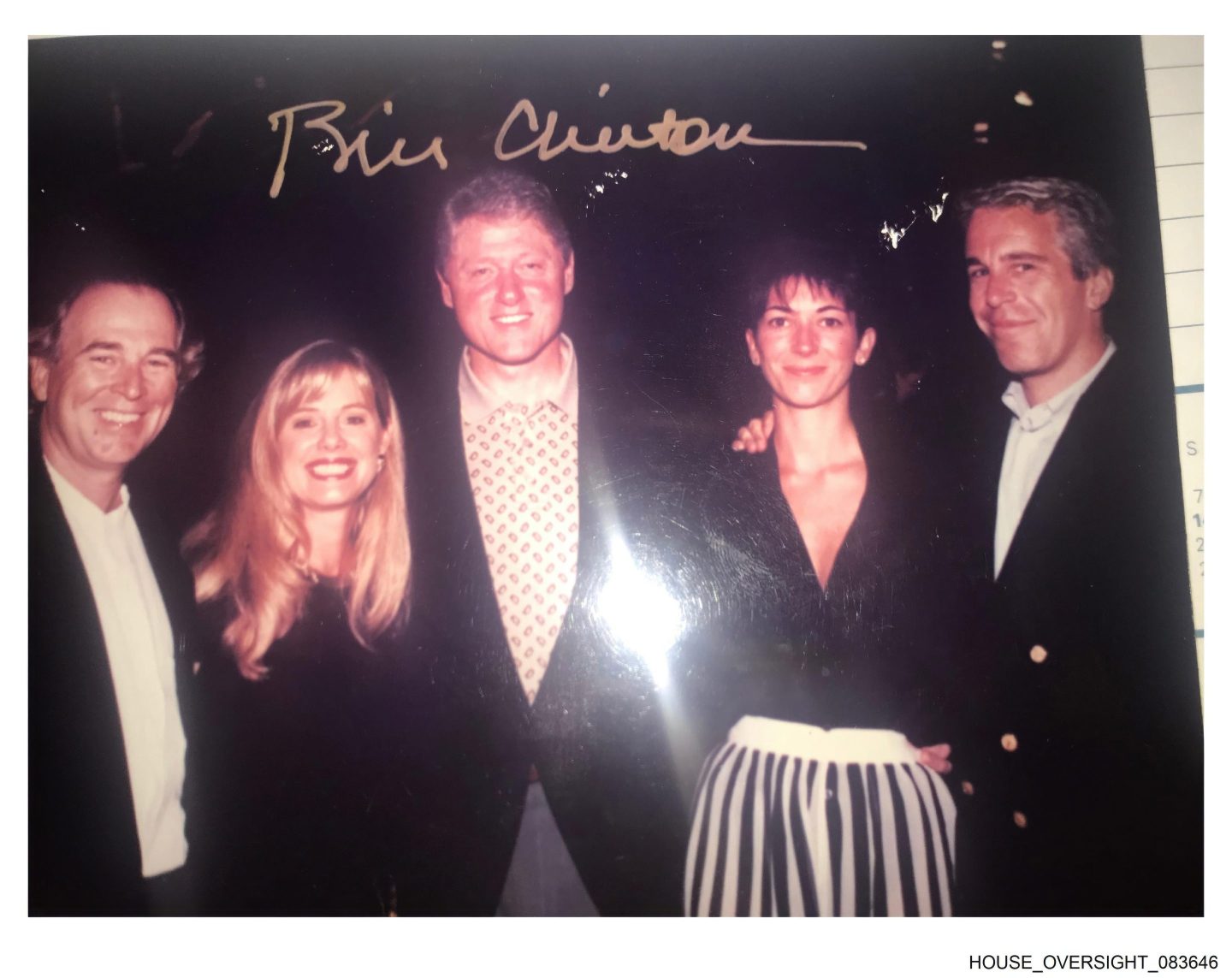

The involvement of Kushner, Donald Trump’s son-in-law, in a deal that the president has said he would personally review drew a lot of unwelcome attention, said people familiar with the decision.

Affinity Partners emerged this month as a participant in Paramount’s bid, which valued the storied Hollywood company at $108.4 billion including debt. Its $200 million contribution to the financing was relatively minor, the people said.Play Video

The dynamics of an investment have changed since it became involved in the process in October, a representative for Affinity said.

“With two strong competitors vying to secure the future of this unique American asset, Affinity has decided no longer to pursue the opportunity,” the investment firm said. “We continue to believe there is a strong strategic rationale for Paramount’s offer.”

After deliberating and reviewing Paramount’s bid, Warner Bros.’ board will urge shareholders as soon as Wednesday to reject the tender offer, said people familiar with the matter. The Warner Bros. board still views its existing agreement with streaming leader Netflix as offering greater value, certainty and terms than what Paramount has proposed, the people said, asking not to be identified discussing confidential information.

One major sticking point in a deal has been Warner Bros.’ concern about the financing proposed by Paramount, which is led by David Ellison. The equity is backstopped by a trust that manages the wealth of Ellison’s father, software billionaire Larry Ellison. Because it’s a revocable trust, assets can be taken out of it at any time, and Warner Bros. may have no recourse if that happens, Bloomberg News reported.

Representatives for Warner Bros. and Paramount declined to comment.

Warner Bros. controls vast archives and is one of the biggest studios that releases films in theaters. With the company’s films and TV shows, Netflix would wield tremendous power over the content offered to online audiences. Paramount, meanwhile, aims to marry two legacy Hollywood studios to counter the influence of Netflix, Walt Disney Co. and Amazon.com Inc.

Both bids raise significant antitrust concerns — something underscored by multibillion-dollar breakup fees the parties have offered. Netflix and Paramount have each been laying the groundwork to win over the White House.

Paramount’s offer is also being bankrolled by a list of influential Middle Eastern investors, including Saudi Arabia’s Public Investment Fund and the Qatar Investment Authority, as well as a little-known group from Abu Dhabi called L’imad Holding Co. Kushner has strong ties to the Middle East. He founded Affinity in 2021 with funding from sovereign wealth funds from the region.

This week, Bloomberg News reported that Affinity dropped plans for a hotel in Serbia after tensions around the project culminated in the indictment of a government official who helped clear a path for its development.